Introduction

The requirements and cost to register a group of company with CAC in Nigeria are clearly laid out under the Companies and Allied Matters Act (CAMA). For businesses planning to consolidate ownership, attract investors, and centralize management, group companies provide one of the most efficient legal structures. However, the process is strictly regulated by the Corporate Affairs Commission (CAC), and skipping any step could lead to rejection or delays.

In recent years, Nigerian entrepreneurs and investors have increasingly turned to group structures to expand their footprint. From family-owned businesses in Aba and Onitsha to SMEs scaling into Lagos and Port Harcourt, forming a group company has become a practical way to unify operations and present a stronger corporate identity.

What is a Group Company?

A group company is a parent company formed when at least three Limited Liability Companies (LLCs) come together under a single umbrella entity. These associated companies remain independent but share a common bond of ownership, usually with the same directors and shareholders.

Key characteristics of a group company include:

- Minimum of three companies already registered with CAC.

- Common ownership: directors and shareholders of the parent group must align with those of the associates.

- Similar names: often, the companies adopt similar naming patterns for consistency and brand recognition.

- Distinct parent entity: the group company is registered as its own legal entity and sits above the associates.

Unlike holding companies, which depend on owning a majority of shares in subsidiaries, group companies are built on association and shared ownership across multiple entities.

Why Register a Group Company?

Businesses pursue group structures for both operational and strategic reasons. Some of the most important include:

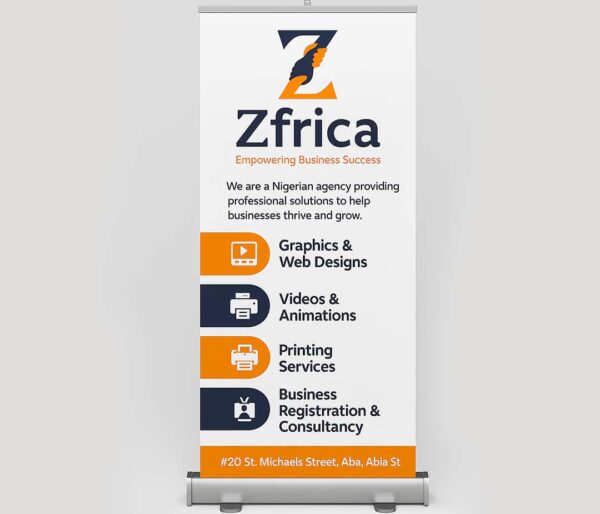

Our Top Selling Services

- Consolidation of Assets

Instead of leaving assets scattered across multiple companies, group structures allow you to consolidate them under one parent. This makes reporting, financing, and management simpler. - Tax Efficiency

By spreading operations across companies under a group, tax planning becomes more efficient. For instance, losses in one company can sometimes be balanced against gains in another within the group, depending on regulations. - Simplified Management

A group company provides a single control point for decision-making. Rather than running each company separately, directors can oversee them collectively, reducing duplication of effort. - Investor Attraction

Investors — particularly foreign ones in Lagos and Abuja — are more comfortable dealing with structured group entities. It signals stability, professionalism, and transparency. - Expansion into New Markets

Many Nigerian SMEs form group companies when expanding operations beyond their original state. For example, ZFRICA customer data shows that nearly 1 in 3 SMEs in Lagos and Port Harcourt adopt group structures when moving into new regions, while family-owned businesses in Aba often create groups for succession planning.

With these advantages, we can also assist you to register a group of company with CAC in Nigeria, ensuring your application meets all CAC requirements and avoiding the costly mistakes that often lead to delays.

Benefits of Group Structures for Nigerian Businesses

Centralized Oversight

Group companies make it easier to coordinate policies, accounting systems, and management strategies across multiple businesses.

Risk Distribution

By spreading operations across subsidiaries, risks can be isolated. If one company faces financial difficulties, the group company can shield the others.

Stronger Brand Identity

Associating several companies under one group enhances brand credibility. For example, an “XYZ Group” presents a stronger image than individual stand-alone companies.

Easier Access to Capital

We recommend this for you

Banks and investors often prefer lending to or investing in group companies due to their consolidated strength and transparency.

Flexibility in Operations

A group company structure allows easier restructuring, mergers, and acquisitions compared to isolated companies.

Legal Restrictions under CAMA

The Companies and Allied Matters Act (CAMA) places specific restrictions on group companies to ensure only genuine associations are registered:

- Restricted Use of the Word “Group”

The word “Group” cannot appear in a company name unless formal consent is obtained from the Registrar General of the CAC. - Limited Liability Companies Only

Only Limited Liability Companies can form a group company. Business names, partnerships, and LLPs do not qualify. - Consent Before Registration

Consent from CAC must be secured before name reservation or incorporation of the parent entity can proceed. - Documentary Compliance

Resolutions from associate companies, updated annual returns, and evidence of secretaries are required before approval.

These rules prevent misuse of the group label and protect the integrity of Nigeria’s corporate framework.

Have you Read this ?

Why Compliance Matters

Ignoring compliance requirements leads to automatic rejection of applications. Many business owners underestimate how strict CAC is about shareholder and director alignment, which is one of the most common reasons for denial.

If you want to save time and avoid unnecessary back-and-forth,

we can help you register a group of company with CAC in Nigeria from start to finish, including preparing resolutions, checking annual returns, and filing all incorporation documents.

Requirements for Registering a Group Company

The CAC enforces strict standards before granting approval for any group company. These are not optional — they are mandatory. Missing even one requirement will cause delays or outright rejection. Note, except for some additional requirements , its the requirements here are almost the same with requirements needed to register a normal Ltd company. LLC

Core Requirements

- At Least Three Registered Companies(with Up to date annual returns)

A group company cannot exist without three or more Limited Liability Companies (LLCs) that are already incorporated with CAC. The three subsidiary companies must also have their annual returns filed up to date. - Common Shareholders and Directors

The directors and shareholders of the associate companies must match those of the proposed group parent. This ensures genuine common ownership. - Formal Application for Consent

Before any registration, a formal application must be submitted to the Registrar General of the CAC for permission to use the word “Group” in the name. - Board Resolutions

Each associate company must pass a resolution during a board meeting, consenting to form the group company. - Updated Annual Returns

CAC requires proof that each associate company has filed and updated its annual returns. Any company in default disqualifies the application. - Evidence of Company Secretary

The details of the company secretary for each associate must be submitted as part of compliance. - Share Capital Threshold

The parent group’s share capital must be at least equal to the highest share capital among the associates. - Section 733 CAMA Compliance

For sensitive industries like banking, pensions, or insurance, additional compliance under Section 733 of CAMA is required.

Step-by-Step Process

The requirements and cost to register a group of company with CAC in Nigeria can be broken down into clear steps:

Step 1: Register Associate Companies First

Each of the three or more associate companies must be Limited Liability Companies. Partnerships, business names, or LLPs do not qualify.

Step 2: Apply for CAC Consent

Submit a formal application to the Registrar General for approval to use “Group.” Documents to attach include:

- CAC incorporation documents of each associate.

- Updated annual returns.

- Proof of common directors and shareholders.

Step 3: Confirm Director & Shareholder Alignment

CAC will review whether the directors and shareholders of the associates match those of the proposed group. This is often where applications fail, so it must be done carefully.

Step 4: Obtain Resolutions

Each associate company must hold a board meeting and pass a resolution consenting to join the group company. These resolutions are attached to the application.

Step 5: Reserve Group Company Name

Once consent is granted, proceed to reserve the proposed group company’s name online. Name reservation lasts 60 days.

Step 6: Prepare Incorporation Documents

Documents include:

- Memorandum and Articles of Association (MEMART).

- List of directors and shareholders of the parent group.

- Statement of share capital.

- Valid identification documents (IDs, passport photos).

Step 7: File With CAC

File all prepared documents online via the CAC registration portal or through an accredited CAC agent.

Step 8: Pay CAC and Stamp Duty Fees

- CAC fee: ₦10,000 for the first ₦1m share capital.

- ₦5,000 for each additional ₦1m (up to ₦500m).

- ₦7,500 for each ₦1m above ₦500m.

- Stamp duty: ₦8,500 for the first ₦1m, ₦7,500 per additional ₦1m.

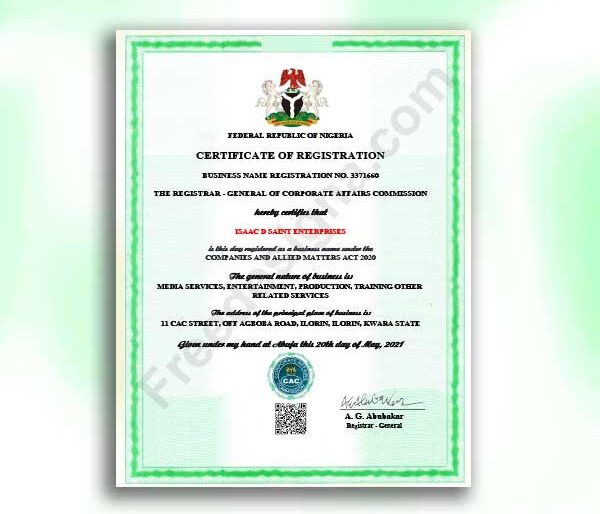

Step 9: Obtain CAC Documents

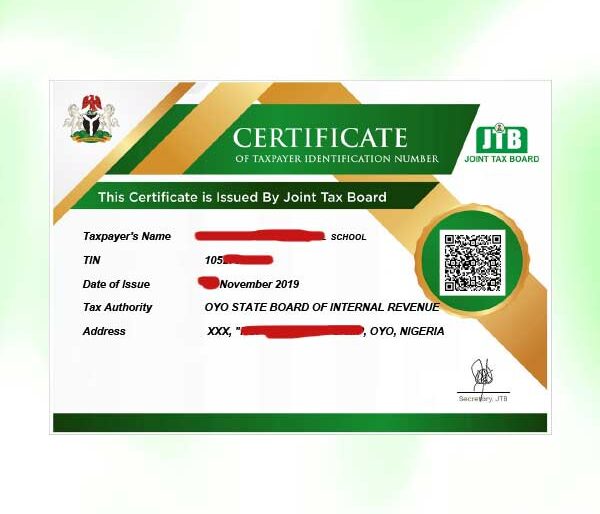

Once approved, CAC issues the Certificate of Incorporation, MEMART, and Tax Identification Number (TIN) for the group parent company.

Cost Breakdown

| Expense | Group Company |

| Name Reservation | ₦500 |

| Consent Fee | ₦5,000 |

| CAC Registration (₦1m share cap.) | ₦10,000 |

| CAC Registration (per ₦1m add.) | ₦5,000 |

| CAC Registration (>₦500m per ₦1m) | ₦7,500 |

| Stamp Duty (₦1m share capital) | ₦8,500 |

| Stamp Duty (per additional ₦1m) | ₦7,500 |

This breakdown gives a clear estimate of how much you’ll need to budget.

Key Differences: Group vs Holding Companies

- Group company:

- Requires at least three associated companies.

- Built on common ownership (directors/shareholders must match).

- Parent share capital must equal or exceed the highest of the associates.

- Holding company:

- Requires at least two subsidiaries.

- Built on ownership of >50% shares in subsidiaries.

- Parent must control subsidiaries through shareholding.

Conclusion

The requirements and cost to register a group of company with CAC in Nigeria may look complex, but once broken into steps, the process is straightforward. The key is preparation: having your associates registered, ensuring annual returns are filed, aligning directors and shareholders, and applying for CAC consent.

Statistical insight: According to ZFRICA customer data, 1 in 3 SMEs in Lagos and Port Harcourt now form group companies to consolidate operations, while businesses in Aba and Onitsha often use groups to unify family-owned ventures.

By carefully preparing and filing the correct documents, you can successfully register your group company without unnecessary delays.

FAQs

Q: How many companies do I need to form a group company?

At least three, and they must all be Limited Liability Companies registered with CAC.Q: Do directors and shareholders have to match?

Yes. CAC requires full alignment of directors and shareholders across the associates and the proposed group parent.Q: Can a business name form part of a group company?

No. Only Limited Liability Companies qualify.Q: What if one associate hasn’t filed annual returns?

The group registration will be rejected until all associates are compliant.Q: What is the cost of registration?

From ₦500 for name reservation, ₦5,000 for consent, ₦10,000 for ₦1m share capital registration, plus ₦8,500 stamp duty. Costs increase with share capital.Q: Can a holding company also join a group?

Yes, provided it meets all CAC requirements and has common ownership with the other associates.