Introduction

The requirements and cost to register a holding company with CAC in Nigeria are guided by the Companies and Allied Matters Act (CAMA). Holding companies are among the most powerful corporate structures for entrepreneurs and investors who want to consolidate control, protect assets, and attract capital. However, the process is highly regulated by the Corporate Affairs Commission (CAC). Without proper compliance, your application will likely be rejected.

Across Nigeria, many expanding businesses are turning to holding companies as they scale. From family-owned firms in Aba consolidating multiple branches, to major firms in Lagos looking to attract foreign investors, the holding structure is becoming a preferred model.

What is a Holding Company?

Unlike a Group of company, a holding company is a parent entity created to control one or more subsidiary companies by owning more than 50% of their shares. Unlike operational companies, a holding company does not necessarily engage in day-to-day business. Instead, its role is to oversee, acquire, and manage its subsidiaries.

Key characteristics include:

- Must have at least two subsidiaries already incorporated with CAC.

- Must hold majority ownership (>50%) of subsidiaries within 90 days of incorporation.

- The word “Holding” can only be used in the name with the formal consent of CAC.

In essence, the holding company exists to supervise and control, leaving subsidiaries to carry out their own business operations.

Why Register a Holding Company?

Holding companies provide several advantages that have made them popular among Nigerian businesses and investors:

- Control and Ownership

By owning a majority stake in subsidiaries, a holding company can influence policies, management, and direction without being directly involved in operations. - Asset Protection

Valuable assets such as property or intellectual property can be owned by the holding company, shielding them from operational risks in subsidiaries. - Tax Efficiency

Holding companies may take advantage of tax planning opportunities by structuring how income flows between subsidiaries and the parent. - Investor Appeal

International investors in Lagos and Abuja often prefer dealing with structured holding companies because they present consolidated strength and clear accountability. - Strategic Growth

According to ZFRICA customer data, over 40% of mid-sized businesses in Port Harcourt and Lagos now adopt holding structures when expanding into new industries or states. This trend shows how holding companies are central to Nigeria’s growth story.

With these advantages, we can also assist you to register a holding company with CAC in Nigeria, ensuring compliance from the start and avoiding unnecessary rejections.

Our Top Selling Services

Benefits of Holding Structures for Nigerian Businesses

Centralized Oversight: A holding company allows entrepreneurs to coordinate the activities of multiple businesses under one roof.

Flexibility in Investment: The structure makes it easier to acquire or dispose of subsidiaries without affecting the holding parent entity.

Risk Isolation: If one subsidiary fails, creditors cannot automatically claim the assets of the holding company or other subsidiaries.

Brand Strength: “XYZ Holdings” has greater prestige than stand-alone companies, which enhances investor trust.

Long-Term Succession Planning: Family-owned enterprises, especially in Aba and Onitsha, use holding companies to ensure seamless succession and consolidated asset management.

Legal Restrictions under CAMA

The Companies and Allied Matters Act (CAMA) sets strict rules for holding companies in Nigeria:

- Use of the Word “Holding”

No company can use “Holding” in its name without the written consent of the Registrar General of the CAC. - Subsidiary Requirement

At least two subsidiary companies must already be registered with CAC before the parent holding company can be incorporated. - Directors’ Statement

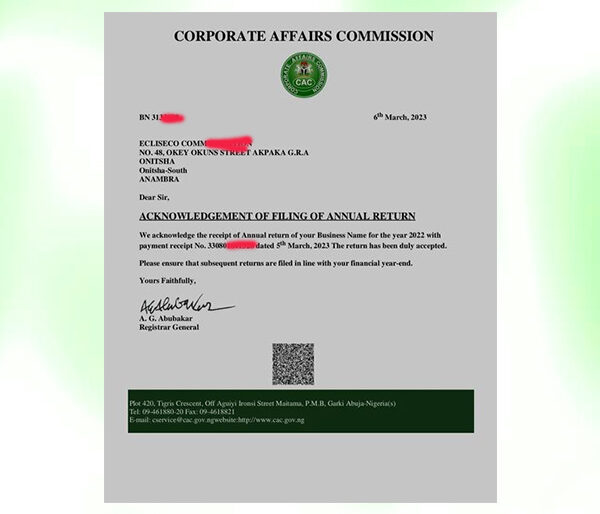

Directors must sign a statement confirming that the holding company will acquire more than 50% of the shareholding of each subsidiary within 90 days of its registration. - Annual Returns Compliance

Subsidiary companies must show proof of up-to-date annual return filings. Any lapse disqualifies the application. - Limited Liability Companies Only

Just like group companies, only Limited Liability Companies qualify. Partnerships, business names, or LLPs cannot form subsidiaries for a holding structure.

Why Compliance Matters

Holding companies provide immense power — but only if they are legally sound. Many applications fail because business owners underestimate CAC’s strictness around shareholder alignment, annual return compliance, and proper documentation.

We recommend this for you

If you want to save time and get it right the first time,

we can help you register a holding company with CAC in Nigeria, handling all filings, consents, and compliance steps on your behalf.

Requirements and Cost to Register a Holding Company with CAC in Nigeria

The CAC has set specific requirements for anyone who wishes to form a holding company. These requirements are designed to confirm that the parent entity is genuine and not simply a name.

Core Requirements

- At Least Two Subsidiary Companies Already Registered

A holding company cannot exist without at least two subsidiaries that are Limited Liability Companies (LLCs) registered with CAC. - Formal Application for Consent

The word “Holding” cannot be used in a company’s name without the Registrar General’s written consent. - Directors’ Statement

A formal statement signed by the majority of directors must confirm that the parent holding company will acquire more than 50% of the shareholding of each subsidiary within 90 days of incorporation. - Updated Annual Returns

Each subsidiary company must be up to date with CAC annual return filings. Failure to comply will result in rejection. - Proof of Compliance Under CAMA

Section 733 of the Companies and Allied Matters Act (CAMA) applies to certain regulated industries such as banks, pension managers, and insurers. - Memorandum and Articles of Association (MEMART)

The holding company must prepare and file MEMART documents tailored to its role as a parent company.

Step-by-Step Process

The requirements and cost to register a holding company with CAC in Nigeria follow a structured nine-step process:

Step 1: Register Subsidiary Companies First

Ensure that two or more subsidiary companies are already incorporated as Limited Liability Companies under CAC. Business names, LLPs, or partnerships cannot qualify.

Step 2: Apply for CAC Consent

Submit a formal application to the Registrar General for permission to use “Holding”. Attach:

- Incorporation documents of subsidiaries.

- Proof of updated annual returns.

- Draft directors’ statement of control.

Step 3: Obtain Directors’ Statement

The directors of the proposed parent holding company must sign a statement confirming that the company will acquire more than half of the nominal share value of each subsidiary within 90 days of incorporation.

Step 4: Reserve Holding Company Name

After consent is granted, reserve the proposed name online through the CAC portal. The reservation is valid for 60 days.

Step 5: Prepare Incorporation Documents

Draft and compile the following:

- Memorandum and Articles of Association (MEMART).

- List of directors and shareholders.

- Statement of share capital.

- Valid identification documents of directors.

Step 6: File With CAC

Submit the incorporation application via the CAC portal or through an accredited CAC agent.

Step 7: Pay CAC Registration Fees

- ₦10,000 for the first ₦1m share capital.

- ₦5,000 per additional ₦1m up to ₦500m.

- ₦7,500 per ₦1m above ₦500m.

Step 8: Pay Stamp Duty

- ₦8,500 for the first ₦1m share capital.

- ₦7,500 per additional ₦1m.

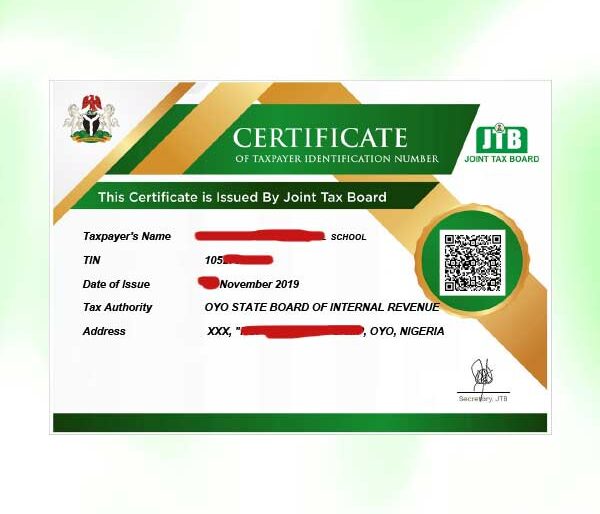

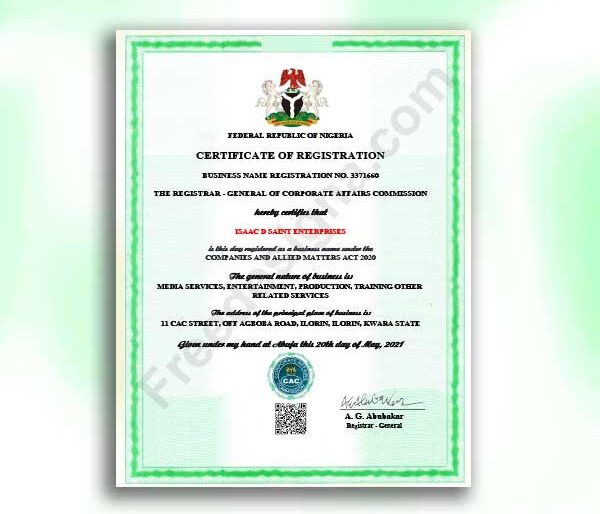

Step 9: Obtain CAC Documents

Once approved, you will receive:

- Certificate of Incorporation.

- MEMART.

- CAC forms and filings.

- Tax Identification Number (TIN).

Cost Breakdown

| Expense | Holding Company |

| Name Reservation | ₦500 |

| Consent Fee | ₦5,000 |

| CAC Registration (₦1m share cap.) | ₦10,000 |

| CAC Registration (per ₦1m add.) | ₦5,000 |

| CAC Registration (>₦500m per ₦1m) | ₦7,500 |

| Stamp Duty (₦1m share capital) | ₦8,500 |

| Stamp Duty (per additional ₦1m) | ₦7,500 |

This means that the higher the share capital, the more you should budget for both registration and stamp duty fees.

Key Differences: Holding vs Group Companies

- Holding company:

- Requires at least two subsidiaries.

- Control is based on majority ownership of shares (>50%).

- Parent must acquire control of subsidiaries within 90 days.

- Group company:

- Requires at least three associated companies.

- Built on association and common ownership of shareholders/directors.

- Parent’s share capital must equal or exceed the highest among associates.

Conclusion

The requirements and cost to register a holding company with CAC in Nigeria may look complex at first, but once broken into steps, it becomes achievable. The most important aspects are registering at least two subsidiaries, securing CAC consent, and ensuring all documents are up to date.

Statistical insight: According to ZFRICA customer data, over 40% of mid-sized businesses in Port Harcourt and Lagos now rely on holding structures to expand into new sectors while consolidating control. In the South-East, especially Aba, holding companies are widely used to protect family assets and manage succession.

By carefully following the process and budgeting for the required fees, you can successfully register your holding company and unlock its long-term benefits.

If you’d prefer a smoother experience, we can also assist you to register a holding company with CAC in Nigeria, handling the consent, filings, and payments to save you time and avoid rejections.

FAQs

Q: How many companies are needed to form a holding company?

At least two subsidiary companies must already be registered with CAC.Q: What does the directors’ statement mean?

It is a signed declaration by the directors confirming that the parent holding company will acquire more than 50% of each subsidiary’s shareholding within 90 days of incorporation.Q: Can a business name be part of a holding company?

No. Only Limited Liability Companies qualify as subsidiaries.Q: What is the minimum share capital for a holding company?

For general businesses, it starts at ₦1 million, though regulated industries such as banks or insurers require higher amounts.Q: How much does it cost to register a holding company?

From ₦500 for name reservation, ₦5,000 for consent, ₦10,000 for ₦1m share capital registration, and ₦8,500 stamp duty. Costs increase with share capital.Q: What happens if subsidiaries are not up to date with annual returns?

The application will be rejected until all subsidiaries have filed their returns.