Many persons ask, What is the difference between a Business name and Limited Ltd company?. Or, What is the difference between BN number and RC number?

Well, the 2 questions above are asking for the same answer. At the end of this post, you will have a full understanding of what each stands for and which one to go for if needs be.

A Quick Answer

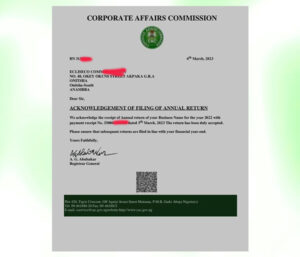

BN number is the CAC registration number found on Certificates of Registration and is only issued to Business names

RC number is the CAC registration number found on Certificates of Incorporation and is only issued to Limited Companies. The image below should make for more clarity

Our Top Selling Services

In details, lets explore the differences between a Business Name and a Limited (Ltd) Company under the following headings

Global Recognition

A limited liability company has more global recognition than a business name. Generally speaking, a limited liability company is an ideal company worldwide. Most of the top businesses you hear of are Limited Liability companies (Ltd). For E.g., Dangote, Paystack, Zfrica etc.

Naming

A business name bears names ending with things like Ventures, Enterprises, Concepts, Farms etc. Whereas a Limited liability company bears names ending with LTD, PLC, or LLC, GROUPS.

Personality and Management

A business name is owned and managed by a Sole Proprietor or The Partners in Business (Eg Husband and Wife)

A limited liability company is owned by Shareholder(s) and managed by the Director(s).

Note: A shareholder can also be a director in a company and vice versa

Although one director is allowed to own a Limited Liability Company, a Limited company is not usually a one-man business affair.

The shareholders are the ones who bring the capital on which the company operate. While the Directors are the ones picked by the company to manage the affairs of the company. The Directors can be changed from time to time, by the company.

We recommend this for you

Most of the start-up companies in Nigeria starts with a One million share capital. The minimum share capital required by CAC for a Limited company is Ten Thousand share capital.

Note: Share capital is not the amount required to register a Limited company, rather, it’s just the total amount of money raised by the company shareholders, necessary for the running of the company

Identity

In the eyes of the law, a business name is not different from the proprietor. This means, in any legal case, the proprietor is required to speak for the business. But in a limited company, the company itself is a legal entity.

The company can be sued to court and will have to represent itself without directly involving the shareholders or the directors. A limited company can obtain a visa of its own. A limited company can check into a hotel with its name. It can acquire assets etc. In essence, a limited company is treated like a juristic person, unlike a Business name.

Succession

For Business names, in the case of an eventuality, like the death of the proprietor, the business automatically ceases to exist. But in a Limited liability company, perpetual succession is allowed. Shares can be transferred from one shareholder to another, and the directors can be changed. The company can live for as long as the shareholders wish.

Ease of Facility/Loan Sourcing

A limited liability company has higher chances of getting a facility/loans from the financial institution than a business name. This is because the financial institution, takes the shares of the company as collateral/equity in the company, so long the company is a legal person. Also, limited liability can secure a loan through a deed of the debenture. These features are not exercise-able by business name certificate holders. Don’t forget accessing from Nigerian financial institutions may involve getting the e-naira account.

Requirements for Registration with CAC

No doubt, Business name registration will require less information, compared to a Limited Liability Company Registration. Here, we have detailed the requirements for the registration of a Business Name. And also requirements for the registration of a Limited company Ltd

Cost of Registration

The cost of registering a business either as business name or limited liability company, through CAC accredited agents averages ₦20,000- ₦25,000 and ₦40,000 – ₦50,000 respectively.

With us, as CAC accredited agents, we can assist you to register your business name at ₦22,000 or assist you to register your limited liability company at ₦42,000

Annual Returns

All registered businesses or companies are expected to file their annual returns at the end of each business year. Business names are due to file their annual returns after 12 months, while Limited companies enjoy a longer period of 18 months, after the day of registration. Also, the annual return fees for business names and Limited companies are different.

Our Suggestion

Now you may be thinking, a Business name is of no value compared to a Limited Liability company. Well, you may not be totally wrong. However, if you are very new to business and not so sure if your business will stand. You should start with a business name.

With a business name, you can still open a cooperate bank account in the name of your business name and keep testing the water. Once you start to gain grounds, you can upgrade your business name registration to a Limited liability company.

On the other hand, if you have taken a business stand, and want your business to grow beyond you. You should go straight for a Limited Liability Company.

The ball is in your court.