Startup capital for your business can come from various means. The best way to acquire funding for your business depends on several factors, including creditworthiness, the amount needed and available options. In this post, we will be highlighting five ways to fund your Startup Business and also let you know where to access each

Table of Contents

Toggle1. Help from Family and Friends

In most cases, your family and friends are the first options to consider when sourcing for funding for your startup business. Although they may not offer you something huge enough to cater for your startup needs but the little they offer can be a starting point. Africas richest man, Dangote, started his first business in 1977, through the financial help from his uncle

All you need to access this fund is a good relationship with your friends and family.

2. Business loans.

If you need financial assistance, a commercial loan through a bank is a good starting point. Oftentimes getting a loan from a bank can be very difficult for startup businesses, as you may not meet the bank loan requirements. If you are unable to take out a bank loan, you can apply from a microfinance bank eg Lapo Micro Finance. Lapo offers loans of up to NGN 500,000 for small businesses and NGN5,000,000 for small and Medium-scale Enterprise

You can also check out access to smaller loans through digital mobile APPS like FairMoney, Paylater etc. Note, Heavy loans are not the best funding option for a startup business

3. Business grants.

This is another cool way to fund a Startup Business. Business grants are similar to loans; however, they do not need to be paid back. Business grants are typically very competitive and come with stipulations that the business must meet to be considered. When trying to secure a small business grant, look for ones that are uniquely specific to your situation.

Our Top Selling Services

-

Sample

LetterHead Paper Printing

₦15000Original price was: ₦15000.₦12000Current price is: ₦12000. Add to cart -

Sample

Custom Office Door Sign Design and Printing, Aba, Nigeria

₦20000Original price was: ₦20000.₦18500Current price is: ₦18500. Add to cart -

Sample

Customized Safety Reflective Jacket Vest Printing and Design, Aba, Nigeria

₦6000Original price was: ₦6000.₦4500Current price is: ₦4500. Add to cart -

Sample

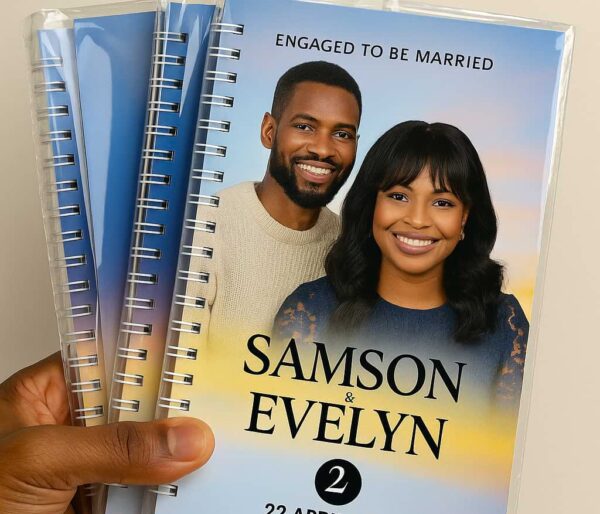

Softcover Jotter Design and Printing, Aba, Nigeria

₦90000Original price was: ₦90000.₦75900Current price is: ₦75900. Add to cart -

Sample

Customized Wristband Design and Printing, Aba, Nigeria

₦900000Original price was: ₦900000.₦875000Current price is: ₦875000. Add to cart -

Sample

Customized Mouse Pad Design and Printing, Aba, Nigeria

₦6000Original price was: ₦6000.₦4000Current price is: ₦4000. Add to cart -

Sample

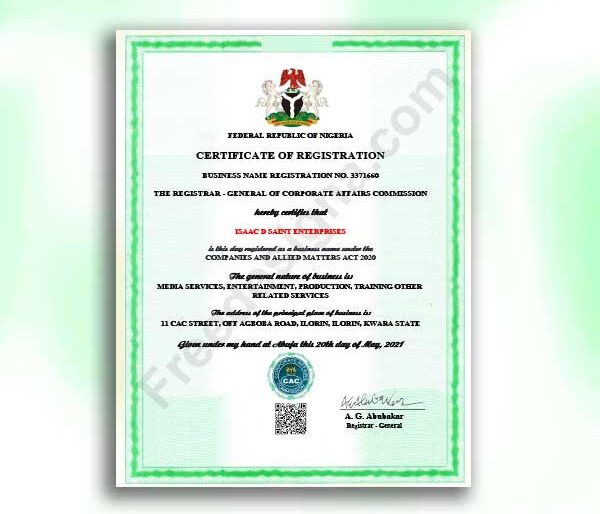

Company Registration PLC (RC)

₦100000Original price was: ₦100000.₦90000Current price is: ₦90000. Add to cart -

Sample

Award Plaque Design and Printing, Aba, Nigeria

₦50000Original price was: ₦50000.₦28000Current price is: ₦28000. Add to cart -

Sample

Customized Luxury Drawer Jewelry Gift Box Design and Printing, Aba, Nigeria

₦450000Original price was: ₦450000.₦425000Current price is: ₦425000. Add to cart -

Sample

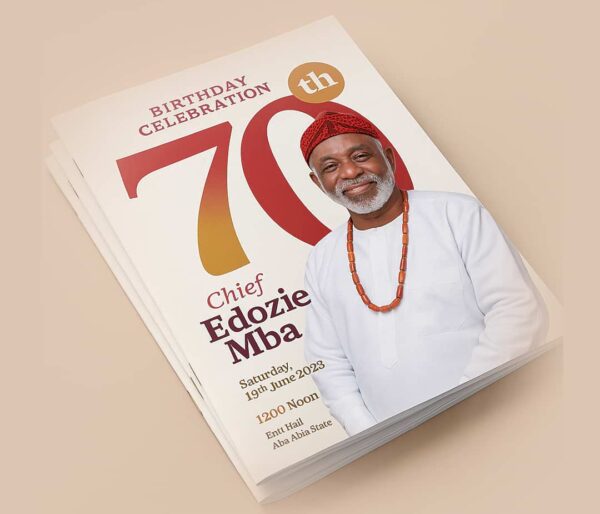

Birthday Programme Design and Printing, Aba, Nigeria

₦145000Original price was: ₦145000.₦136000Current price is: ₦136000. Add to cart -

Sample

Graduation Scroll Design and Printing, Aba, Nigeria

₦10000Original price was: ₦10000.₦6500Current price is: ₦6500. Add to cart -

Sample

Brochure Design

₦15000Original price was: ₦15000.₦10000Current price is: ₦10000. Add to cart -

Sample

Event Ticket Design & Printing, Aba, Nigeria

₦45000Original price was: ₦45000.₦36000Current price is: ₦36000. Add to cart -

Sample

Pylon Signage Design and Branding, Aba, Nigeria

₦400000Original price was: ₦400000.₦365000Current price is: ₦365000. Add to cart -

Sample

Customized Company Seal and Embossing Stamp Branding, Aba, Nigeria

₦50000Original price was: ₦50000.₦45000Current price is: ₦45000. Add to cart -

Sample

Branded Sublimation T-shirt Design and Printing, Aba, Nigeria

₦20000Original price was: ₦20000.₦15000Current price is: ₦15000. Add to cart -

Sample

Company Registration Ltd (RC)

₦60000Original price was: ₦60000.₦55000Current price is: ₦55000. Add to cart -

Sample

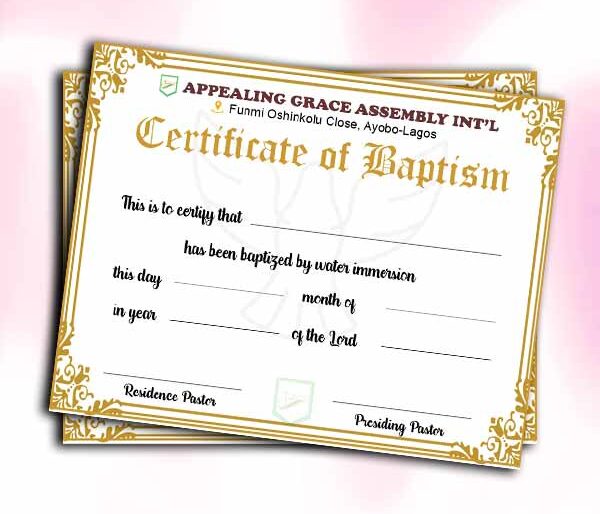

Certificate Printing

₦20000Original price was: ₦20000.₦17000Current price is: ₦17000. Add to cart -

Sample

PVC Plastic ID Card Design and Printing, Aba, Nigeria

₦6000Original price was: ₦6000.₦4000Current price is: ₦4000. Add to cart -

Sample

Personalized Metal Achievement Medals Design and Printing, Aba, Nigeria

₦6000Original price was: ₦6000.₦4500Current price is: ₦4500. Add to cart -

Sample

Company Profile

₦40000Original price was: ₦40000.₦25000Current price is: ₦25000. Add to cart -

Sample

Acrylic Wedding Invitation Card Design and Printing, Aba, Nigeria

₦190000Original price was: ₦190000.₦185000Current price is: ₦185000. Add to cart -

SCUML Certificate

Read more -

Sample

Event Table Tent Tag Name Design and Printing, Aba, Nigeria

₦80000Original price was: ₦80000.₦75000Current price is: ₦75000. Add to cart -

Sample

CAC Minutes of Meeting Template for Church Registration in Nigeria

₦12000Original price was: ₦12000.₦10000Current price is: ₦10000. Add to cart -

Sample

Customized USB Flash Drive Design and Printing, Aba, Nigeria

₦15000Original price was: ₦15000.₦12000Current price is: ₦12000. Add to cart -

Sample

Blog Design

₦200000Original price was: ₦200000.₦150000Current price is: ₦150000. Add to cart -

Sample

TShirt & Polo Customization

₦7000Original price was: ₦7000.₦5000Current price is: ₦5000. Add to cart -

Sample

Customized Travel Mugs Design and Printing, Aba, Nigeria

₦25000Original price was: ₦25000.₦17200Current price is: ₦17200. Add to cart -

Sample

Customized Fabric Label Design and Printing, Aba, Nigeria

₦200000Original price was: ₦200000.₦165000Current price is: ₦165000. Add to cart -

Sample

Write Articles & Blog Contents

₦15000Original price was: ₦15000.₦10000Current price is: ₦10000. Add to cart -

Sample

Certificate Design

₦12000Original price was: ₦12000.₦7000Current price is: ₦7000. Add to cart -

Sample

Paper Bag Design and Printing, Aba, Nigeria

₦50000Original price was: ₦50000.₦40800Current price is: ₦40800. Add to cart -

Sample

Custom Political Campaign Sticker Design and Printing, Aba, Nigeria

₦25000Original price was: ₦25000.₦19000Current price is: ₦19000. Add to cart -

Sample

Label & Sticker Design

₦8000Original price was: ₦8000.₦7000Current price is: ₦7000. Add to cart -

Sample

Bi-fold and Tri-fold Brochure Design and Printing, Aba, Nigeria

₦25000Original price was: ₦25000.₦18000Current price is: ₦18000. Add to cart -

Sample

Poster Design and Printing, Aba, Nigeria

₦50000Original price was: ₦50000.₦35000Current price is: ₦35000. Add to cart -

Sample

School Website Design

₦350000Original price was: ₦350000.₦300000Current price is: ₦300000. Add to cart -

Sample

Wine Paper Bag Design and Printing, Aba, Nigeria

₦124000Original price was: ₦124000.₦115400Current price is: ₦115400. Add to cart -

Sample

Double-Sided Business Card Design and Printing, Aba, Nigeria

₦15000Original price was: ₦15000.₦9000Current price is: ₦9000. Add to cart -

Sample

Customized Name Tag Printing and Design, Aba, Nigeria

₦50000Original price was: ₦50000.₦44000Current price is: ₦44000. Add to cart -

Sample

Business Card Printing

₦15000Original price was: ₦15000.₦10000Current price is: ₦10000. Add to cart -

Sample

Ad / Social Media Design

₦9000Original price was: ₦9000.₦5000Current price is: ₦5000. Add to cart -

Sample

Custom Hoodie Design and Printing, Aba, Nigeria

₦40000Original price was: ₦40000.₦22000Current price is: ₦22000. Add to cart -

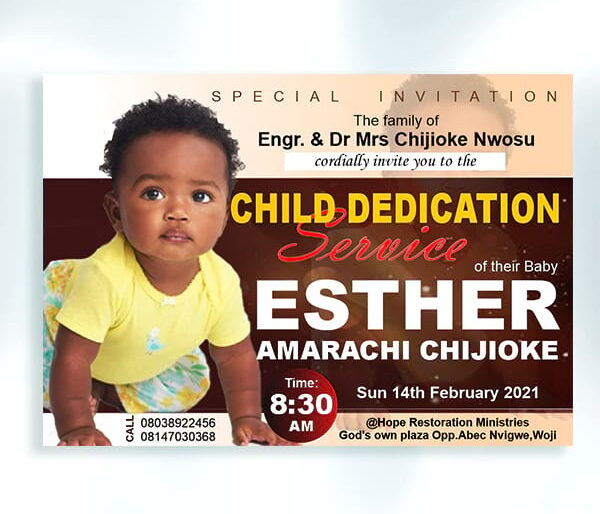

Sample

Invitation Card Printing

₦10000Original price was: ₦10000.₦5000Current price is: ₦5000. Add to cart -

Sample

Flex Banner Design and Printing, Aba, Nigeria

₦600Original price was: ₦600.₦520Current price is: ₦520. Add to cart -

Sample

Customized Company Rubber & Dater Stamp Design and Printing, Aba, Nigeria

₦40000Original price was: ₦40000.₦27000Current price is: ₦27000. Add to cart -

Sample

Wedding Invitation Card Design and Printing, Aba, Nigeria

₦400000Original price was: ₦400000.₦370000Current price is: ₦370000. Add to cart -

Sample

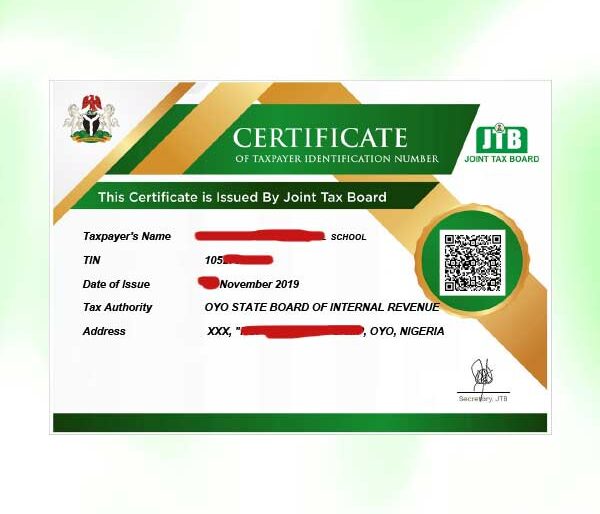

TIN Registration

₦8000Original price was: ₦8000.₦6000Current price is: ₦6000. Add to cart -

Sample

E Commerce Website Design

₦500000Original price was: ₦500000.₦400000Current price is: ₦400000. Add to cart -

Sample

Customized Pen Design and Printing, Aba, Nigeria

₦30000Original price was: ₦30000.₦20000Current price is: ₦20000. Add to cart -

Sample

Brochure Design and Printing , Aba, Nigeria

₦30000Original price was: ₦30000.₦23600Current price is: ₦23600. Add to cart -

Sample

Advertising Pole Signage & Signs Design and Printing, Aba, Nigeria

₦615000Original price was: ₦615000.₦605000Current price is: ₦605000. Add to cart -

Sample

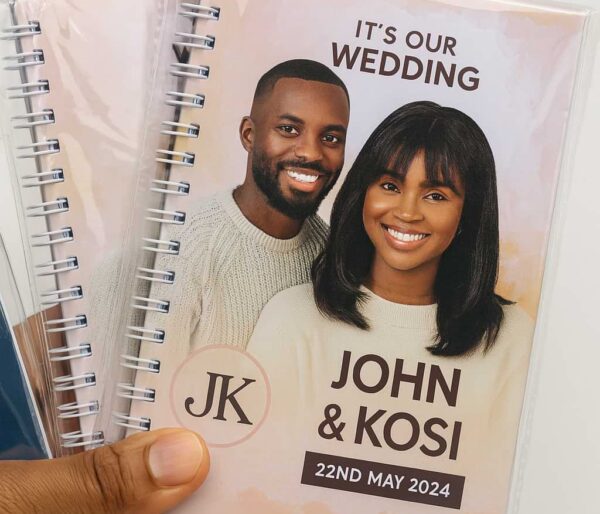

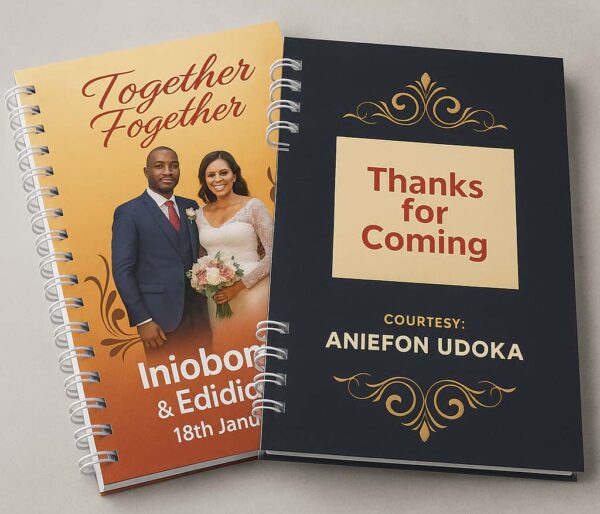

Customized Wedding Souvenir Jotter Design and Printing, Aba, Nigeria

₦200000Original price was: ₦200000.₦175000Current price is: ₦175000. Add to cart -

Sample

Birthday Party Design

₦15000Original price was: ₦15000.₦10000Current price is: ₦10000. Add to cart -

Sample

Invoice Booklet Design and Printing, Aba, Nigeria

₦40000Original price was: ₦40000.₦30000Current price is: ₦30000. Add to cart -

Sample

Customized Magic Cup Design and Printing, Aba, Nigeria

₦10000Original price was: ₦10000.₦7000Current price is: ₦7000. Add to cart -

Sample

Custom Certificate Design and Printing, Aba, Nigeria

₦5000Original price was: ₦5000.₦3000Current price is: ₦3000. Add to cart -

Sample

Custom Temperature Flask Design and Printing, Aba, Nigeria

₦10000Original price was: ₦10000.₦7000Current price is: ₦7000. Add to cart -

Sample

Advert Billboard Design and Printing – Aba, Nigeria

₦90000Original price was: ₦90000.₦75000Current price is: ₦75000. Add to cart -

Sample

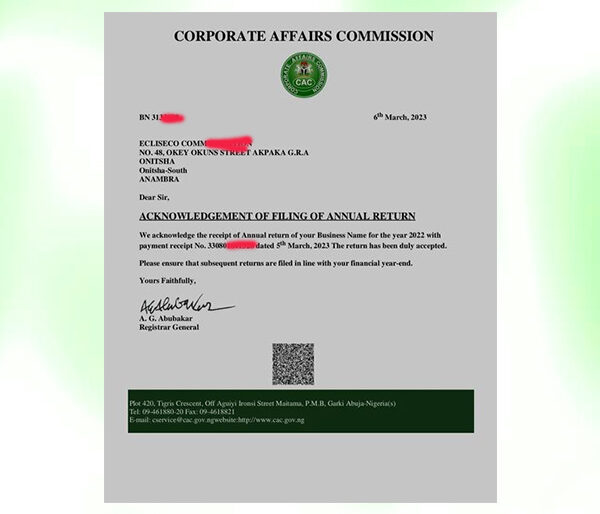

Filing CAC Annual Returns

₦10000Original price was: ₦10000.₦7500Current price is: ₦7500. Add to cart -

Sample

Business Name Registration-BN

₦50000Original price was: ₦50000.₦35000Current price is: ₦35000. Add to cart -

Sample

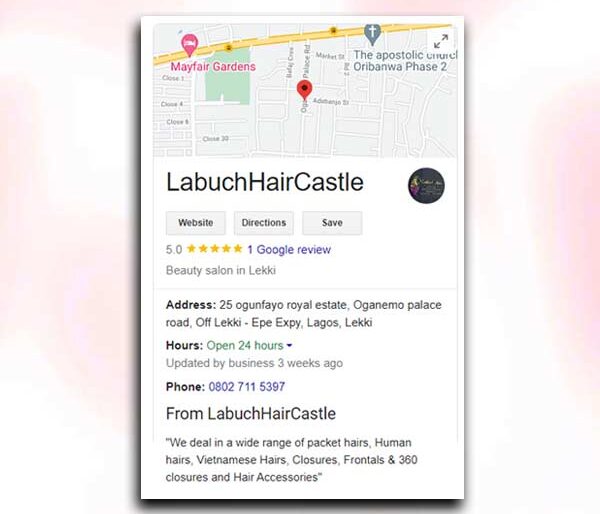

Google my Business (MAP) Page

₦70000Original price was: ₦70000.₦50000Current price is: ₦50000. Add to cart -

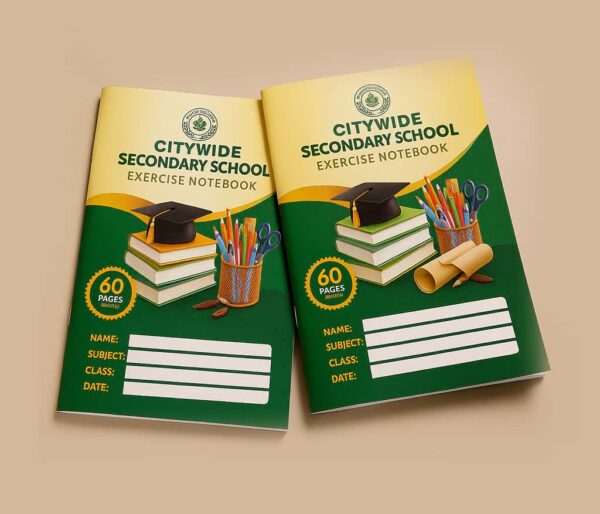

Sample

Notebook & Exercise Book Design and Printing, Aba, Nigeria

₦50000Original price was: ₦50000.₦41500Current price is: ₦41500. Add to cart -

Sample

Brand Identity Kit

₦70000Original price was: ₦70000.₦50000Current price is: ₦50000. Add to cart -

Sample

Waybill & Delivery Note Booklet Design and Printing, Aba, Nigeria

₦40000Original price was: ₦40000.₦30000Current price is: ₦30000. Add to cart -

Sample

Single-Sided Business Card Design and Printing, Aba, Nigeria

₦10000Original price was: ₦10000.₦7000Current price is: ₦7000. Add to cart -

Sample

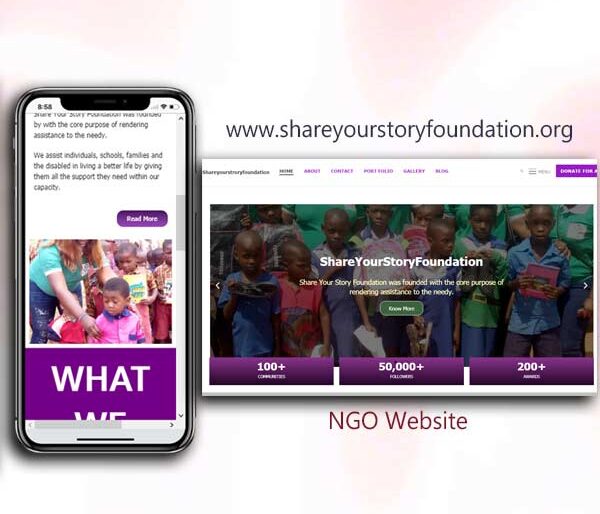

Church / NGO Website Design

₦400000Original price was: ₦400000.₦350000Current price is: ₦350000. Add to cart -

Sample

Hand and Table Flag Design and Printing, Aba, Nigeria

₦20000Original price was: ₦20000.₦16000Current price is: ₦16000. Add to cart -

Sample

Document Typing & Editing

₦10000Original price was: ₦10000.₦5000Current price is: ₦5000. Add to cart -

Sample

Banner/Poster Design

₦10000Original price was: ₦10000.₦7000Current price is: ₦7000. Add to cart -

Sample

A2 Wall Calendar Design and Printing, Aba, Nigeria

₦840000Original price was: ₦840000.₦540000Current price is: ₦540000. Add to cart -

Sample

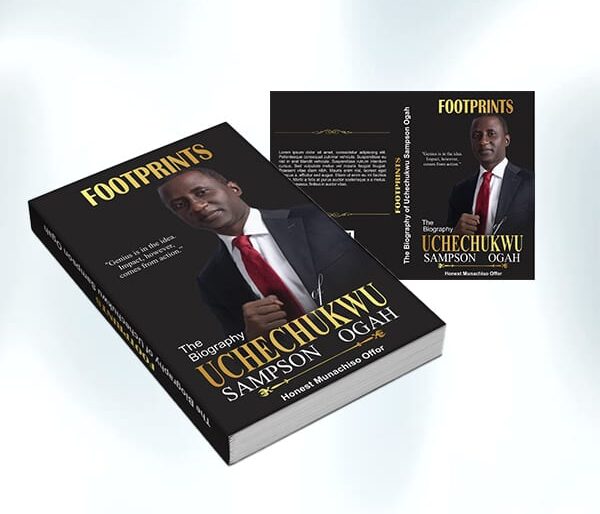

eBook / Book Cover Design

₦15000Original price was: ₦15000.₦10000Current price is: ₦10000. Add to cart -

Sample

Logo Design

₦25000Original price was: ₦25000.₦15000Current price is: ₦15000. Add to cart -

Sample

Customized Throw Pillow Design and Printing, Aba, Nigeria

₦30000Original price was: ₦30000.₦21000Current price is: ₦21000. Add to cart -

Sample

Hardcover Jotter Design and Printing, Aba, Nigeria

₦250000Original price was: ₦250000.₦158600Current price is: ₦158600. Add to cart -

Sample

Customized Luxury Product Package & Gift Box Design and Printing, Aba, Nigeria

₦450000Original price was: ₦450000.₦425000Current price is: ₦425000. Add to cart -

Sample

Receipt Booklet Design and Printing, Aba, Nigeria

₦30000Original price was: ₦30000.₦20000Current price is: ₦20000. Add to cart -

Sample

Customized Embroidery Monogram Towel Printing and Design, Aba, Nigeria

₦25000Original price was: ₦25000.₦17500Current price is: ₦17500. Add to cart -

Sample

Business Card Design

₦10000Original price was: ₦10000.₦7000Current price is: ₦7000. Add to cart -

Sample

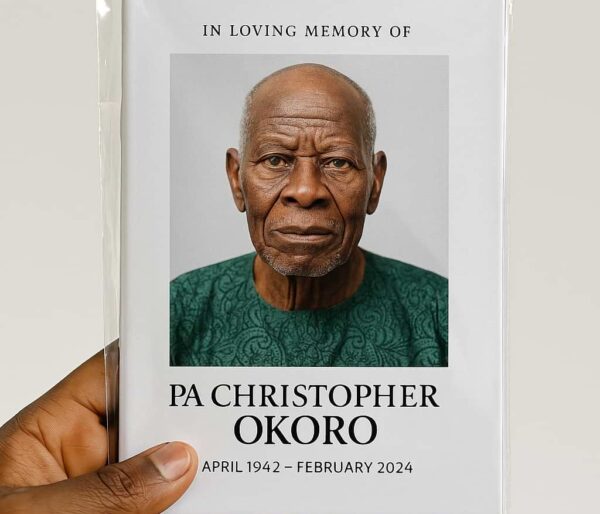

Customized Burial/Funeral Jotter Design and Printing, Aba, Nigeria

₦200000Original price was: ₦200000.₦175000Current price is: ₦175000. Add to cart -

Sample

Flyer / Poster Printing

₦7000Original price was: ₦7000.₦3500Current price is: ₦3500. Add to cart -

Sample

Customized Long Note Exercise Book Design and Printing, Aba, Nigeria

₦200000Original price was: ₦200000.₦140000Current price is: ₦140000. Add to cart -

Sample

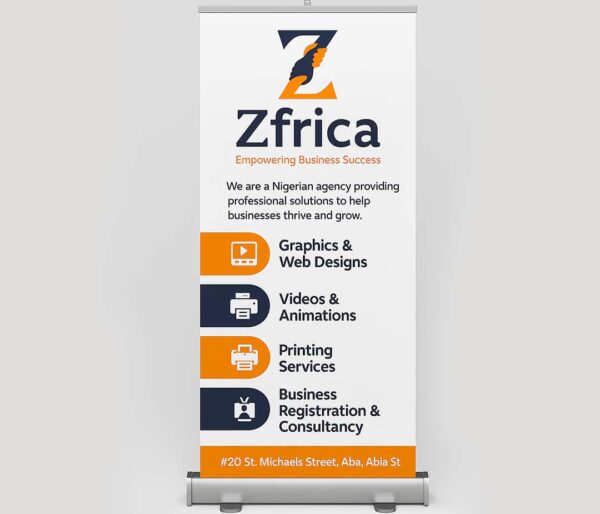

Rollup Banner Design and Printing (Small Base), Aba, Nigeria

₦70000Original price was: ₦70000.₦60000Current price is: ₦60000. Add to cart -

Sample

Customized Key Holder Design and Branding, Aba, Nigeria

₦5000Original price was: ₦5000.₦3500Current price is: ₦3500. Add to cart -

Sample

Customized Face Cap Printing and Design, Aba, Nigeria

₦6000Original price was: ₦6000.₦4000Current price is: ₦4000. Add to cart -

Sample

Customized Construction Helmet Design and Printing, Aba, Nigeria

₦15000Original price was: ₦15000.₦10500Current price is: ₦10500. Add to cart -

Sample

Letter Head Design

₦7000Original price was: ₦7000.₦5000Current price is: ₦5000. Add to cart -

Sample

Customized Dome Sticker Lapel Pins Design and Printing, Aba, Nigeria

₦130000Original price was: ₦130000.₦125000Current price is: ₦125000. Add to cart -

Sample

C.V / Resume Writing

₦10000Original price was: ₦10000.₦7000Current price is: ₦7000. Add to cart -

Sample

Tri-fold Wedding Programme Design and Printing, Aba, Nigeria

₦60000Original price was: ₦60000.₦56000Current price is: ₦56000. Add to cart -

Sample

Food Packaging Paper Bag Design and Printing, Aba, Nigeria

₦124000Original price was: ₦124000.₦115400Current price is: ₦115400. Add to cart -

Sample

Label & Sticker Printing

₦6000Original price was: ₦6000.₦5000Current price is: ₦5000. Add to cart -

Sample

Customized Phone Case Design and Branding, Aba, Nigeria

₦7000Original price was: ₦7000.₦5000Current price is: ₦5000. Add to cart -

Sample

Invitattion Card Design

₦7500Original price was: ₦7500.₦5000Current price is: ₦5000. Add to cart -

Sample

Door/Window Graphic Design Print and Branding, Aba, Nigeria

₦23000Original price was: ₦23000.₦18000Current price is: ₦18000. Add to cart -

Sample

Product Label Sticker Design and Printing, Aba, Nigeria

₦20000Original price was: ₦20000.₦15000Current price is: ₦15000. Add to cart -

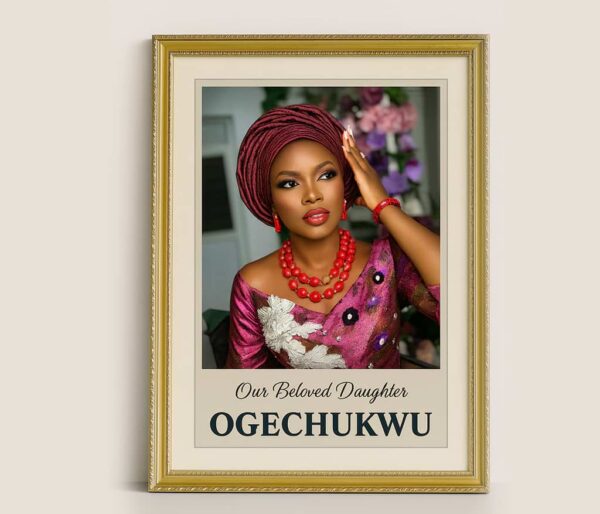

Sample

Customized Picture Frame Design and Printing, Aba, Nigeria

₦20000Original price was: ₦20000.₦15000Current price is: ₦15000. Add to cart -

Sample

Custom Sash Design and Printing, Aba, Nigeria

₦20000Original price was: ₦20000.₦16500Current price is: ₦16500. Add to cart -

Sample

Branded Customized Mug Design and Printing, Aba, Nigeria

₦7000Original price was: ₦7000.₦5000Current price is: ₦5000. Add to cart -

Sample

NGO, CHURCH, Mosque Registration (IT)

₦200000Original price was: ₦200000.₦150000Current price is: ₦150000. Add to cart -

Sample

Upgrade Business Name to Limited Company CAC

₦80000Original price was: ₦80000.₦65000Current price is: ₦65000. Add to cart -

Sample

Customized Birthday Jotter Design and Printing, Aba, Nigeria

₦200000Original price was: ₦200000.₦175000Current price is: ₦175000. Add to cart -

Sample

Clothing Tag Label Design and Printing, Aba, Nigeria

₦20000Original price was: ₦20000.₦14600Current price is: ₦14600. Add to cart -

Sample

Customized Table Cloth Covering Design and Printing, Aba, Nigeria

₦60000Original price was: ₦60000.₦56000Current price is: ₦56000. Add to cart -

Sample

Customized Water Bottle Design and Printing, Aba, Nigeria

₦10000Original price was: ₦10000.₦8500Current price is: ₦8500. Add to cart -

Sample

Customized Apron Printing and Design, Aba, Nigeria

₦20000Original price was: ₦20000.₦13500Current price is: ₦13500. Add to cart -

Sample

Website Editing / Optimization

₦70000Original price was: ₦70000.₦50000Current price is: ₦50000. Add to cart -

Sample

Customized Event Souvenir Jotter Design and Printing, Aba, Nigeria

₦200000Original price was: ₦200000.₦175000Current price is: ₦175000. Add to cart -

Sample

ID Card Design

₦9500Original price was: ₦9500.₦7000Current price is: ₦7000. Add to cart -

Sample

Business Consultancy (Physical)

₦140000Original price was: ₦140000.₦70000Current price is: ₦70000. Add to cart -

Sample

Rollup Banner Design and Printing (Big Base), Aba, Nigeria

₦80000Original price was: ₦80000.₦65000Current price is: ₦65000. Add to cart -

Sample

Company Profile Design and Printing, Aba, Nigeria

₦140000Original price was: ₦140000.₦136000Current price is: ₦136000. Add to cart -

Sample

Album Cover

₦15000Original price was: ₦15000.₦10000Current price is: ₦10000. Add to cart -

Sample

Business Consultancy (Online)

₦55000Original price was: ₦55000.₦25000Current price is: ₦25000. Add to cart -

Sample

Customized Satin Ribbon Printing and Design, Aba, Nigeria

₦25000Original price was: ₦25000.₦22000Current price is: ₦22000. Add to cart -

Sample

Business Website Design

₦300000Original price was: ₦300000.₦250000Current price is: ₦250000. Add to cart -

Sample

File Conversions

₦3000Original price was: ₦3000.₦2000Current price is: ₦2000. Add to cart -

Sample

Customized ID Card Rope Design and Printing, Aba, Nigeria

₦6000Original price was: ₦6000.₦4000Current price is: ₦4000. Add to cart -

Sample

Plastic ID Card Printing

₦6500Original price was: ₦6500.₦4000Current price is: ₦4000. Add to cart -

Sample

Flyer Design and Printing, Aba, Nigeria

₦60000Original price was: ₦60000.₦52300Current price is: ₦52300. Add to cart -

Sample

CAC Minutes of Meeting Template for Mosque Registration in Nigeria

₦12000Original price was: ₦12000.₦10000Current price is: ₦10000. Add to cart -

Sample

Complete Branding & Brand Style Guide

₦100000Original price was: ₦100000.₦70000Current price is: ₦70000. Add to cart -

Sample

GET SMEDAN CERTIFICATE REGISTRATION

₦10000Original price was: ₦10000.₦5000Current price is: ₦5000. Add to cart -

Sample

Customized Yoyo Tag Design and Printing, Aba, Nigeria

₦5000Original price was: ₦5000.₦2000Current price is: ₦2000. Add to cart -

Sample

Website Content

₦13000Original price was: ₦13000.₦7000Current price is: ₦7000. Add to cart -

Sample

Nylon Design, Customization & Printing

₦5000 – ₦10000Price range: ₦5000 through ₦10000 Select options This product has multiple variants. The options may be chosen on the product page -

Sample

Customized Umbrella Design and Printing, Aba, Nigeria

₦10000Original price was: ₦10000.₦7500Current price is: ₦7500. Add to cart -

Sample

Table Calendar Design and Printing, Aba, Nigeria

₦65000Original price was: ₦65000.₦54000Current price is: ₦54000. Add to cart -

Sample

Customized T-shirt Design and Printing, Aba, Nigeria

₦15000Original price was: ₦15000.₦10000Current price is: ₦10000. Add to cart -

Sample

Customized Envelope Design and Printing, Aba, Nigeria

₦60000Original price was: ₦60000.₦50000Current price is: ₦50000. Add to cart -

Sample

Thank You Card Design and Printing, Aba, Nigeria

₦10000Original price was: ₦10000.₦7000Current price is: ₦7000. Add to cart -

Sample

Indoor Wall Logo Glass Signage Design and Branding, Aba, Nigeria

₦130000Original price was: ₦130000.₦125000Current price is: ₦125000. Add to cart -

Sample

Food and Drink Menu Design and Printing, Aba, Nigeria

₦50000Original price was: ₦50000.₦43500Current price is: ₦43500. Add to cart -

Sample

Shoulder and Waist Bag Design and Printing, Aba, Nigeria

₦120000Original price was: ₦120000.₦111800Current price is: ₦111800. Add to cart -

Sample

Custom Branded Political Campaign Face Cap Design and Printing, Aba, Nigeria

₦10000Original price was: ₦10000.₦6000Current price is: ₦6000. Add to cart -

Sample

Customized Serving Tray Printing and Design, Aba, Nigeria

₦65000Original price was: ₦65000.₦60000Current price is: ₦60000. Add to cart -

Sample

Special Business Card Design and Printing, Aba, Nigeria

₦65000Original price was: ₦65000.₦52000Current price is: ₦52000. Add to cart -

Sample

Customized Backdrop Banner Design and Printing, Aba, Nigeria

₦500000Original price was: ₦500000.₦425000Current price is: ₦425000. Add to cart -

Sample

Customized Political Campaign T-Shirt Design and Printing, Aba, Nigeria

₦25000Original price was: ₦25000.₦17500Current price is: ₦17500. Add to cart -

Sample

Backpack Drawstring Bag Design and Printing, Aba, Nigeria

₦70000Original price was: ₦70000.₦60000Current price is: ₦60000. Add to cart -

Sample

Event Ask Me Name Tag Design and Printing, Aba, Nigeria

₦40000Original price was: ₦40000.₦30000Current price is: ₦30000. Add to cart -

Sample

Customized Jersey T-Shirt Printing and Design, Aba, Nigeria

₦40000Original price was: ₦40000.₦35000Current price is: ₦35000. Add to cart -

Sample

Promotional Pennant Banner Design and Printing, Aba, Nigeria

₦15000Original price was: ₦15000.₦10500Current price is: ₦10500. Add to cart -

Sample

Custom Branded Political Campaign PVC Hand Fan Design and Printing, Aba, Nigeria

₦175000Original price was: ₦175000.₦150000Current price is: ₦150000. Add to cart -

Sample

Country and Logo Flag Pole Design and Printing, Aba, Nigeria

₦80000Original price was: ₦80000.₦67000Current price is: ₦67000. Add to cart -

Sample

Customized Courier Nylon Bag Design and Printing, Aba, Nigeria

₦50000Original price was: ₦50000.₦48200Current price is: ₦48200. Add to cart -

Sample

Customized Logistics Courier Dispatch Rider Bike Delivery Box Printing and Branding, Aba, Nigeria

₦35000Original price was: ₦35000.₦32000Current price is: ₦32000. Add to cart -

Sample

Magazine Design and Printing, Aba, Nigeria

₦140000Original price was: ₦140000.₦136000Current price is: ₦136000. Add to cart -

Sample

Company Annual Report Design and Print, Aba, Nigeria

₦140000Original price was: ₦140000.₦136000Current price is: ₦136000. Add to cart -

Sample

Customized Canvas Tote Bag Design and Printing, Aba, Nigeria

₦10000Original price was: ₦10000.₦6500Current price is: ₦6500. Add to cart -

Sample

Political Campaign Poster Design and Printing, Aba, Nigeria

₦175000Original price was: ₦175000.₦163000Current price is: ₦163000. Add to cart -

Sample

Flex Banner Printing

₦6000Original price was: ₦6000.₦5000Current price is: ₦5000. Add to cart -

Sample

Flier Design

₦10000Original price was: ₦10000.₦7000Current price is: ₦7000. Add to cart -

Sample

Wedding Programme Design and Printing, Aba, Nigeria

₦145000Original price was: ₦145000.₦136000Current price is: ₦136000. Add to cart -

Sample

Custom Desk Name Plate Sign Stand Design and Printing, Aba, Nigeria

₦50000Original price was: ₦50000.₦32000Current price is: ₦32000. Add to cart

From time to time, CBN, Ministry of Agriculture NGO’S like Tony Elumelu Foundation do give out grants to startup businesses. Keep yourself updated with the latest news from these bodies. As of the time of writing this post, the top bodies offering grants in Nigeria are

- Africa’s Young Entrepreneur Empowerment Nigeria (AYEEN)

- Tony Elumelu Foundation Entrepreneurship Programme

- Shell LiveWire

- GroFin Fund

4. Investors.

This option is suitable for business owners who are willing to share their business profits once it starts paying. An investor is willing to pump his/her millions into your startup business, on the note that he/she will be getting some percentage of the business profit. If you are comfortable with this, you even approach a rich person within your area and persuade him/her to invest in your business.

5. Crowdfunding.

Crowdfunding is the practice of funding a project or venture by raising money from a large number of people, typically via the Internet eg Facebook, Twitter etc

Once you have a convincing reason backing your crowdfunding campaign, you can launch one and watch people contribute immensely to your business. Crowdfunding has helped numerous companies in recent years, and here are some reliable crowdfunding platforms in Nigeria, designed for different types of businesses.