Description

As CAC accredited agents, we will assist you to file your CAC annual returns within 5 days.

What is CAC Annual Returns

Think of CAC annual returns as your business’s way of telling Corporate Affairs Commission (CAC) yearly —”Hey, we’re here, and we’re active!” It’s the only way to ensures that your business name stays alive and kicking in the official records.

When is your business due for Annual Return?

The Company and Allied Matters Act (CAMA) requires that annual returns is filed each year and should start

— one year after registration, for business names

—18 months after registration, for Limited companies

— one year after registration, for Incorporated Trustees (Churches, Associations, Mosque, NGO etc. )

In any case,

Our Top Selling Services

— businesses are required to file their annual returns for each year between 1st January and 30th June.

— limited companies are required to file their annual returns 14 days after their annual general meeting.

—incorporated trustees are required to file their annual returns between 1st July to 31st December.

Failure to adhere to the CAMA act provisions results to penalties.

CAC Annual Return Cost?

Below is the official cost for filing CAC annual returns.

Business Names : ₦3000

Limited Company : ₦5000

Incorporated Trustees: ₦5000

Note: Accredited agents service charge and possible late filing charges have not been added to the cost listed above. Adding such can significantly increase the cost.

Requirements to file CAC annual returns?

To file CAC annual returns, you will need

— complete CAC documents, which clearly shows the business details

We recommend this for you

— a financial figure stating the business total income for the year

— a financial figure stating the business total profit for the year. That is (total income – all expenditure)

— an audited financial report (only for incorporated trustees – NGO, Mosque, Churches etc.).

We can as well assist you prepare the audited report through our chattered accountant.

In a case where the business did not carry out any financial operation for the year, that is, no income nor expenditure, the business will still need to file annual returns for that year but will fill in the financial record space with NIL.

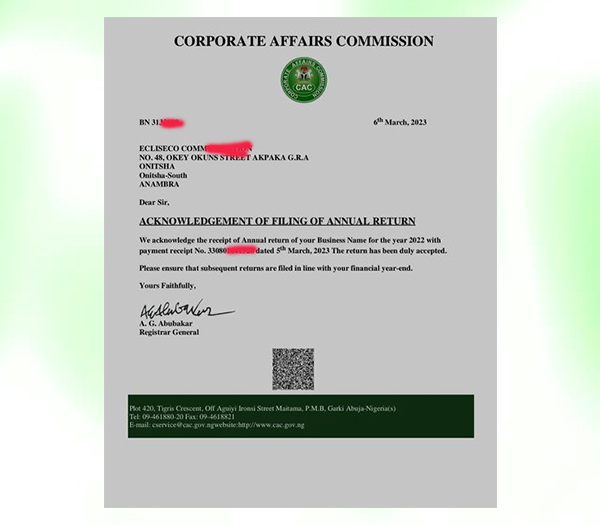

What you will get

You will get your CAC Annual return acknowledgement letter with 3-7 working days

Delivery: To your mail and WhatsApp

Order Or Contact

With these requirements, you can proceed to order or chat with our customer support on WhatsApp for more help.