Opening a corporate bank account can be daunting if one does not know, what’s involved in opening such an account. In this post, we have detailed the requirements and guidelines needed to open a Corporate/Business Bank Account in Nigeria. But first,

What is a corporate bank account?

In simple terms, a corporate bank account is a bank account that businesses use to hold their money. Corporate accounts are often referred to as business accounts and must be a CURRENT account type. A corporate account can be used for investing, saving, loans or everyday banking. Just like getting an affordable website, getting a corporate bank account adds legitimacy to any business.

Requirements to open a corporate bank account

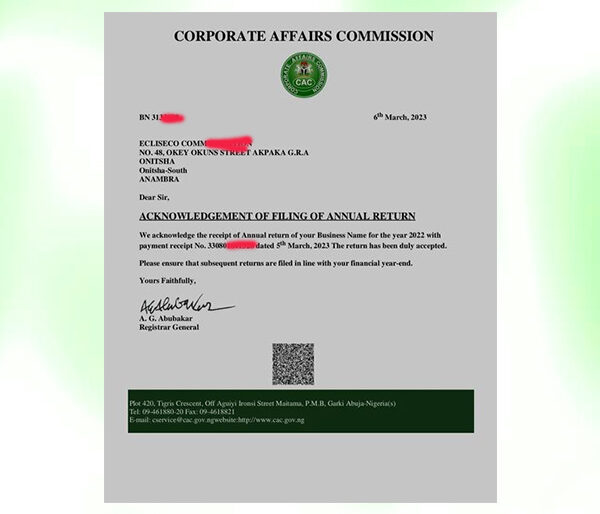

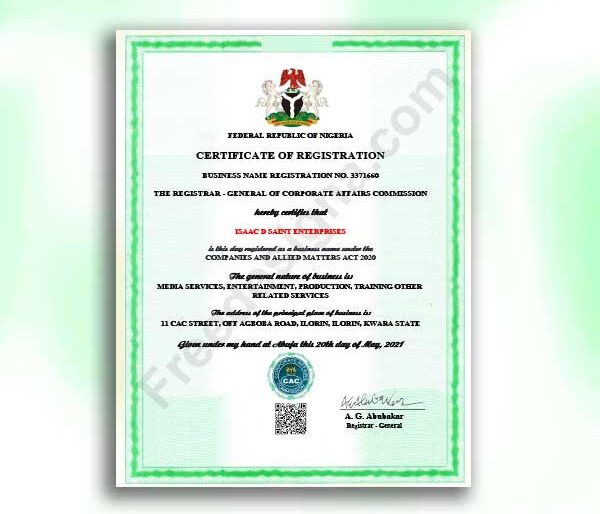

1. CAC Documents

Before you think of getting a cooperate bank account for any business, first such business has to be duly registered with CAC. And we assist people in registering their businesses with CAC, (Business name, Ltd, Plc, NGO, Church) at the most affordable cost. Once your business is duly registered, the CAC documents required include

- RC/BN Number

- Certificate of incorporation

- CAC Application Form

- Memorandum of Articles – for Ltd and Plc companies only

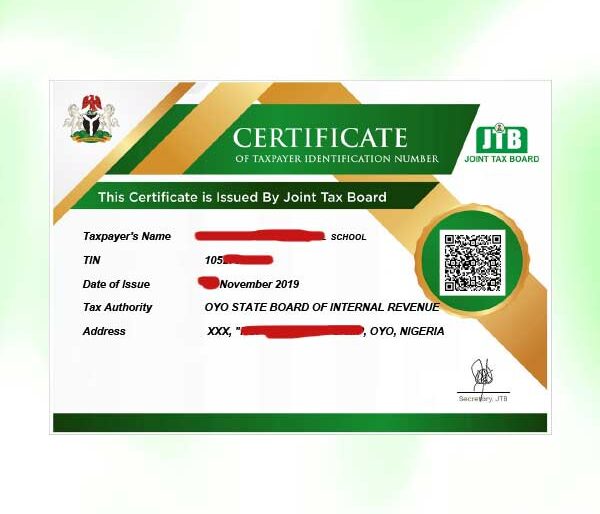

2. Tax Identification Number (TIN)

This is another mandatory requirement to open Corporate Bank Account in Nigeria. You should have a company/Business TIN by registering your company/business with Federal Inland Revenue Service (FIRS). We can assist you to get your TIN within 1 week. If you wish to do it on your own, here is a detailed guide to registering for TIN in Nigeria

3. Valid Means of Identification

A valid means of identification of the Business Proprietor or Company Directors is needed. A valid means of identification in Nigeria can be

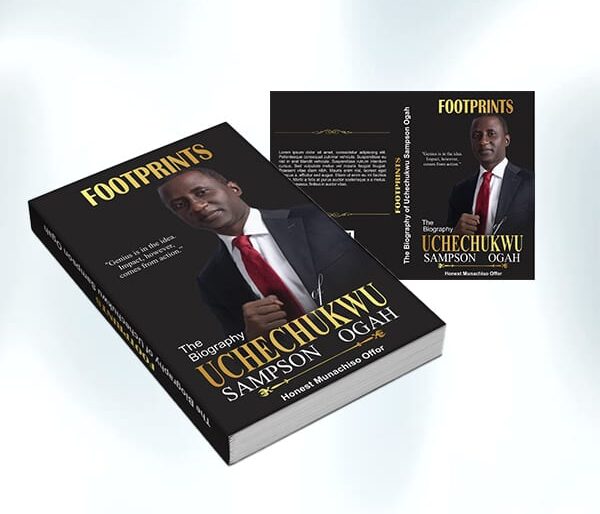

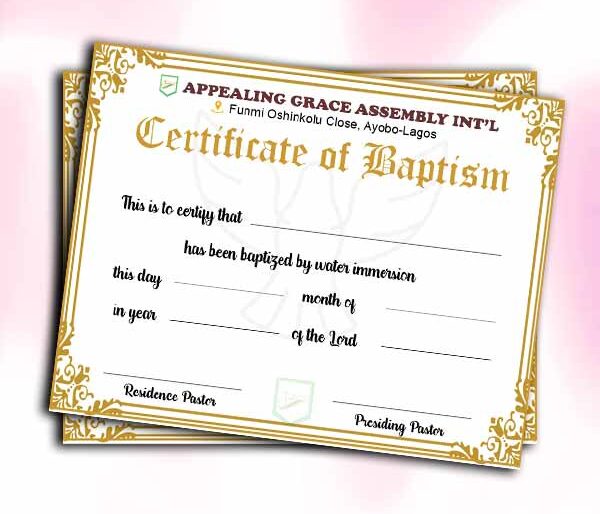

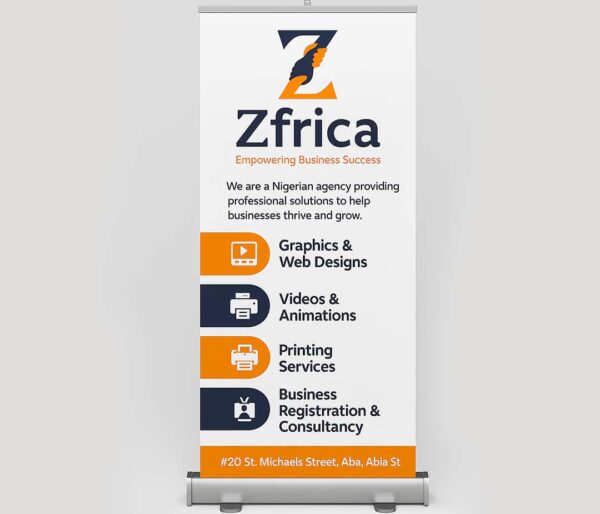

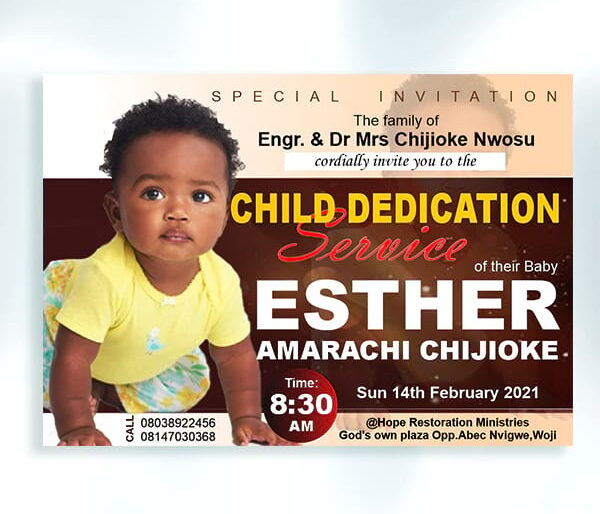

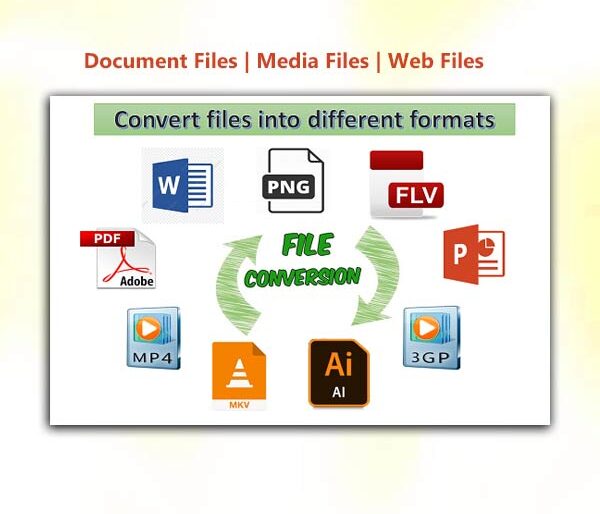

Our Top Selling Services

- Permanent Voters card

- Drivers licence

- International passport

- National Identity card (NIN)

4. Bank Verification Number (BVN)

The BVN of the Business Priopeitor(s) or Company Director(s) is needed.

5. Proof of Address

The acceptable proof of address can be any of the following,

- Telephone bill

- Tenancy agreement/rent receipt

- Electricity bill

- Water bill

- Waste bill

Note Any of the proof of address you present should not be more than 3 months old. Also, it should bear the business address you submitted to CAC when registering the business.

6. Passport Photographs

A passport photograph of the Business Priopeitor or Company Directors is needed. More than one copy of the passport may be needed depending on the bank in question.

7. Board Resolution

This is required for companies registered as Ltd or Plc or Incorporated Trustees. Business names are exempted from this requirement

A board resolution is a letter that states that the board of directors had a meeting and concluded to open the corporate account with the concerned bank, in an acceptable format. The board resolution:

- Should be signed by, at least, two (2) directors

- Must state the signing mandate of the proposed account

8. Two (2) Referees

You need to fill a referee account form provided by the bank. Depending on the bank, you will need 1 or 2 referees for this.

Note :

We recommend this for you

- An individual or personal account type cannot stand as your referee

- For your Business name account, you will need an existing business name account as a referee

- An Ltd company account will need another Ltd company account as a referee

- So is it for Plc and Incorporated Trustees account

9. More Requirements

Depending on the nature of the business/company for which you want to open an account. Other extra documents could be required. Eg, for business in these categories below, would need a SCUML certificate

- NGO’S

- Precious Stones and Metals

- Jewellery

- Real Estate, Estate Developers

- Chartered Accountants

- Estate Agents

- Audit Firms

- Tax Consultants

- etc

SCUML Certificate

SCUML is an abbreviation for Special Control Unit against Money Laundering. It is a unit under the Economic and Financial Crime Commission (EFCC). We can also assist you to register and get your SCUML certificate within 3 weeks. However, here is a detailed guide on how to apply for a SCUML certificate on your own.

Conclusion

We have carefully highlighted all needed to open a Corporate/Business Bank Account in Nigeria. Once you have these documents ready, you can walk into your preferred bank, to get your business/ company account opened. And if things go very straight, your corporate account should be ready within 24 hours.