Introduction

Understanding the variance between private and public companies is essential for founders, directors, and professionals. The private vs public company differences affect everything from board structure to compliance obligations. In this post, we explore the key points—mandatory meetings, decision‑making, officer requirements, and additional global insights—to help you build a well-structured company tailored to your needs and future ambitions.

Mandatory Statutory Meetings

Public companies must hold a statutory meeting within six months of incorporation. This formal gathering introduces shareholders to promoters, reviews initial financials, and establishes oversight frameworks early on.

Private companies, conversely, enjoy flexibility. They aren’t legally obligated to hold a statutory meeting, lowering early-stage administrative and financial burdens—ideal for startups and closely-held ventures.

Decision-Making: Written Resolutions vs Formal Meetings

Private companies can pass written resolutions, allowing key decisions without physical meetings. This agility speeds up processes like board appointments or policy changes without coordination challenges.

Our Top Selling Services

Public companies must hold formal group meetings—Annual General Meetings (AGMs), Extraordinary General Meetings (EGMs)—complete with notices, agendas, voting protocols, and minutes. This structure ensures transparency and protects investors.

Officer Qualifications: Flexible vs Regulated Standards

Public companies face stricter officer requirements. Directors and company secretaries often need professional qualifications or experience, sometimes even independent board members, to safeguard broader shareholder interests.

Private companies operate with fewer constraints. Founder-directors or trusted associates can serve without formal qualifications, helping small teams maintain swift, cost-effective governance.

Governance and Compliance Requirements

Public companies must issue audited financial statements, publish detailed annual reports, and adhere to stock exchange and corporate governance frameworks. These standards underpin investor confidence and public trust.

Private companies follow core company law without the heavy regulatory burden, unless they grow in size or complexity. Their reporting remains simpler, and internal procedures remain flexible—ideal for early-stage businesses and modest shareholder groups.

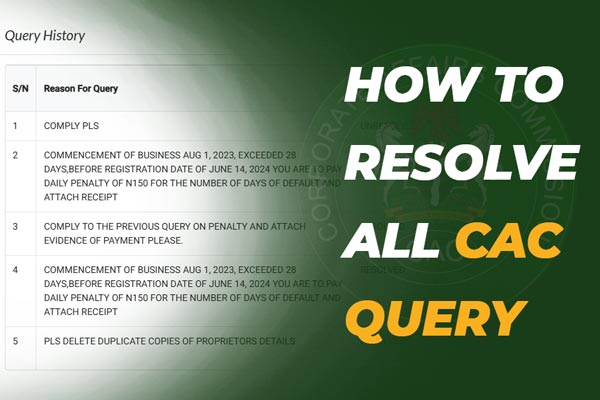

We recommend this for you

Global Context: Beyond Nigerian Company Law

In many markets, public companies carry extra layers of accountability. Stock exchange regulations require practices like transparent trading, periodic disclosures, and board independence. In countries using IFRS or GAAP, public firms must meet rigorous financial reporting and audit standards.

Technology increasingly supports both company types: private companies use e-signatures and digital minutes, while public firms rely on investor platforms and compliance software. This blend of local rules and global best practices helps companies scale responsibly.

Conclusion

Grasping private vs public company differences forms the backbone of successful business structure planning. Here’s what to remember:

- Public companies must hold statutory meetings; private companies do not.

- Private firms can make decisions via written resolutions; public enterprises require formal gatherings.

- Public company officers must meet stricter qualification criteria; private companies face fewer restrictions.

- Public entities follow enhanced governance and disclosure norms; private companies enjoy greater flexibility.

Choose the structure that aligns with your goals—whether lean, private beginnings or fully regulated public growth. Understanding these differences ensures you build with clarity, compliance, and forward momentum.

Have you Read this ?

Frequently Asked Questions (FAQs)

What is the deadline for a public company’s statutory meeting?

Public companies in Nigeria must hold a statutory meeting within six months of incorporation.

Can private companies use written resolutions legally?

Yes. Written resolutions carry the same validity as decisions made in person, so long as they meet formal requirements.

Who can serve as company secretary in a private company?

Often founders or associates act as secretary without needing formal professional qualifications.

What are the audit requirements for public versus private companies?

Public companies need audited financial statements and must file disclosures; private firms may have simplified audit obligations depending on size.

Can a private company transition to public in the future?

Yes—if a private company wants to go public later, it must adopt public company governance and compliance standards.

Why do public companies need independent directors?

Independent directors protect shareholder interests, improve governance, and support objective decision-making.

How do I decide which company type suits my business best?

If you plan to raise capital or scale publicly, a public structure may be suitable; for smaller operations and flexibility, private status works best.