Description

As CAC accredited agents, we will assist you to file your CAC annual returns within 5 days.

What is CAC Annual Returns

Think of CAC annual returns as your business’s way of telling Corporate Affairs Commission (CAC) yearly —”Hey, we’re here, and we’re active!” It’s the only way to ensures that your business name stays alive and kicking in the official records.

When is your business due for Annual Return?

The Company and Allied Matters Act (CAMA) requires that annual returns is filed each year and should start

— one year after registration, for business names

—18 months after registration, for Limited companies

— one year after registration, for Incorporated Trustees (Churches, Associations, Mosque, NGO etc. )

In any case,

Our Top Selling Services

-

Sample

Custom Hoodie Design and Printing, Aba, Nigeria

₦40000Original price was: ₦40000.₦22000Current price is: ₦22000. Add to cart -

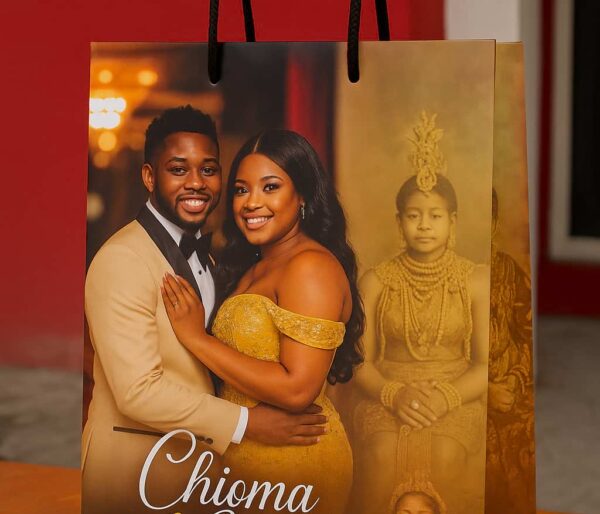

Sample

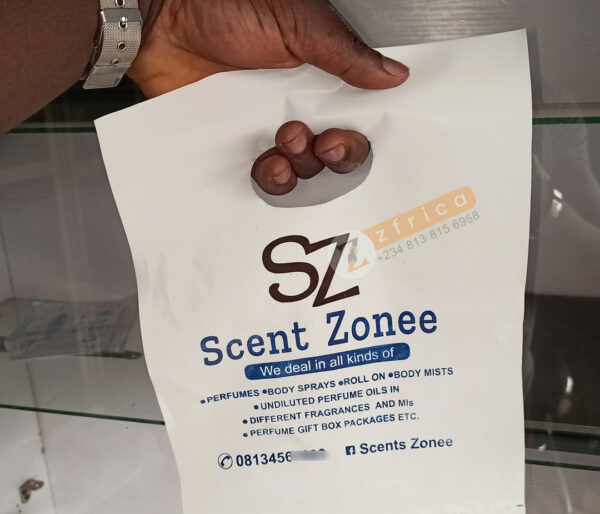

Paper Bag Design and Printing, Aba, Nigeria

₦50000Original price was: ₦50000.₦40800Current price is: ₦40800. Add to cart -

Sample

Graduation Scroll Design and Printing, Aba, Nigeria

₦10000Original price was: ₦10000.₦6500Current price is: ₦6500. Add to cart -

Sample

Customized Mouse Pad Design and Printing, Aba, Nigeria

₦6000Original price was: ₦6000.₦4000Current price is: ₦4000. Add to cart -

Sample

Food and Drink Menu Design and Printing, Aba, Nigeria

₦50000Original price was: ₦50000.₦43500Current price is: ₦43500. Add to cart -

Sample

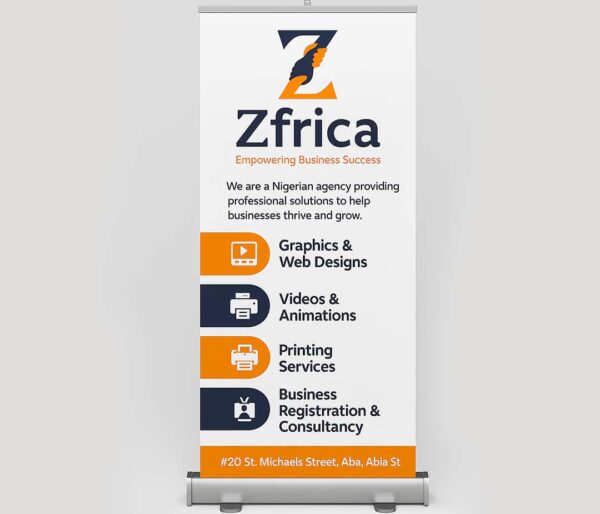

Rollup Banner Design and Printing (Big Base), Aba, Nigeria

₦80000Original price was: ₦80000.₦65000Current price is: ₦65000. Add to cart -

Sample

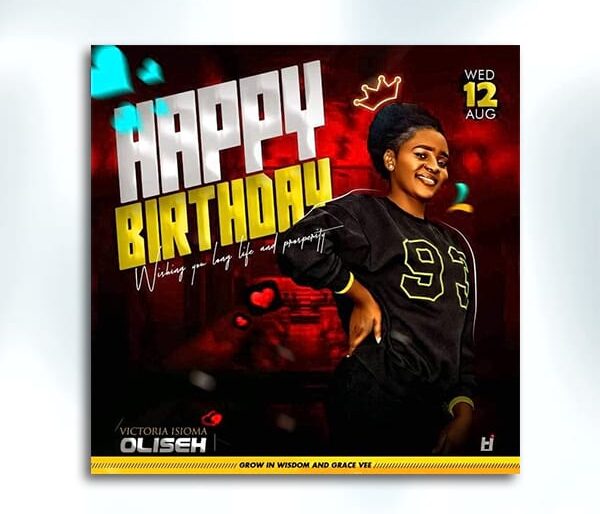

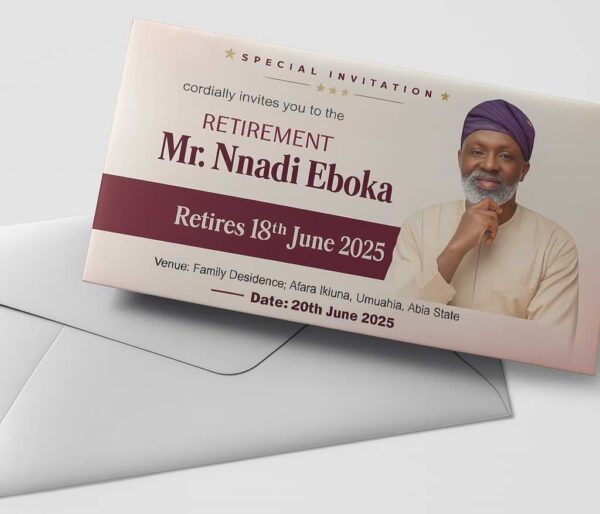

Birthday Party Design

₦15000Original price was: ₦15000.₦10000Current price is: ₦10000. Add to cart -

Sample

Document Typing & Editing

₦10000Original price was: ₦10000.₦5000Current price is: ₦5000. Add to cart -

Sample

Hand and Table Flag Design and Printing, Aba, Nigeria

₦20000Original price was: ₦20000.₦16000Current price is: ₦16000. Add to cart -

Sample

Custom Political Campaign Sticker Design and Printing, Aba, Nigeria

₦25000Original price was: ₦25000.₦19000Current price is: ₦19000. Add to cart -

Sample

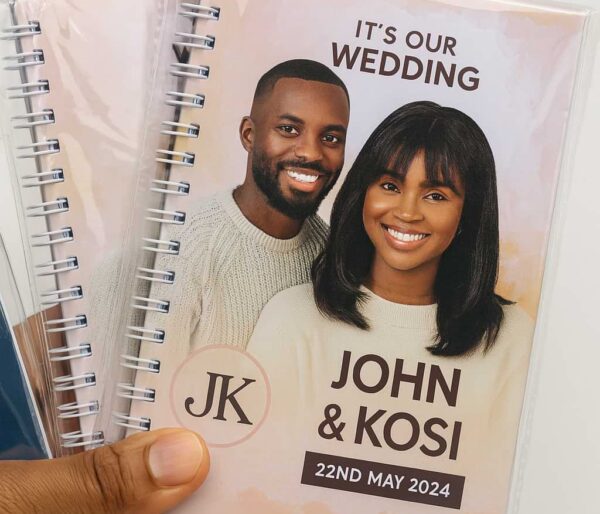

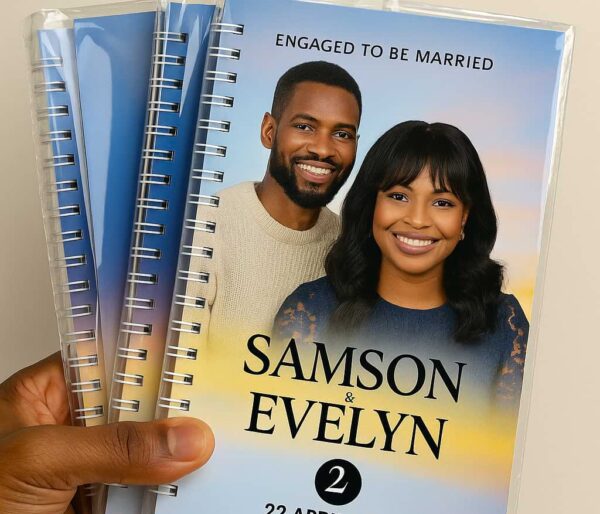

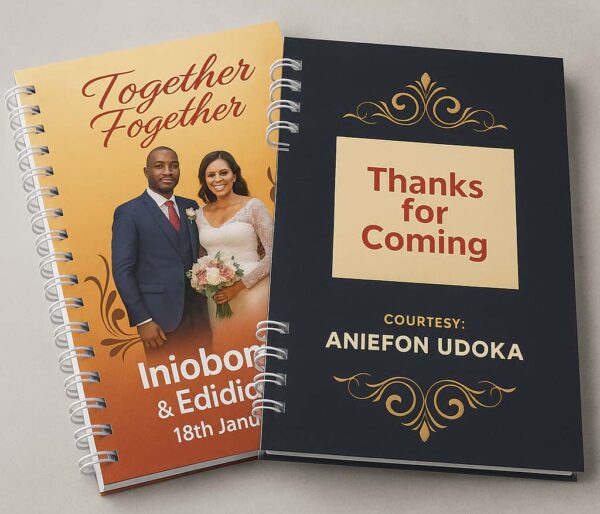

Customized Wedding Souvenir Jotter Design and Printing, Aba, Nigeria

₦200000Original price was: ₦200000.₦175000Current price is: ₦175000. Add to cart -

Sample

Event Ask Me Name Tag Design and Printing, Aba, Nigeria

₦40000Original price was: ₦40000.₦30000Current price is: ₦30000. Add to cart -

Sample

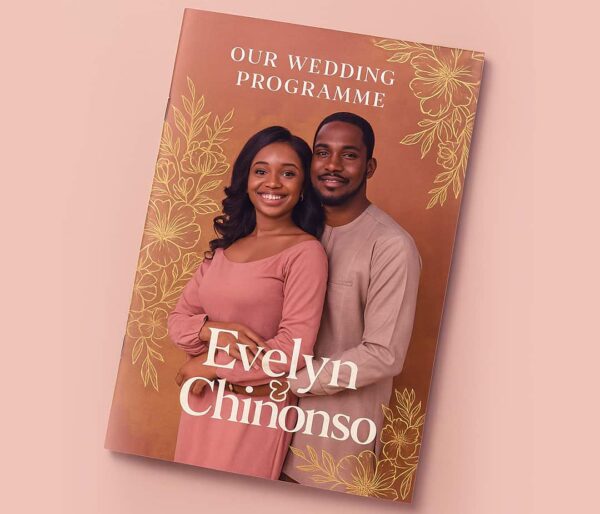

Tri-fold Wedding Programme Design and Printing, Aba, Nigeria

₦60000Original price was: ₦60000.₦56000Current price is: ₦56000. Add to cart -

Sample

Customized Fabric Label Design and Printing, Aba, Nigeria

₦200000Original price was: ₦200000.₦165000Current price is: ₦165000. Add to cart -

Sample

Customized Courier Nylon Bag Design and Printing, Aba, Nigeria

₦50000Original price was: ₦50000.₦48200Current price is: ₦48200. Add to cart -

Sample

Flyer / Poster Printing

₦7000Original price was: ₦7000.₦3500Current price is: ₦3500. Add to cart -

Sample

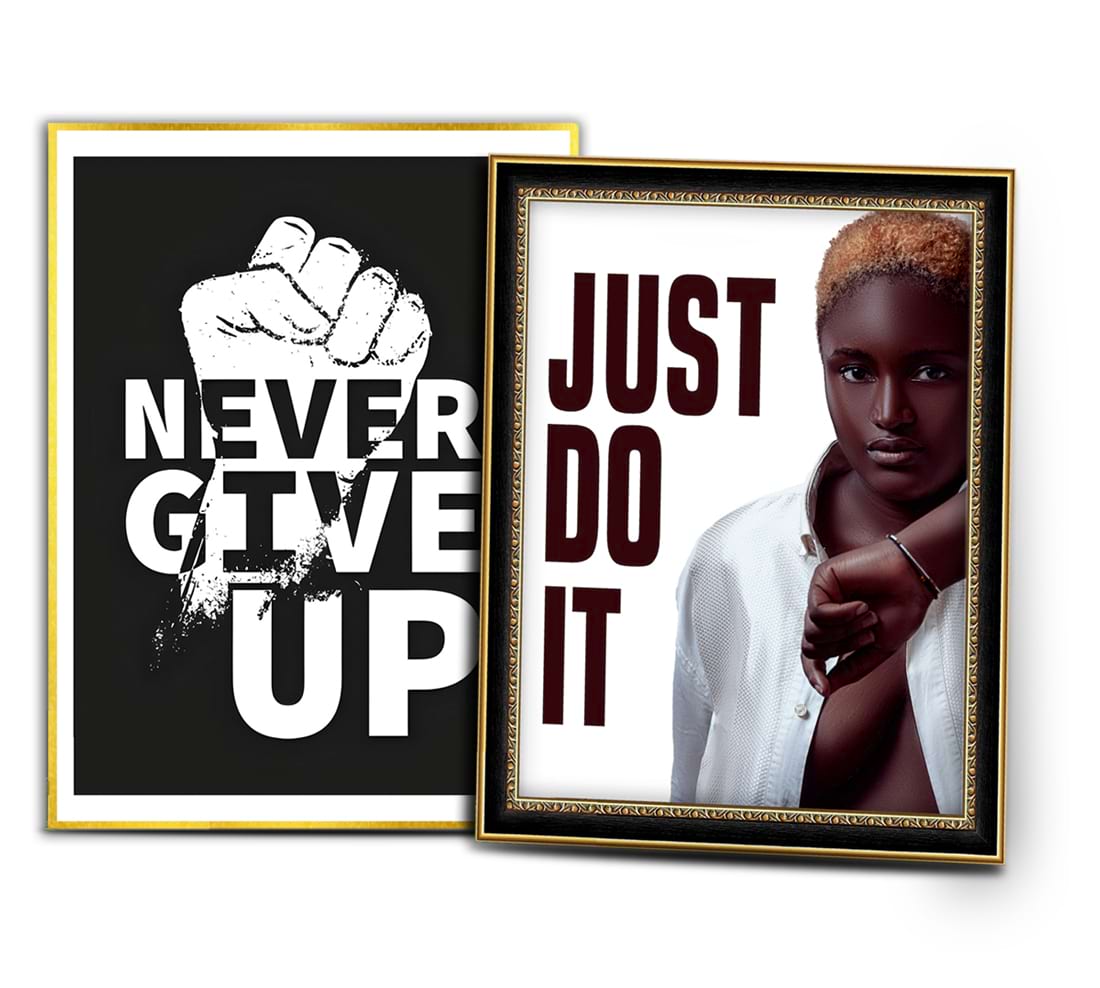

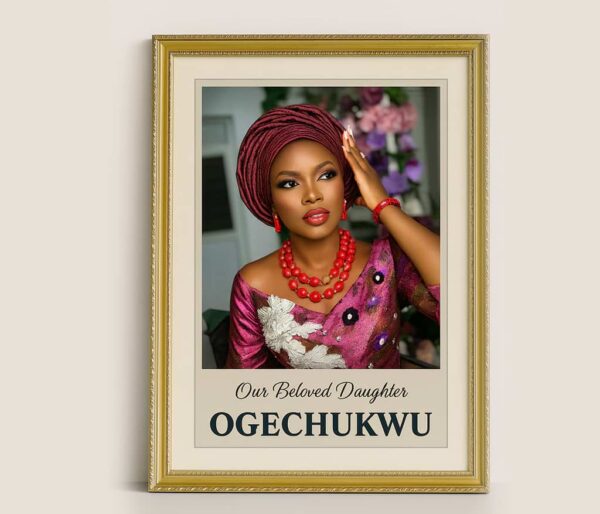

Customized Picture Frame Design and Printing, Aba, Nigeria

₦20000Original price was: ₦20000.₦15000Current price is: ₦15000. Add to cart -

Sample

Award Plaque Design and Printing, Aba, Nigeria

₦50000Original price was: ₦50000.₦28000Current price is: ₦28000. Add to cart -

Sample

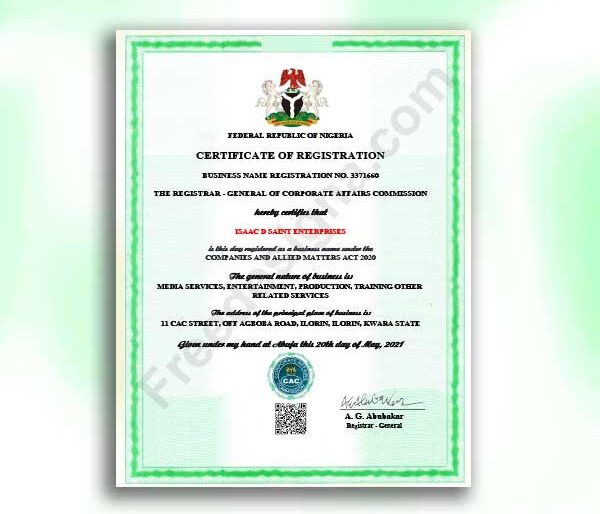

Company Registration Ltd (RC)

₦60000Original price was: ₦60000.₦55000Current price is: ₦55000. Add to cart -

Sample

Indoor Wall Logo Glass Signage Design and Branding, Aba, Nigeria

₦130000Original price was: ₦130000.₦125000Current price is: ₦125000. Add to cart -

Sample

Shoulder and Waist Bag Design and Printing, Aba, Nigeria

₦120000Original price was: ₦120000.₦111800Current price is: ₦111800. Add to cart -

Sample

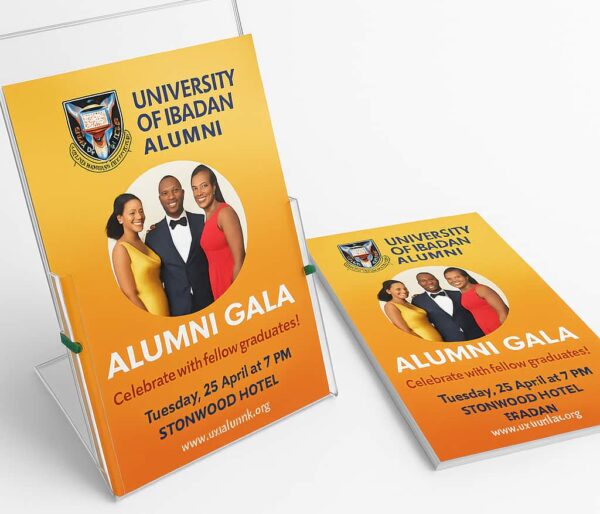

Flyer Design and Printing, Aba, Nigeria

₦60000Original price was: ₦60000.₦52300Current price is: ₦52300. Add to cart -

SCUML Certificate

Read more -

Sample

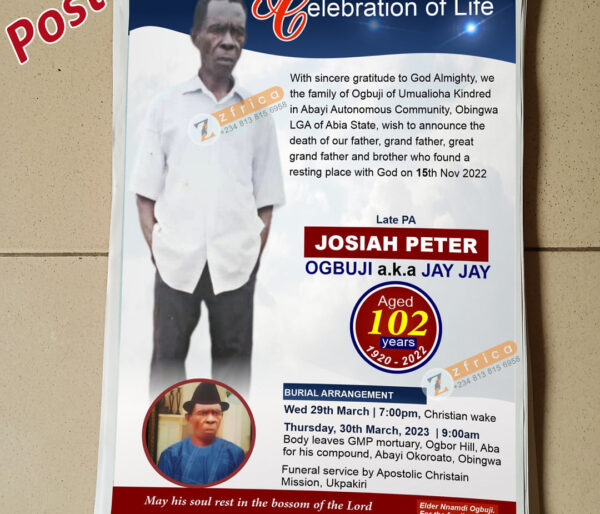

Poster Design and Printing, Aba, Nigeria

₦50000Original price was: ₦50000.₦35000Current price is: ₦35000. Add to cart -

Sample

Customized Luxury Drawer Jewelry Gift Box Design and Printing, Aba, Nigeria

₦450000Original price was: ₦450000.₦425000Current price is: ₦425000. Add to cart -

Sample

Write Articles & Blog Contents

₦15000Original price was: ₦15000.₦10000Current price is: ₦10000. Add to cart -

Sample

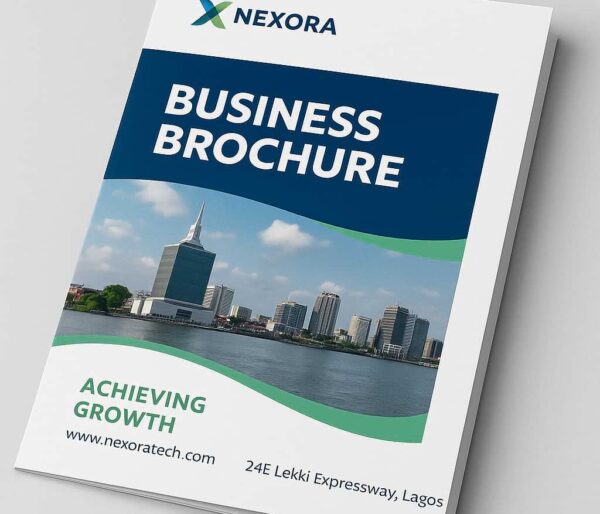

Brochure Design and Printing , Aba, Nigeria

₦30000Original price was: ₦30000.₦23600Current price is: ₦23600. Add to cart -

Sample

Custom Desk Name Plate Sign Stand Design and Printing, Aba, Nigeria

₦50000Original price was: ₦50000.₦32000Current price is: ₦32000. Add to cart -

Sample

Door/Window Graphic Design Print and Branding, Aba, Nigeria

₦23000Original price was: ₦23000.₦18000Current price is: ₦18000. Add to cart -

Sample

Waybill & Delivery Note Booklet Design and Printing, Aba, Nigeria

₦40000Original price was: ₦40000.₦30000Current price is: ₦30000. Add to cart -

Sample

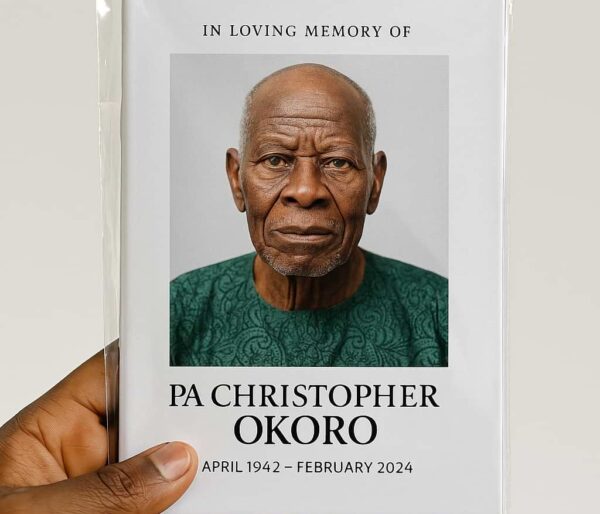

Customized Burial/Funeral Jotter Design and Printing, Aba, Nigeria

₦200000Original price was: ₦200000.₦175000Current price is: ₦175000. Add to cart -

Sample

Promotional Pennant Banner Design and Printing, Aba, Nigeria

₦15000Original price was: ₦15000.₦10500Current price is: ₦10500. Add to cart -

Sample

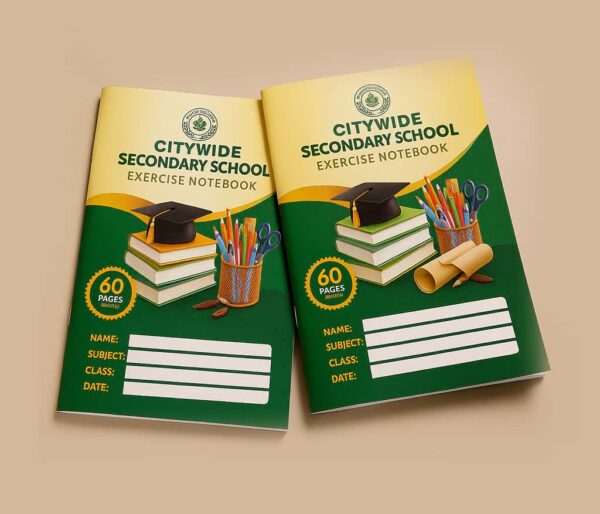

Customized Long Note Exercise Book Design and Printing, Aba, Nigeria

₦200000Original price was: ₦200000.₦140000Current price is: ₦140000. Add to cart -

Sample

Customized Serving Tray Printing and Design, Aba, Nigeria

₦65000Original price was: ₦65000.₦60000Current price is: ₦60000. Add to cart -

Sample

Backpack Drawstring Bag Design and Printing, Aba, Nigeria

₦70000Original price was: ₦70000.₦60000Current price is: ₦60000. Add to cart -

Sample

Customized Dome Sticker Lapel Pins Design and Printing, Aba, Nigeria

₦130000Original price was: ₦130000.₦125000Current price is: ₦125000. Add to cart -

Sample

Wedding Programme Design and Printing, Aba, Nigeria

₦145000Original price was: ₦145000.₦136000Current price is: ₦136000. Add to cart -

Sample

Special Business Card Design and Printing, Aba, Nigeria

₦65000Original price was: ₦65000.₦52000Current price is: ₦52000. Add to cart -

Sample

Single-Sided Business Card Design and Printing, Aba, Nigeria

₦10000Original price was: ₦10000.₦7000Current price is: ₦7000. Add to cart -

Sample

Ad / Social Media Design

₦9000Original price was: ₦9000.₦5000Current price is: ₦5000. Add to cart -

Sample

Customized Company Seal and Embossing Stamp Branding, Aba, Nigeria

₦50000Original price was: ₦50000.₦45000Current price is: ₦45000. Add to cart -

Sample

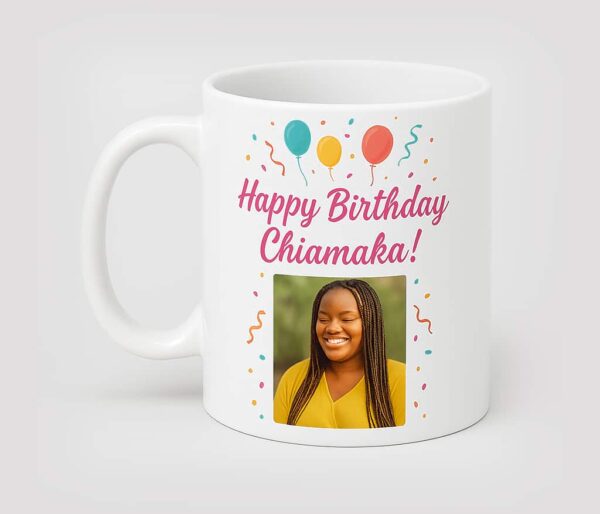

Branded Customized Mug Design and Printing, Aba, Nigeria

₦7000Original price was: ₦7000.₦5000Current price is: ₦5000. Add to cart -

Sample

C.V / Resume Writing

₦10000Original price was: ₦10000.₦7000Current price is: ₦7000. Add to cart -

Sample

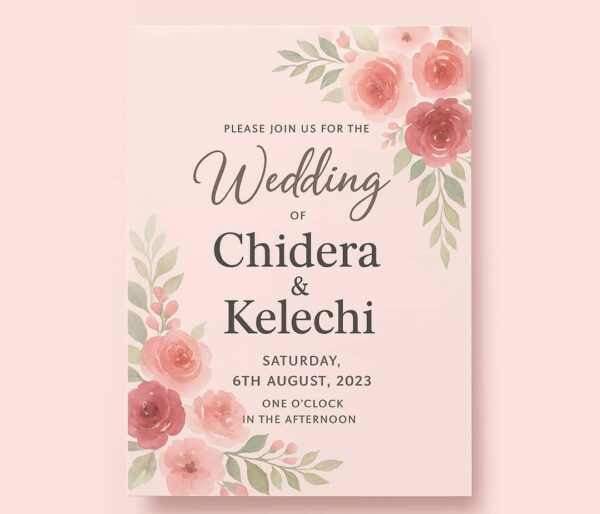

Wedding Invitation Card Design and Printing, Aba, Nigeria

₦400000Original price was: ₦400000.₦370000Current price is: ₦370000. Add to cart -

Sample

Upgrade Business Name to Limited Company CAC

₦80000Original price was: ₦80000.₦65000Current price is: ₦65000. Add to cart -

Sample

Business Consultancy (Online)

₦55000Original price was: ₦55000.₦25000Current price is: ₦25000. Add to cart -

Sample

Business Website Design

₦300000Original price was: ₦300000.₦250000Current price is: ₦250000. Add to cart -

Sample

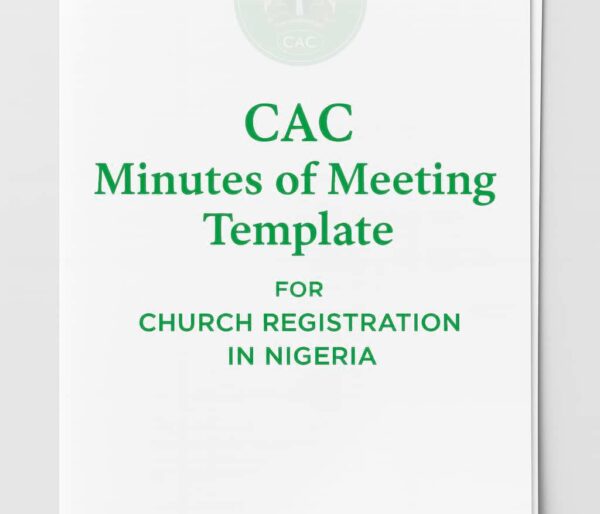

CAC Minutes of Meeting Template for Church Registration in Nigeria

₦12000Original price was: ₦12000.₦10000Current price is: ₦10000. Add to cart -

Sample

A2 Wall Calendar Design and Printing, Aba, Nigeria

₦840000Original price was: ₦840000.₦540000Current price is: ₦540000. Add to cart -

Sample

Custom Sash Design and Printing, Aba, Nigeria

₦20000Original price was: ₦20000.₦16500Current price is: ₦16500. Add to cart -

Sample

Complete Branding & Brand Style Guide

₦100000Original price was: ₦100000.₦70000Current price is: ₦70000. Add to cart -

Sample

Customized Satin Ribbon Printing and Design, Aba, Nigeria

₦25000Original price was: ₦25000.₦22000Current price is: ₦22000. Add to cart -

Sample

Customized Jersey T-Shirt Printing and Design, Aba, Nigeria

₦40000Original price was: ₦40000.₦35000Current price is: ₦35000. Add to cart -

Sample

Brochure Design

₦15000Original price was: ₦15000.₦10000Current price is: ₦10000. Add to cart -

Sample

Thank You Card Design and Printing, Aba, Nigeria

₦10000Original price was: ₦10000.₦7000Current price is: ₦7000. Add to cart -

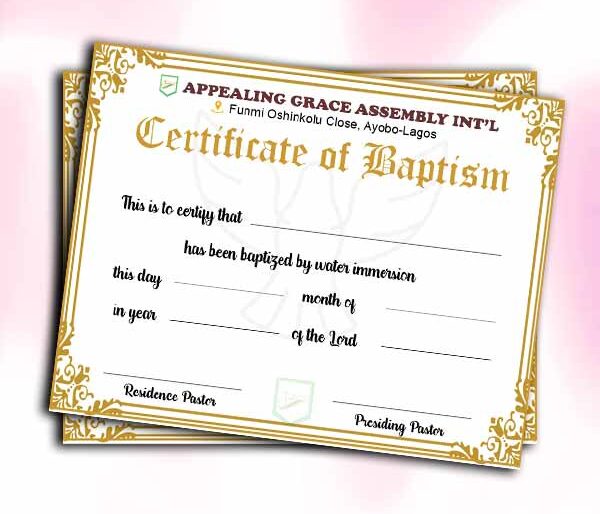

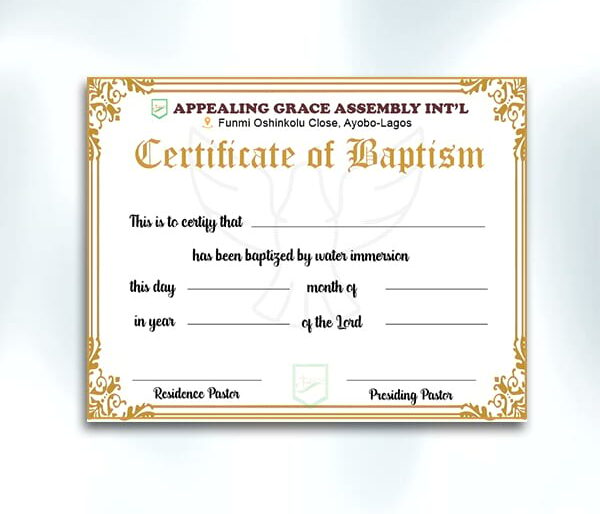

Sample

Certificate Printing

₦20000Original price was: ₦20000.₦17000Current price is: ₦17000. Add to cart -

Sample

Business Card Printing

₦15000Original price was: ₦15000.₦10000Current price is: ₦10000. Add to cart -

Sample

Certificate Design

₦12000Original price was: ₦12000.₦7000Current price is: ₦7000. Add to cart -

Sample

Personalized Metal Achievement Medals Design and Printing, Aba, Nigeria

₦6000Original price was: ₦6000.₦4500Current price is: ₦4500. Add to cart -

Sample

NGO, CHURCH, Mosque Registration (IT)

₦200000Original price was: ₦200000.₦150000Current price is: ₦150000. Add to cart -

Sample

Customized Name Tag Printing and Design, Aba, Nigeria

₦50000Original price was: ₦50000.₦44000Current price is: ₦44000. Add to cart -

Sample

Website Editing / Optimization

₦70000Original price was: ₦70000.₦50000Current price is: ₦50000. Add to cart -

Sample

Customized ID Card Rope Design and Printing, Aba, Nigeria

₦6000Original price was: ₦6000.₦4000Current price is: ₦4000. Add to cart -

Sample

Food Packaging Paper Bag Design and Printing, Aba, Nigeria

₦124000Original price was: ₦124000.₦115400Current price is: ₦115400. Add to cart -

Sample

Acrylic Wedding Invitation Card Design and Printing, Aba, Nigeria

₦190000Original price was: ₦190000.₦185000Current price is: ₦185000. Add to cart -

Sample

Political Campaign Poster Design and Printing, Aba, Nigeria

₦175000Original price was: ₦175000.₦163000Current price is: ₦163000. Add to cart -

Sample

Company Profile

₦40000Original price was: ₦40000.₦25000Current price is: ₦25000. Add to cart -

Sample

Customized Luxury Product Package & Gift Box Design and Printing, Aba, Nigeria

₦450000Original price was: ₦450000.₦425000Current price is: ₦425000. Add to cart -

Sample

Customized Canvas Tote Bag Design and Printing, Aba, Nigeria

₦10000Original price was: ₦10000.₦6500Current price is: ₦6500. Add to cart -

Sample

Invoice Booklet Design and Printing, Aba, Nigeria

₦40000Original price was: ₦40000.₦30000Current price is: ₦30000. Add to cart -

Sample

LetterHead Paper Printing

₦15000Original price was: ₦15000.₦12000Current price is: ₦12000. Add to cart -

Sample

Customized Backdrop Banner Design and Printing, Aba, Nigeria

₦500000Original price was: ₦500000.₦425000Current price is: ₦425000. Add to cart -

Sample

Customized Wristband Design and Printing, Aba, Nigeria

₦900000Original price was: ₦900000.₦875000Current price is: ₦875000. Add to cart -

Sample

Customized Company Rubber & Dater Stamp Design and Printing, Aba, Nigeria

₦40000Original price was: ₦40000.₦27000Current price is: ₦27000. Add to cart -

Sample

Rollup Banner Design and Printing (Small Base), Aba, Nigeria

₦70000Original price was: ₦70000.₦60000Current price is: ₦60000. Add to cart -

Sample

Custom Certificate Design and Printing, Aba, Nigeria

₦5000Original price was: ₦5000.₦3000Current price is: ₦3000. Add to cart -

Sample

Country and Logo Flag Pole Design and Printing, Aba, Nigeria

₦80000Original price was: ₦80000.₦67000Current price is: ₦67000. Add to cart -

Sample

Company Profile Design and Printing, Aba, Nigeria

₦140000Original price was: ₦140000.₦136000Current price is: ₦136000. Add to cart -

Sample

Branded Sublimation T-shirt Design and Printing, Aba, Nigeria

₦20000Original price was: ₦20000.₦15000Current price is: ₦15000. Add to cart -

Sample

Album Cover

₦15000Original price was: ₦15000.₦10000Current price is: ₦10000. Add to cart -

Sample

Business Name Registration-BN

₦50000Original price was: ₦50000.₦35000Current price is: ₦35000. Add to cart -

Sample

Banner/Poster Design

₦10000Original price was: ₦10000.₦7000Current price is: ₦7000. Add to cart -

Sample

Pylon Signage Design and Branding, Aba, Nigeria

₦400000Original price was: ₦400000.₦365000Current price is: ₦365000. Add to cart -

Sample

Customized Birthday Jotter Design and Printing, Aba, Nigeria

₦200000Original price was: ₦200000.₦175000Current price is: ₦175000. Add to cart -

Sample

Business Card Design

₦10000Original price was: ₦10000.₦7000Current price is: ₦7000. Add to cart -

Sample

eBook / Book Cover Design

₦15000Original price was: ₦15000.₦10000Current price is: ₦10000. Add to cart -

Sample

Website Content

₦13000Original price was: ₦13000.₦7000Current price is: ₦7000. Add to cart -

Sample

Softcover Jotter Design and Printing, Aba, Nigeria

₦90000Original price was: ₦90000.₦75900Current price is: ₦75900. Add to cart -

Sample

Customized Phone Case Design and Branding, Aba, Nigeria

₦7000Original price was: ₦7000.₦5000Current price is: ₦5000. Add to cart -

Sample

Customized Water Bottle Design and Printing, Aba, Nigeria

₦10000Original price was: ₦10000.₦8500Current price is: ₦8500. Add to cart -

Sample

TShirt & Polo Customization

₦7000Original price was: ₦7000.₦5000Current price is: ₦5000. Add to cart -

Sample

Customized Embroidery Monogram Towel Printing and Design, Aba, Nigeria

₦25000Original price was: ₦25000.₦17500Current price is: ₦17500. Add to cart -

Sample

E Commerce Website Design

₦500000Original price was: ₦500000.₦400000Current price is: ₦400000. Add to cart -

Sample

Customized Yoyo Tag Design and Printing, Aba, Nigeria

₦5000Original price was: ₦5000.₦2000Current price is: ₦2000. Add to cart -

Sample

Customized Face Cap Printing and Design, Aba, Nigeria

₦6000Original price was: ₦6000.₦4000Current price is: ₦4000. Add to cart -

Sample

Label & Sticker Design

₦8000Original price was: ₦8000.₦7000Current price is: ₦7000. Add to cart -

Sample

Customized Umbrella Design and Printing, Aba, Nigeria

₦10000Original price was: ₦10000.₦7500Current price is: ₦7500. Add to cart -

Sample

Customized Table Cloth Covering Design and Printing, Aba, Nigeria

₦60000Original price was: ₦60000.₦56000Current price is: ₦56000. Add to cart -

Sample

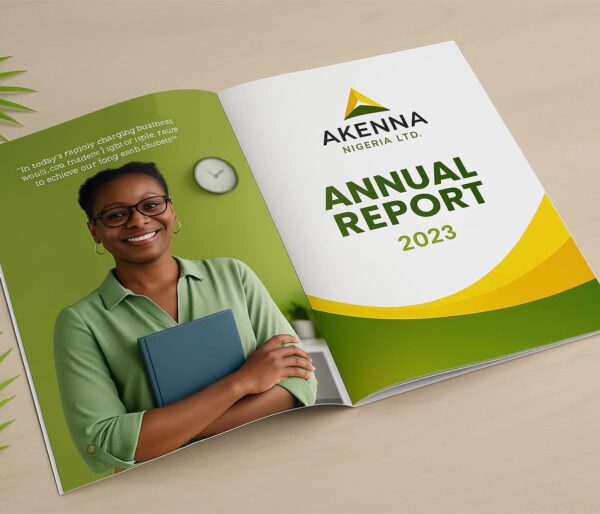

Company Annual Report Design and Print, Aba, Nigeria

₦140000Original price was: ₦140000.₦136000Current price is: ₦136000. Add to cart -

Sample

Customized Throw Pillow Design and Printing, Aba, Nigeria

₦30000Original price was: ₦30000.₦21000Current price is: ₦21000. Add to cart -

Sample

Company Registration PLC (RC)

₦100000Original price was: ₦100000.₦90000Current price is: ₦90000. Add to cart -

Sample

Clothing Tag Label Design and Printing, Aba, Nigeria

₦20000Original price was: ₦20000.₦14600Current price is: ₦14600. Add to cart -

Sample

Custom Branded Political Campaign PVC Hand Fan Design and Printing, Aba, Nigeria

₦175000Original price was: ₦175000.₦150000Current price is: ₦150000. Add to cart -

Sample

Customized Event Souvenir Jotter Design and Printing, Aba, Nigeria

₦200000Original price was: ₦200000.₦175000Current price is: ₦175000. Add to cart -

Sample

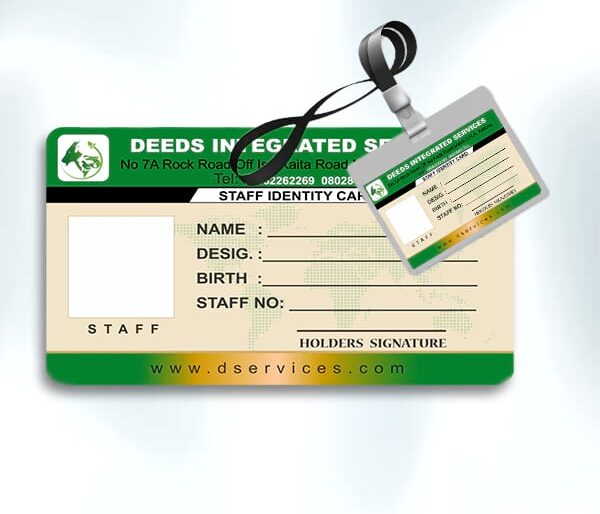

PVC Plastic ID Card Design and Printing, Aba, Nigeria

₦6000Original price was: ₦6000.₦4000Current price is: ₦4000. Add to cart -

Sample

Wine Paper Bag Design and Printing, Aba, Nigeria

₦124000Original price was: ₦124000.₦115400Current price is: ₦115400. Add to cart -

Sample

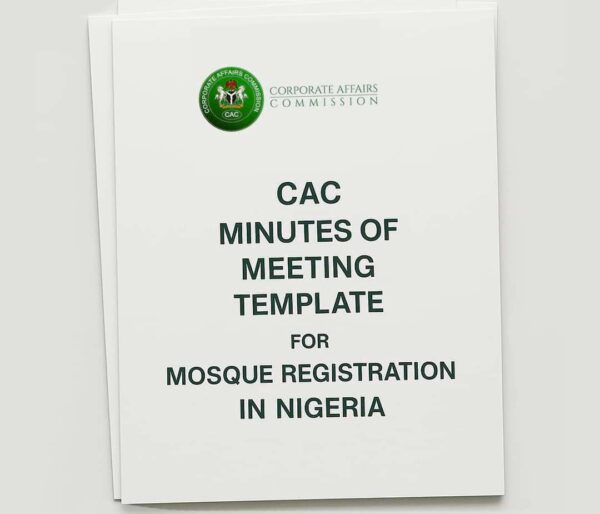

CAC Minutes of Meeting Template for Mosque Registration in Nigeria

₦12000Original price was: ₦12000.₦10000Current price is: ₦10000. Add to cart -

Sample

Bi-fold and Tri-fold Brochure Design and Printing, Aba, Nigeria

₦25000Original price was: ₦25000.₦18000Current price is: ₦18000. Add to cart -

Sample

Letter Head Design

₦7000Original price was: ₦7000.₦5000Current price is: ₦5000. Add to cart -

Sample

Customized Envelope Design and Printing, Aba, Nigeria

₦60000Original price was: ₦60000.₦50000Current price is: ₦50000. Add to cart -

Sample

Plastic ID Card Printing

₦6500Original price was: ₦6500.₦4000Current price is: ₦4000. Add to cart -

Sample

Label & Sticker Printing

₦6000Original price was: ₦6000.₦5000Current price is: ₦5000. Add to cart -

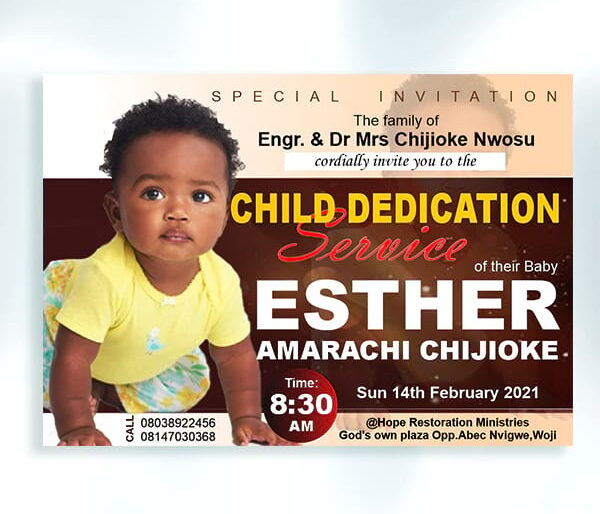

Sample

Invitation Card Printing

₦10000Original price was: ₦10000.₦5000Current price is: ₦5000. Add to cart -

Sample

Customized Magic Cup Design and Printing, Aba, Nigeria

₦10000Original price was: ₦10000.₦7000Current price is: ₦7000. Add to cart -

Sample

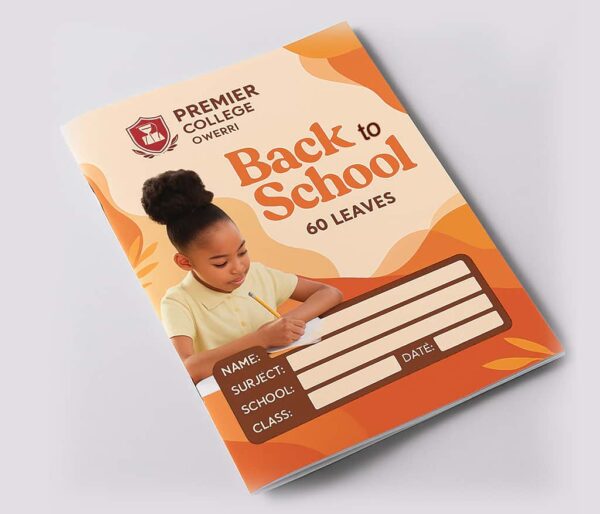

Notebook & Exercise Book Design and Printing, Aba, Nigeria

₦50000Original price was: ₦50000.₦41500Current price is: ₦41500. Add to cart -

Sample

Customized Apron Printing and Design, Aba, Nigeria

₦20000Original price was: ₦20000.₦13500Current price is: ₦13500. Add to cart -

Sample

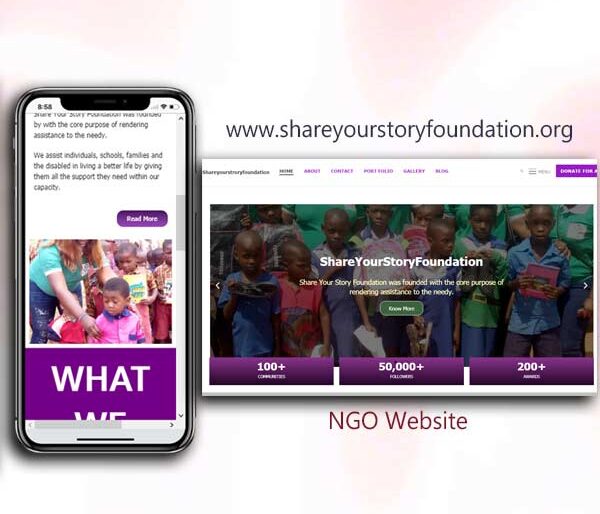

Church / NGO Website Design

₦400000Original price was: ₦400000.₦350000Current price is: ₦350000. Add to cart -

Sample

Blog Design

₦200000Original price was: ₦200000.₦150000Current price is: ₦150000. Add to cart -

Sample

Customized T-shirt Design and Printing, Aba, Nigeria

₦15000Original price was: ₦15000.₦10000Current price is: ₦10000. Add to cart -

Sample

Customized Political Campaign T-Shirt Design and Printing, Aba, Nigeria

₦25000Original price was: ₦25000.₦17500Current price is: ₦17500. Add to cart -

Sample

Receipt Booklet Design and Printing, Aba, Nigeria

₦30000Original price was: ₦30000.₦20000Current price is: ₦20000. Add to cart -

Sample

Nylon Design, Customization & Printing

₦5000 – ₦10000Price range: ₦5000 through ₦10000 Select options This product has multiple variants. The options may be chosen on the product page -

Sample

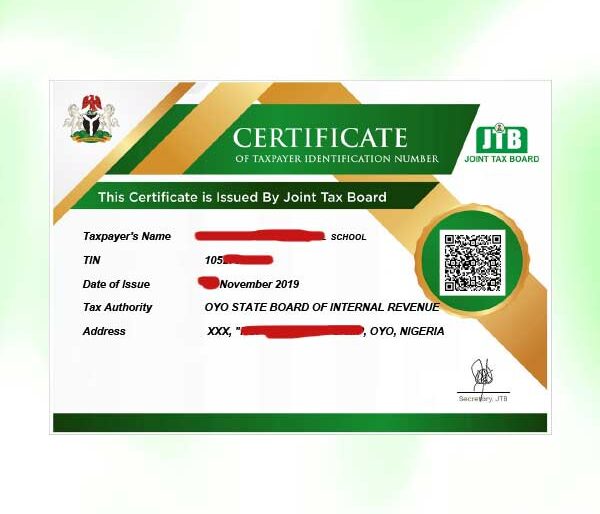

TIN Registration

₦8000Original price was: ₦8000.₦6000Current price is: ₦6000. Add to cart -

Sample

Double-Sided Business Card Design and Printing, Aba, Nigeria

₦15000Original price was: ₦15000.₦9000Current price is: ₦9000. Add to cart -

Sample

Customized USB Flash Drive Design and Printing, Aba, Nigeria

₦15000Original price was: ₦15000.₦12000Current price is: ₦12000. Add to cart -

Sample

Table Calendar Design and Printing, Aba, Nigeria

₦65000Original price was: ₦65000.₦54000Current price is: ₦54000. Add to cart -

Sample

Hardcover Jotter Design and Printing, Aba, Nigeria

₦250000Original price was: ₦250000.₦158600Current price is: ₦158600. Add to cart -

Sample

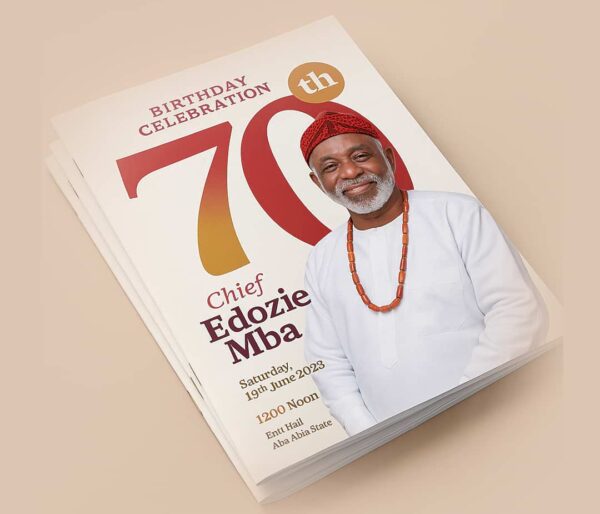

Birthday Programme Design and Printing, Aba, Nigeria

₦145000Original price was: ₦145000.₦136000Current price is: ₦136000. Add to cart -

Sample

GET SMEDAN CERTIFICATE REGISTRATION

₦10000Original price was: ₦10000.₦5000Current price is: ₦5000. Add to cart -

Sample

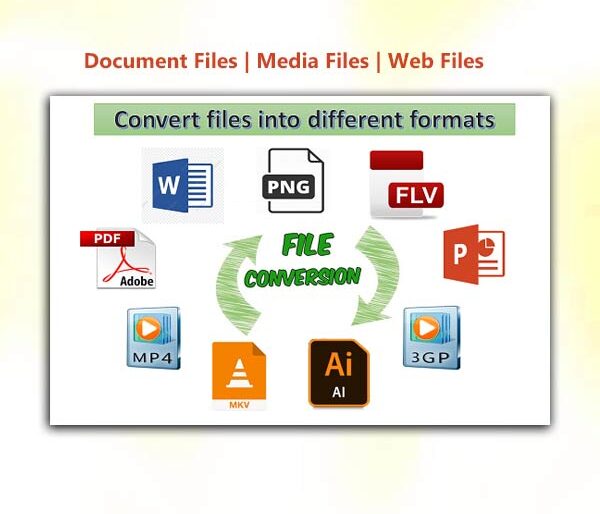

File Conversions

₦3000Original price was: ₦3000.₦2000Current price is: ₦2000. Add to cart -

Sample

Magazine Design and Printing, Aba, Nigeria

₦140000Original price was: ₦140000.₦136000Current price is: ₦136000. Add to cart -

Sample

Event Table Tent Tag Name Design and Printing, Aba, Nigeria

₦80000Original price was: ₦80000.₦75000Current price is: ₦75000. Add to cart -

Sample

Advertising Pole Signage & Signs Design and Printing, Aba, Nigeria

₦615000Original price was: ₦615000.₦605000Current price is: ₦605000. Add to cart -

Sample

Product Label Sticker Design and Printing, Aba, Nigeria

₦20000Original price was: ₦20000.₦15000Current price is: ₦15000. Add to cart -

Sample

Custom Temperature Flask Design and Printing, Aba, Nigeria

₦10000Original price was: ₦10000.₦7000Current price is: ₦7000. Add to cart -

Sample

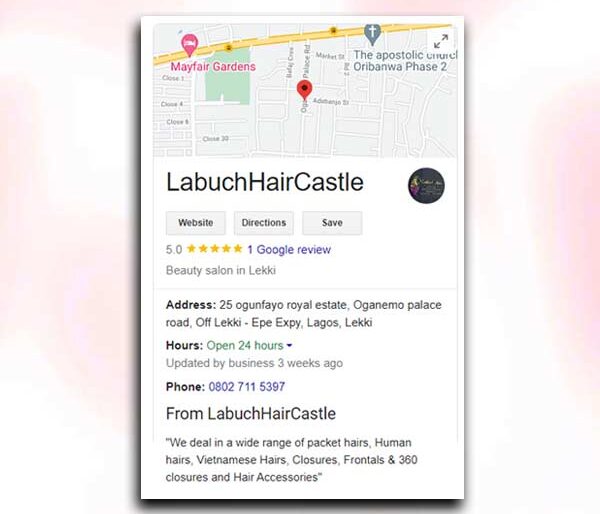

Google my Business (MAP) Page

₦70000Original price was: ₦70000.₦50000Current price is: ₦50000. Add to cart -

Sample

Logo Design

₦25000Original price was: ₦25000.₦15000Current price is: ₦15000. Add to cart -

Sample

School Website Design

₦350000Original price was: ₦350000.₦300000Current price is: ₦300000. Add to cart -

Sample

Customized Safety Reflective Jacket Vest Printing and Design, Aba, Nigeria

₦6000Original price was: ₦6000.₦4500Current price is: ₦4500. Add to cart -

Sample

Flex Banner Printing

₦6000Original price was: ₦6000.₦5000Current price is: ₦5000. Add to cart -

Sample

Customized Pen Design and Printing, Aba, Nigeria

₦30000Original price was: ₦30000.₦20000Current price is: ₦20000. Add to cart -

Sample

Custom Office Door Sign Design and Printing, Aba, Nigeria

₦20000Original price was: ₦20000.₦18500Current price is: ₦18500. Add to cart -

Sample

Flier Design

₦10000Original price was: ₦10000.₦7000Current price is: ₦7000. Add to cart -

Sample

Advert Billboard Design and Printing – Aba, Nigeria

₦90000Original price was: ₦90000.₦75000Current price is: ₦75000. Add to cart -

Sample

ID Card Design

₦9500Original price was: ₦9500.₦7000Current price is: ₦7000. Add to cart -

Sample

Flex Banner Design and Printing, Aba, Nigeria

₦600Original price was: ₦600.₦520Current price is: ₦520. Add to cart -

Sample

Business Consultancy (Physical)

₦140000Original price was: ₦140000.₦70000Current price is: ₦70000. Add to cart -

Sample

Customized Key Holder Design and Branding, Aba, Nigeria

₦5000Original price was: ₦5000.₦3500Current price is: ₦3500. Add to cart -

Sample

Customized Travel Mugs Design and Printing, Aba, Nigeria

₦25000Original price was: ₦25000.₦17200Current price is: ₦17200. Add to cart -

Sample

Invitattion Card Design

₦7500Original price was: ₦7500.₦5000Current price is: ₦5000. Add to cart -

Sample

Customized Logistics Courier Dispatch Rider Bike Delivery Box Printing and Branding, Aba, Nigeria

₦35000Original price was: ₦35000.₦32000Current price is: ₦32000. Add to cart -

Sample

Brand Identity Kit

₦70000Original price was: ₦70000.₦50000Current price is: ₦50000. Add to cart -

Sample

Event Ticket Design & Printing, Aba, Nigeria

₦45000Original price was: ₦45000.₦36000Current price is: ₦36000. Add to cart -

Sample

Custom Branded Political Campaign Face Cap Design and Printing, Aba, Nigeria

₦10000Original price was: ₦10000.₦6000Current price is: ₦6000. Add to cart -

Sample

Customized Construction Helmet Design and Printing, Aba, Nigeria

₦15000Original price was: ₦15000.₦10500Current price is: ₦10500. Add to cart

— businesses are required to file their annual returns for each year between 1st January and 30th June.

— limited companies are required to file their annual returns 14 days after their annual general meeting.

—incorporated trustees are required to file their annual returns between 1st July to 31st December.

Failure to adhere to the CAMA act provisions results to penalties.

CAC Annual Return Cost?

Below is the official cost for filing CAC annual returns.

Business Names : ₦3000

Limited Company : ₦5000

Incorporated Trustees: ₦5000

Note: Accredited agents service charge and possible late filing charges have not been added to the cost listed above. Adding such can significantly increase the cost.

Requirements to file CAC annual returns?

To file CAC annual returns, you will need

— complete CAC documents, which clearly shows the business details

We recommend this for you

— a financial figure stating the business total income for the year

— a financial figure stating the business total profit for the year. That is (total income – all expenditure)

— an audited financial report (only for incorporated trustees – NGO, Mosque, Churches etc.).

We can as well assist you prepare the audited report through our chattered accountant.

In a case where the business did not carry out any financial operation for the year, that is, no income nor expenditure, the business will still need to file annual returns for that year but will fill in the financial record space with NIL.

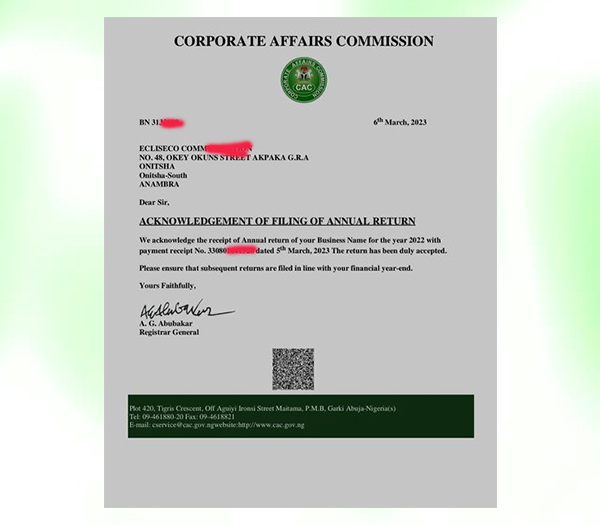

What you will get

You will get your CAC Annual return acknowledgement letter with 3-7 working days

Delivery: To your mail and WhatsApp

Order Or Contact

With these requirements, you can proceed to order or chat with our customer support on WhatsApp for more help.