Introduction

Nigeria, Africa’s largest economy and home to over 200 million people, is an inviting destination for foreign investors—especially Americans. With a GDP exceeding $450 billion and growing trade volumes between both countries, many U.S. entrepreneurs are setting up companies in Nigeria to tap into a rapidly expanding consumer market and a thriving technology ecosystem.

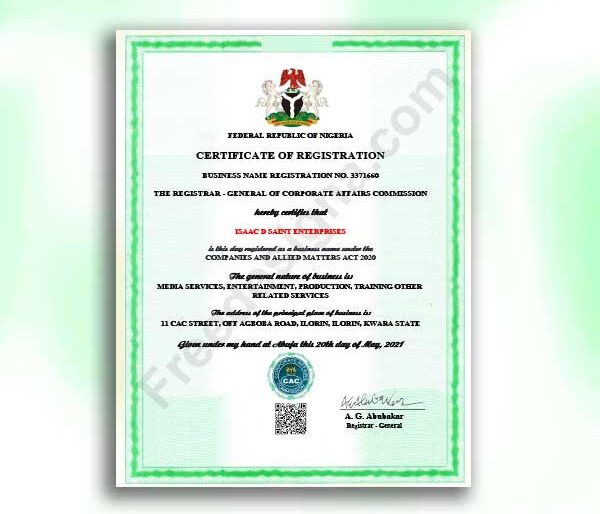

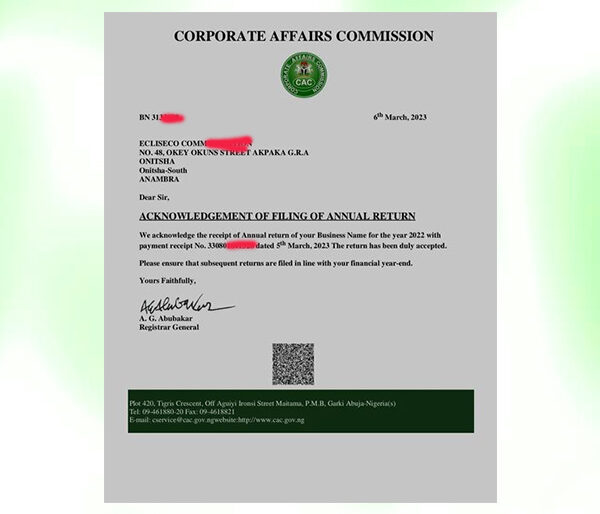

The process is now more accessible than ever. Thanks to the Corporate Affairs Commission (CAC)’s fully digital registration platform, an American can register a company from anywhere in the world without mailing documents or visiting Nigeria in person. Still, knowing the right steps, requirements, and costs makes the journey smoother and helps you avoid unnecessary delays.

Why U.S. Businesses Are Expanding into Nigeria

Nigeria’s appeal goes beyond its market size. It’s the gateway to West Africa and a strategic location for expanding into the continent. The population is young, English is the official business language, and corporate laws follow the familiar UK-based system—making it easy for U.S. investors to adapt.

Here are some reasons American companies are incorporating in Nigeria today:

- Vast consumer base: Over 200 million people with rising purchasing power.

- Regional gateway: Membership in ECOWAS provides access to 15 West African markets.

- English-language environment: Business and legal transactions require no translation.

- Improved digital infrastructure: CAC, FIRS, and major banks now operate online.

- Skilled workforce: A fast-growing youth population drives innovation and technology adoption.

According to data from the Nigerian Investment Promotion Commission (NIPC), more than 900 foreign-owned businesses—nearly 14% from the United States—registered in Nigeria between 2021 and 2024. This trend continues to grow as more small and mid-sized U.S. businesses follow the path of established multinationals.

Our Top Selling Services

Choosing the Right Business Structure

For most Americans, the most suitable business structure is a Private Limited Liability Company (Ltd or LLC equivalent). It offers personal liability protection, 100% foreign ownership, and access to corporate banking, investment licenses, and government contracts.

Other structures, such as partnerships or business names, exist but are generally not practical for foreign investors seeking scalability, long-term presence, or investor confidence.

How to Register a Company in Nigeria as an American

The registration process for an American-owned company in Nigeria involves several stages. Each has its own documentation and approval body, but all are now easier thanks to the CAC’s online system.

- Company Name Reservation

Start by checking and reserving your company name with the Corporate Affairs Commission. You can propose two options—one primary and one backup. Once approved, the name is reserved for 60 days to allow registration.

- Preparation of Incorporation Documents

Next, you’ll provide the essential company details and documentation. These include:

- Registered business address (a local service address may be used)

- Shareholding structure (100% foreign ownership permitted)

- Details of directors and shareholders (names, nationality, address, ID, and email)

- Memorandum and Articles of Association (MEMART) outlining company objectives

- Minimum share capital requirement of ₦10,000,000 (for companies with foreign participation)

Once compiled, these documents are submitted via the CAC portal, where stamp duty and incorporation fees are calculated based on your share capital.

We recommend this for you

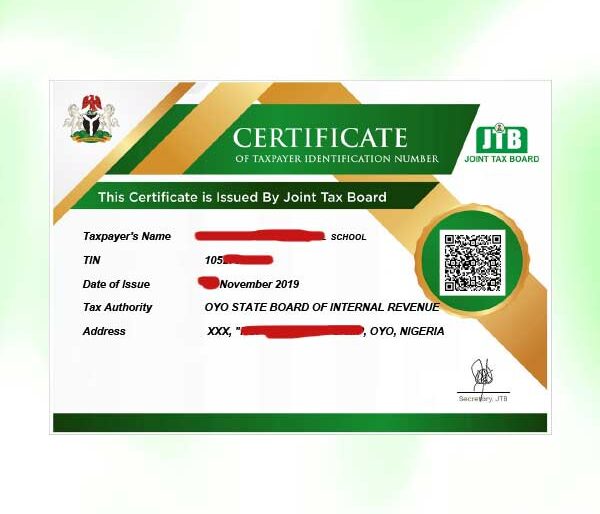

- Digital Incorporation and Tax Registration

Upon approval, the CAC issues a digital Certificate of Incorporation, along with a Status Report and MEMART. At the same time, a Tax Identification Number (TIN) is generated by the Federal Inland Revenue Service (FIRS).

- NIPC Business Registration

All foreign-owned companies must register with the Nigerian Investment Promotion Commission (NIPC) before commencing business. The NIPC promotes and monitors foreign investments and issues a Business Registration Certificate—a legal requirement for operation.

- SCUML and Anti-Money Laundering Compliance

For banking and operational purposes, every registered business must obtain a SCUML Certificate from the Economic and Financial Crimes Commission (EFCC). It ensures compliance with Nigeria’s anti-money-laundering standards.

Immigration and Residency Requirements

While Americans can fully own Nigerian companies, certain local regulations apply if you plan to work or act as a director within Nigeria. To legally live or manage your company’s operations, you’ll need the following immigration documents:

- Expatriate Quota: This is an approval granted by the Ministry of Interior, allowing your company to employ a specified number of foreigners for designated roles.

- STR Visa (Subject to Regularization): Obtained from the Nigerian Consulate in the United States, it allows your initial entry as an employee or director.

- CERPAC Card: The Combined Expatriate Residence Permit and Aliens Card serves as your Nigerian residency permit. It’s also required to obtain a Bank Verification Number (BVN) and a National Identification Number (NIN), both essential for operating a local bank account.

Until these steps are complete, most American investors appoint a temporary Nigerian director who handles compliance and banking setup locally. You remain the principal shareholder and can later take full control through internet banking and updated company resolutions once residency is secured.

Have you Read this ?

With our experience as CAC-accredited agents, we can assist you to register your company in Nigeria and guide you through NIPC registration, expatriate quota applications, and all post-incorporation processes—ensuring compliance from the very start.

Banking Setup for Foreign-Owned Companies

Opening a corporate bank account in Nigeria requires a few additional verifications for foreign shareholders. Most major banks now integrate CAC and FIRS databases, meaning once your incorporation and TIN are active, the next step is relatively straightforward.

You’ll typically need:

- Your CAC Certificate of Incorporation

- TIN certificate from FIRS

- SCUML certificate (mandatory for most sectors)

- Board resolution authorizing account opening

- Director and shareholder IDs

- BVN and NIN (if applicable)

Some digital banks also support remote account opening once CAC and SCUML details are verified. However, if you do not yet have residency, it’s advisable to assign local directors temporarily for banking authorization.

Zfrica can help you coordinate this entire process, from preparing the CAC and NIPC filings to ensuring your corporate bank account is opened smoothly, even if you’re managing your business from the United States.

Cost of Registering a Company in Nigeria as an American

The cost of registration depends on share capital, sector, and additional regulatory steps. However, the average cost for a U.S. investor establishing a standard Limited Liability Company (LLC) in Nigeria is summarized below:

| Service | Duration | Approximate Cost (USD) |

| CAC Incorporation (₦100m share capital) | 7–14 working days | $1,775 |

| SCUML Certificate | 5–7 working days | $60 |

| TIN & Tax Clearance Certificate | 3–5 weeks | $275 |

| Director Verification | Same day | $150 |

| Bank Account Setup Assistance | After TIN | $80 |

| Registered Office Address (1 year) | 1 year | $250 |

| Change of Director (if needed) | 2–4 working days | $60 |

| Total Estimated Package | 5–6 weeks total | $2,650 |

This estimate covers all government fees, documentation, and compliance steps for most industries. However, sectors such as finance, oil and gas, aviation, and health may require higher share capital or additional licenses.

Key Compliance After Incorporation

Once your company is registered, a few ongoing responsibilities will keep it in good standing:

- Annual Returns: File with CAC each year between January and June.

- Tax Compliance: Register with FIRS and remit Company Income Tax, VAT, and PAYE as applicable.

- SCUML Renewal: Keep your SCUML certificate active to maintain bank compliance.

- NIPC Updates: Inform NIPC of any major structural or ownership changes.

- Accounting and Audit: Maintain basic accounting records and submit audited statements annually (recommended for credibility).

For American founders, we simplify this with a complete post-registration service, ensuring your CAC records, tax filings, and compliance reports remain up to date.

Typical Timeline for American Company Setup

| Stage | Timeframe |

| Name reservation and approval | 1–2 days |

| CAC incorporation & TIN | 7–14 working days |

| NIPC registration | 3–5 working days |

| SCUML certificate | 5–7 working days |

| Immigration processing (STR & CERPAC) | 4–6 weeks |

| Bank account setup | Within 3 days after documentation |

Total estimated duration: 5–6 weeks for a fully compliant and operational company.

Common Misconceptions About Foreign Ownership

| Misconception | Reality |

| Americans cannot own Nigerian companies. | Nigeria allows 100% foreign ownership. |

| CAC issues physical certificates. | All certificates are now digital and downloadable. |

| SCUML isn’t needed for non-financial businesses. | Most banks require SCUML for all accounts. |

| Residency is not needed for banking. | BVN/NIN require residency (CERPAC). |

| Only large firms can register. | Startups and SMEs can also register successfully. |

Why Partnering with Zfrica Matters

Registering a company in another country can feel overwhelming at first—different laws, timelines, and documentation. That’s why working with an experienced CAC-accredited agent like Zfrica helps you get it right the first time.

We’ve successfully handled registrations for hundreds of clients across different Nigerian states since 2019. Whether you’re incorporating from the U.S., upgrading your business status, or filing annual returns, we offer:

- End-to-end handling of CAC registration and NIPC filings

- Post-registration support (TIN, SCUML, and tax setup)

- Timely updates at every stage

- Affordable and transparent pricing

- Optional assistance with business bank account opening

You can explore our CAC registration packages at zfrica.com, or reach our WhatsApp support directly through https://wa.me/2348138156958.

Conclusion

Nigeria presents one of Africa’s most exciting frontiers for American investors. With over 200 million consumers, improved digital systems, and clear legal frameworks, registering a company here is more accessible than ever.

As this guide shows, the requirements and cost for American to register a company in Nigeria are straightforward—provided you follow the right sequence: CAC incorporation, NIPC registration, tax compliance, immigration processing, and bank activation.

Whether you aim to establish a new branch, build a manufacturing base, or tap into Africa’s fastest-growing markets, your journey begins with proper registration and guidance.

And if you’re ready to take that step, Zfrica can help you register your company in Nigeria, handle your filings from start to finish, and keep your documents fully compliant—no matter where you are in the world.

FAQs on Requirements and Cost for American to Register a Company in Nigeria

- Can an American register a company in Nigeria remotely?

Yes. You can complete the entire registration process online through the Corporate Affairs Commission (CAC) portal without being physically present in Nigeria.- Do Americans need a Nigerian partner to register a company?

No. Nigeria allows 100% foreign ownership of a limited liability company. However, certain sectors such as broadcasting or defense may have restrictions.- How much does it cost for an American to register a company in Nigeria?

The total estimated cost is around $2,650, which covers CAC incorporation, NIPC registration, SCUML certificate, tax setup, and bank account assistance.- What is the minimum share capital required?

For companies with foreign participation, the minimum issued share capital is ₦10,000,000, though some industries may require higher thresholds.- Can an American open a Nigerian business bank account?

Yes, but to be an authorized signatory, you must obtain residency (CERPAC) and have a valid BVN and NIN. Until then, temporary local directors can manage the account under your control.- How long does the process take from start to finish?

From name reservation to banking setup, the process typically takes 5–6 weeks when documents are in order.- Is there any tax advantage for American-owned companies?

Yes. Nigeria offers tax incentives through the Nigerian Investment Promotion Commission (NIPC), especially for sectors such as agriculture, health, manufacturing, and export-oriented industries.- Can Zfrica handle everything from registration to banking?

Absolutely. As a CAC-accredited agent, Zfrica provides complete support—from company registration and compliance filing to assisting with tax and banking documentation. You can start by visiting zfrica.com or messaging us directly via WhatsApp.