Introduction

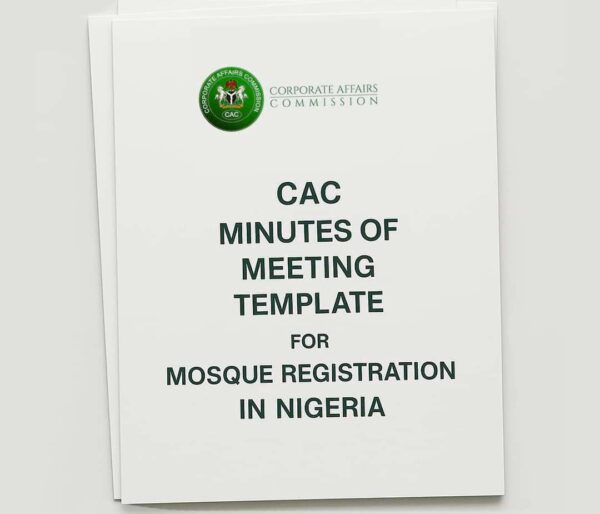

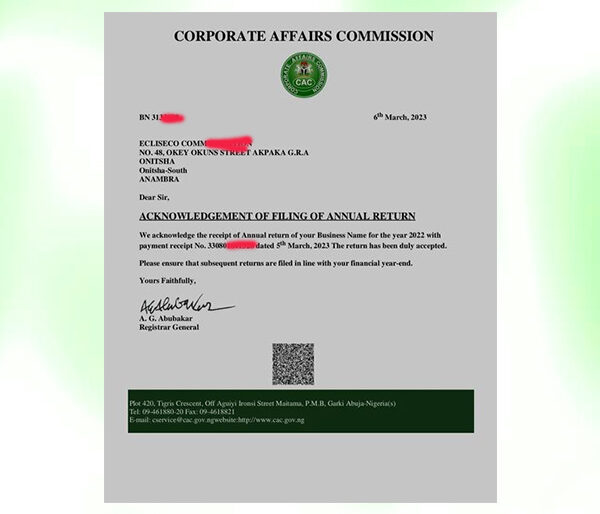

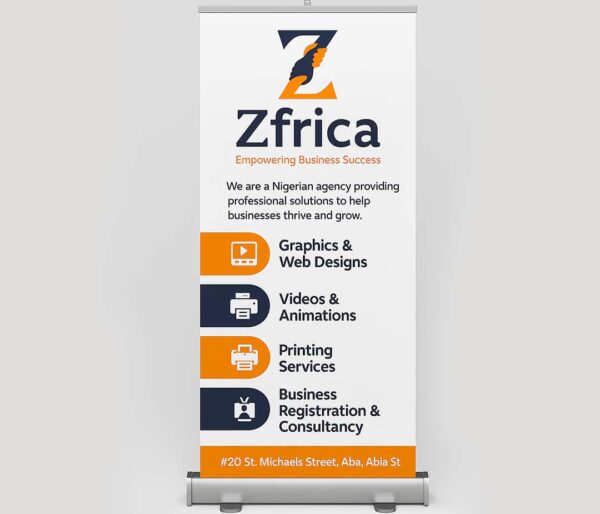

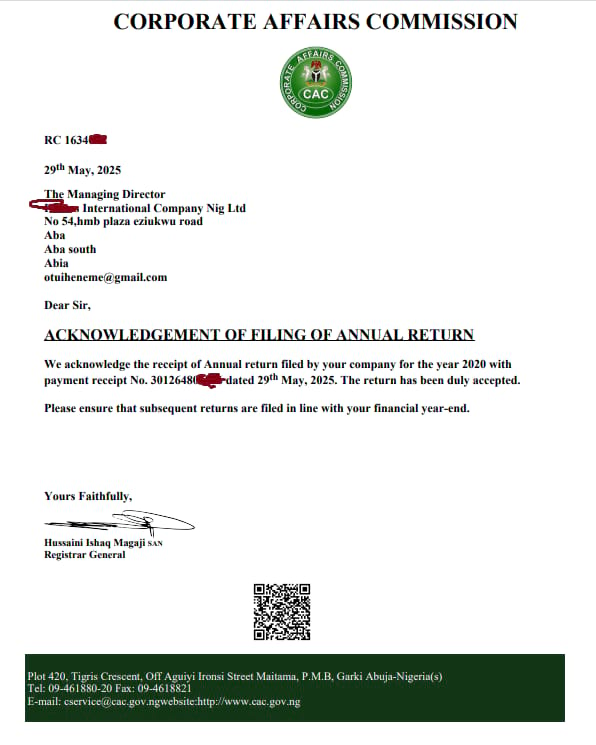

Every registered business in Nigeria must file annual returns with the Corporate Affairs Commission (CAC). It’s a legal obligation that confirms your company is still operational. Upon completion, CAC issues an essential document: the CAC annual returns acknowledgement letter. But how do you know it’s authentic?

This guide explains everything you need to know about the acknowledgement letter—what it is, why it matters, and how to verify it to avoid fraud or double payments. Here is also a guide on how to verify your CAC certificate and documents.

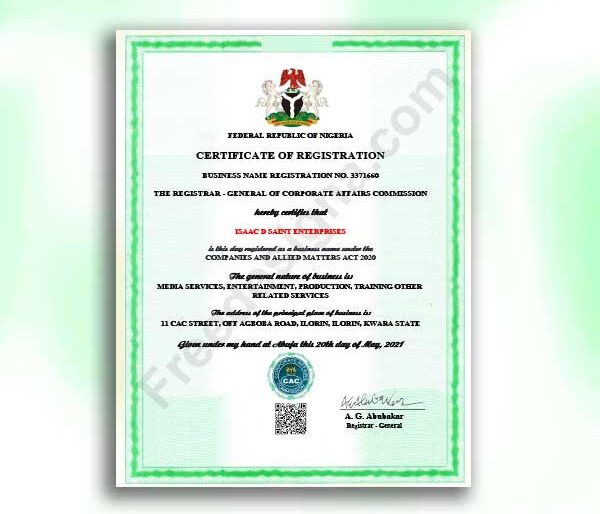

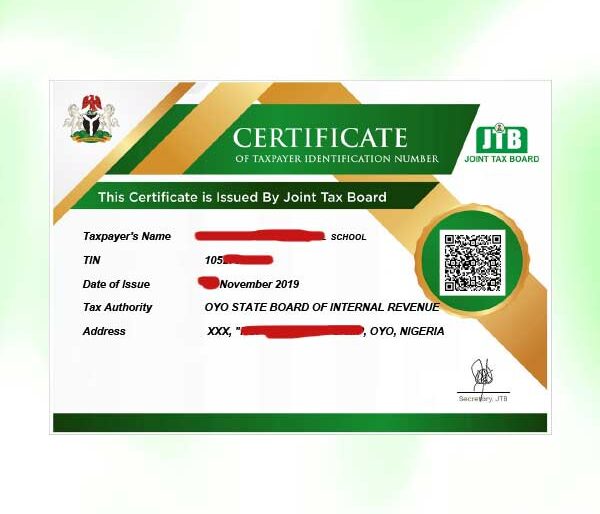

What Is a CAC Annual Returns Acknowledgement Letter?

The CAC annual returns acknowledgement letter is an official confirmation issued by the Corporate Affairs Commission after a business successfully files its annual returns. It’s not a generic receipt; it serves as evidence that the CAC has received and processed your return for that particular financial year.

Key Information Contained in the Acknowledgement Letter:

- Name of the company or business

- RC or BN number

- Date of return filing

- Year the return covers

- A unique QR code for verification

- CAC’s digital signature or reference number

This letter validates that your business has fulfilled its legal responsibility to submit annual returns, which is crucial for maintaining your company’s good standing with the government.

Our Top Selling Services

Why the Acknowledgement Letter Matters

Too many business owners overlook the significance of this document. In reality, the CAC annual returns acknowledgement letter is your proof of compliance. Without it, there’s no way to confirm that your filing was completed successfully.

Here’s why it matters:

-

Proof of Compliance:

Banks, government contracts, and potential investors may request it.

-

Avoids Redundant Payments:

Without this letter, you might be tricked into paying for the same service twice.

-

Helps in Legal Disputes:

Should any regulatory or legal issue arise, it confirms your business’s compliance history.

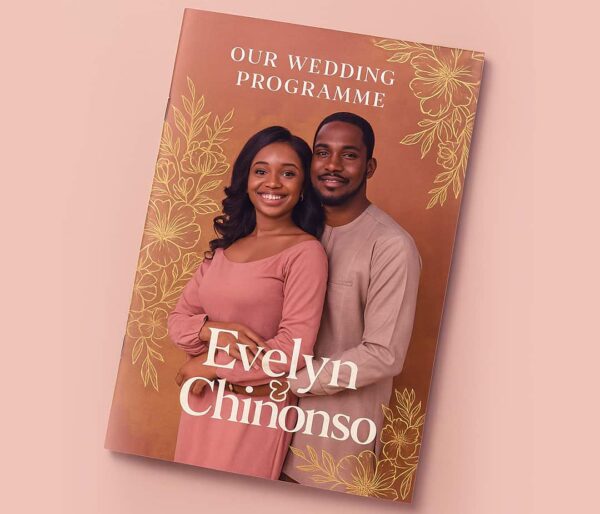

A Real-Life Scenario: How Non-Verification Leads to Loss

A woman paid an agent to file her annual returns. He claimed to have completed the filing but failed to provide any document afterward. Unsure of the process, she later paid another agent to do the same job.

Eventually, it turned out the first agent never submitted anything. She was charged twice for the same task—only one of which was actually executed.

What would have saved her the trouble? Simply asking for and verifying the CAC annual returns acknowledgement letter.

How to Verify Your CAC Annual Returns Acknowledgement Letter

Verifying your acknowledgement letter is both simple and necessary. Here’s a step-by-step process:

We recommend this for you

-

Scan the QR Code

Most CAC acknowledgement letters issued post-2021 now include a unique QR code.

- Download a QR code scanner app on your phone or use your camera (most smartphones support this).

- Point your device at the QR code on the document.

- A URL should pop up—click on it.

- It should lead to CAC’s portal or a verification page with matching information.

-

Cross-Check Information on the Link

Ensure the details on the link match what’s on your document:

- Same company or business name

- Same RC or BN number

- Matching year and date of filing

If they do not align, the document may be fake.

-

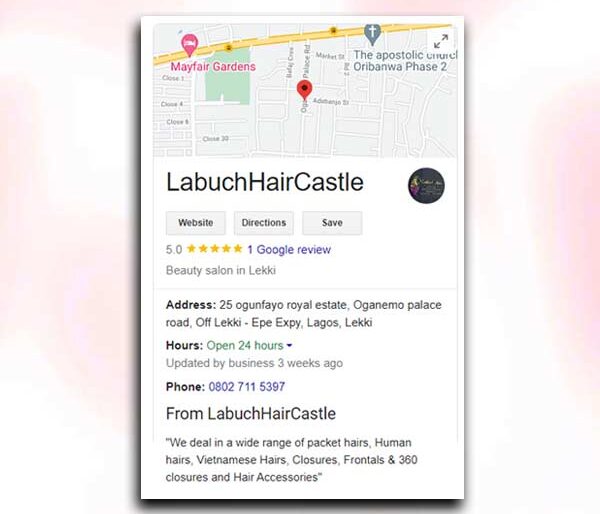

Use the CAC Public Search Tool

If you didn’t receive a QR code:

- Visit the CAC public search portal (search.cac.gov.ng)

- Enter your company name or RC number

- Look under the “Annual Returns” section for the most recent return filing date

While this won’t provide the document itself, it will show whether your return is registered.

-

Verify the Digital Signature (If Present)

Some acknowledgement letters carry a CAC digital signature. While not always present, its inclusion increases authenticity. Always confirm it looks like CAC’s official e-signature if available.

Common Issues With CAC Acknowledgement Letters

-

Fake Acknowledgement Letters

Some dishonest agents fabricate acknowledgement letters using editing tools. These may look real but cannot pass QR or CAC database verification.

Tip: Always cross-verify independently.

-

No Document Delivered After Filing

A red flag. Any genuine filing will result in an acknowledgement letter. If you don’t receive one, ask immediately or check the CAC portal for confirmation.

-

Letter From a Wrong Year

The acknowledgement letter must clearly state the year the return covers. Filing for 2023 should generate a document indicating “Annual Return for 2023.” Using a 2022 document as proof for 2023 is invalid.

Best Practices for Managing Annual Returns

-

File Early:

Avoid delays that may cause regulatory issues or penalties.

-

Always Request Documentation:

Never consider any filing complete without receiving the acknowledgement letter.

-

Verify Immediately:

Don’t wait until months later—scan the QR and check details once received.

-

Retain Digital and Printed Copies:

Save soft copies in secure cloud storage and print hard copies for physical archives.

-

Stick With Trusted Agents:

If you’re using a third party, ensure they are CAC-accredited and provide proper documentation post-service.

Conclusion

The CAC annual returns acknowledgement letter is more than a formality—it’s your legal proof that your company has fulfilled one of its most essential regulatory duties. Verifying this document protects you from fraud, double payments, and potential compliance issues.

Whether you’re filing through an agent or directly via CAC’s portal, always ensure this document is issued, received, and authenticated. Your company’s integrity and legal standing depend on it.

Frequently Asked Questions (FAQs)

What is the CAC annual returns acknowledgement letter?

It is the official confirmation that your annual returns have been submitted and processed by the Corporate Affairs Commission.

Can I file annual returns multiple times in a year?

No. CAC allows only one annual return filing per year. Attempting to do so again is unnecessary and could result in additional charges.

What happens if I lose my acknowledgement letter?

You can request a copy from your agent if they filed on your behalf or check your filing status through the CAC portal. Always save digital copies.

How can I tell if an acknowledgement letter is fake?

Fake documents often lack a valid QR code or lead to a non-CAC URL when scanned. Cross-check details and verify using CAC’s public tools.

Is a receipt the same as an acknowledgement letter?

No. A payment receipt shows that you paid, but the acknowledgement letter proves that CAC accepted and processed your annual return.

What should I do if my agent fails to provide this letter?

Request it immediately. If not provided, assume the filing may not have been done. You may need to contact CAC or re-file through a trusted party.

Is there a deadline for filing annual returns?

Yes. Most businesses must file annual returns by the end of their anniversary month each year. Late filing may attract penalties.