Some individuals and businesses at different times may come under attack by scammers. Their main aim is to trick, confuse you and steal your money. Scamming simply means to deceive and defraud (someone). If you consciously understand those highlighted words. “Deceive and Defraud”. It will be easier for you to understand how scammers operate in Nigeria. Or, How scammers scam people. And also how you can easily spot and avoid them.

Most persons think that the success of scammers depends on just the sophisticated machines they use. But on the contrary, using sophisticated machines alone, no matter how sophisticated is not enough to scam anybody. Deception must be involved for any scam to be successful.

Hence this post is looking forward to exposing most of these deceptive moves by scammers and provide you with some intelligence to identify them. Scammers operate in 4 broad styles.

- Exploiting your ignorance

- Using someone inhouse or a relative

- Using some machines/computers to aid their effort

- Doing a Guess Work

Depending on the aim of the scammer, one or a combination of the methods mentioned above could be employed. Therefore, let’s see how these methods can be deployed, with different examples.

Important Note: To cover tracks and for proper monitoring, Scammers works as a team. Sometimes in pairs, sometimes in groups.

Our Top Selling Services

Also, Scammers in one way or the other establish contact with their target before the actual date for the crime. It is highly difficult for somebody from nowhere to step into a place and commit a crime without some pre-information

In our examples, we used First bank as an example. This does not in any way suggest nor imply that First Bank are scammers or supports scams.

1. Fake Debit Alert

Digital payment methods are now widely used in Nigeria. These include payments using POS, ATM transfers, Transfer through Bank APPS, and Transfer through Mobile phone via USSD.

The debit alert is the message, one receives from his/her bank whenever, he/she sends out money. The debit alert usually states how much was transferred, to whom it was transferred, the time of the transaction, the reference code for the transaction and the date of the transaction

Using a Fake Debit Alert, a scammer can use some of these digital payment options to scam business owner (s) at the point of buying.

How they do it

Before the Scam Day

First, before the day of the Scam, one of the scam members actually visits the target business. He buys a few things and legitimately transfers the agreed money properly. This will cause him to receive a legitimate debit from his bank. This debit alert will contain the exact business name, business bank, and some reference codes.

One they are furnished with these details. They will use the newly got debit alert to prepare the fake debit alert required on the scam date. Basically, they will change the date, the reference code and price so it tallies with their scam plan. Also, he will save his number the assistant scammer’s phone using your Bank Name Eg First Bank.

On the Scam Day

The assistant scammer stays outside in a position he can monitor what’s happening inside the shop. The main scammer enters your shop and makes a choice of product. After, negotiations, he will opt to pay through bank transfer.

We recommend this for you

As an unsuspecting salesperson, you agree. He brings out his phone, types the USSD code and sends it. Along the line of doing the transfer, he terminates the normal process. Then he tells you he has done it. That he is now waiting for a debit alert from his bank.

Now with a signal, he alerts the assistant scammer who is outside, to send the debit alert, already prepared on his phone. Remember the scammer inside the shop has already saved the assistant scammers’ contact, as your Bank Name eg First Bank. Once the assistant scammer sends the alert, it will appear on the main scammer’s phone as First Bank.

It will contain all your business details correctly. It will bear that current time. He then shows you the alert as the awaited Debit alert. As an unsuspecting business owner, you thank him/her for patronage, sorry, for scamming you. The deal is done. You will never see them again. They’ve exploited your ignorance. Sorry, you’ve been scammed

How to avoid Fake Debit alert.

The fake debit alert is very difficult to spot. It looks so real that you cant differentiate it from the real one. Hence, Never trust any debit alert. Real or Fake. Assume all of them are fake.

Until you receive a credit alert, never allow the customer to go with your product.

No matter, how much in a hurry he seems to appear, let him know you need to confirm the transaction before he goes and stick to it.

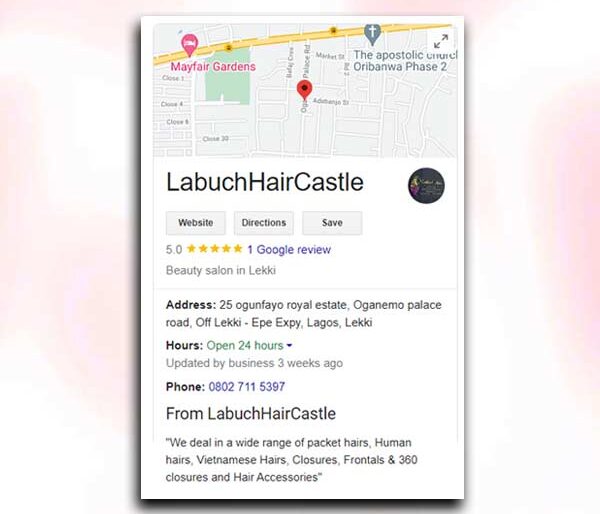

Have you Read this ?

But wait, is getting a Credit alert a guarantee, that you are not dealing with a scammer?. Well to an extent, YES. But advanced scammers can still send Fake Credit Alert to your own phone. How do they do that? Let us see the second method of carrying out a scam in Nigeria.

2. Fake Credit Alert

This is similar to Fake Debit Alert, except that who now receives the Credit alert is the Salesperson. The scam group figures out a way to send you the message as though it coming from your bank.

Note: A credit alert is a message, one receives from his/her bank whenever money is sent to him/her. The credit alert usually states how much was transferred, who transferred it, the time of the transfer, the reference code for the transaction and the date of the transfer.

How they do it

Remember our important note- Scammers work as a team. Also, remember 4 broad ways to scam

- Exploiting your ignorance

- Using someone inhouse or a relative

- Using some machines/computers to aid their effort

- Doing a Guess Work

Now, in sending a Fake Credit alert. an in-house person is really needed. The in-house person could be the business owner’s child, salesgirl, or anybody who can gain access to his alert phone. Once access is gained to the business owner’s phone.

They will quickly save the scammer’s phone number in the phone as the owner’s bank name. eg First Bank. That is, inside the business owner’s phone, there is now a contact say (081381569**) now stored as First bank. This number belongs to one of the scam team members.

Now they can easily get the real First banks credit template by performing a real transaction to a real First bank account. This will supply them with a real First bank CREDIT alert. They can now edit the real message and store it, waiting for the scam day

On the scam day

On the scam day, just like the in the Fake Debit alert example above. As the assistant scammer is sending the main scammer the fake debit alert, he will also send a Fake credit alert to the business owner’s phone.

Because their number has already been stored on the business owner’s phone. The unsuspecting business owner receives the fake alert and feels happy he has made some sales. But, behold. He has been scammed.

Alternative Method

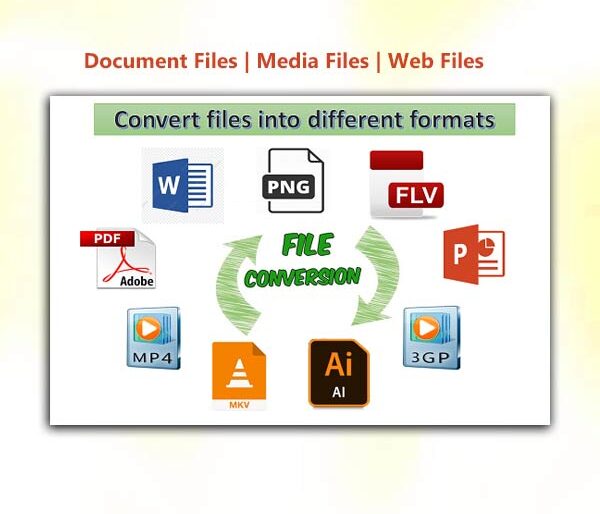

It is not always easy for scammers to convince an insider to assist them in their plan. Hence, instead of trying to gain access to the business owner’s phone. They employ a tool known as the Bulk Sms tool. It’s a tool accessible to anybody who can browse online.

The Bulk SMS Tool

The bulk SMS tool allows you to customize a message sender. Eg. With the tool, A scammer can decide to send a message to you using a Brand name eg First Bank. So, when the receiver receives the message, instead of the scammer’s number to show as the sender. It will show as First Bank. Hence tricking the business owner to believe that the message actually came from First Bank.

However, in recent years, this method hardly works, because, most Bulk SMS tools would not allow you to use Bank names to send your SMS.

How to avoid Fake Credit Alert

The best way to avoid anything credit alert fraud is to never trust any alert by anybody. If you want your business to accept digital payment methods. Be ready to be digital too.

Have your Bank account APP ready. Once anybody says, he has done this or that alert to you. Quickly log in to your BANK APP and check your Transaction History. Not only the Account balance. Your transaction history is more like a real-time statement of account. It will not lie.

These two described above are just a few of the ways you could be scammed. There are various ways scammers operate in Nigeria. This takes us to SCAM strategy three (3).

3. Investment Scam

Due to many victims of this type of scam, people are now more careful whenever they are being introduced to any Investment business.

Whats an Investment Business

On the very basic level, an investment business is any business that asks you to invest some sum of money, usually ₦10,000 to ₦50,000, then promise you that after some while, your money will multiply by some proportion.

Often times they advertise their scam this way

- Invest ₦10,000 to earn ₦20,000 in 2 days

- Invest ₦20,000 to earn ₦40,000 in 2 days

- etc

Most of these scammers have a website, and dashboard that makes what they say look so real. Like they can get your friend to invest, then within some hours, his money multiplies. Then you invest, just to realize you’ve been scammed after 2 days

How do they do it

There are diverse ways this can be done. But let us take just one of the ways. In this case, we are taking Bitcoin Investment Scam. In this case, the scammers create a real website. A website that has all the security. Then they create a dashboard for their users. From the dashboard, an investor can see how much he invested, and how much his/her money has grown.

That’s where the trick comes into play. Once you invest, The increase you see on your dashboard is fake. Normally, what should happen is as they keep trading the bitcoin, and keep making gains, your dashboard as an investor should be automatically updating based on the gains of the bitcoin business

But now, they are not trading any bitcoin whatsoever, then how is your money growing. Well, if you understand that your dashboard is accessible to them from a part called the Backend. You will understand that they can from that backend edit (keep increasing) your initial investment capital. Whereas, there is no real money increasing anywhere.

The CATCH

As you see your money increases as they promise. You believe with everything you have that it’s real. You can then swear to make your friends and family register. Once you’ve brought your friends to register, and they feel comfortable with what they have raised from the registrations. They quickly pull down the site. And that’s it.

You’ve been SCAMMED. Not only you. Your friends and family have been scammed too. Sorry.

How to avoid Investment Scam.

This is simple. Avoid any invest #10,000 to get #20,000 in 2 days business. There is never a legitimate business that operates like that. I repeat NEVER. You can find out some profitable businesses you can do with #20,000 in Nigeria.

Let’s see the fourth method

4. Vishing

Don’t get confused by the name. Vishing is one of the most common scam strategies in Nigeria today. But what is Vishing?