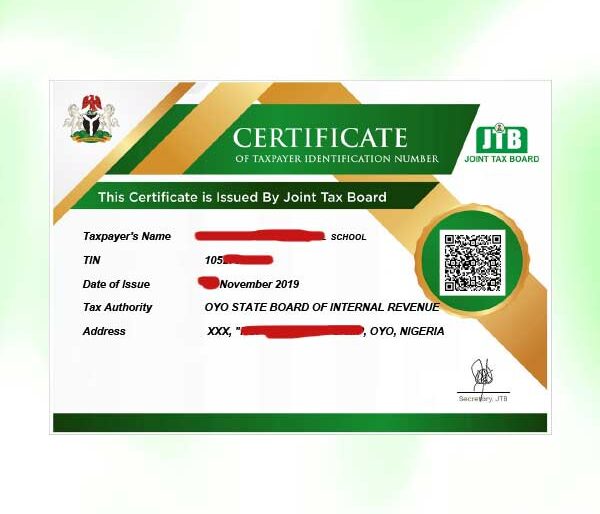

This blog post focuses on why your JTB TIN application is not approved after a long while and how we can help you overcome the challenge quickly and efficiently.

This blog post focuses on why your JTB TIN application is not approved after a long while and how we can help you overcome the challenge quickly and efficiently.

Delays in the Tax Identification Number (TIN) application process have become a significant source of frustration for many Nigerians. Despite following all the required steps and submitting necessary documents to the Joint Tax Board (JTB), applicants often find themselves waiting days, weeks, or even months for approval. For many, even constant follow-ups through emails and calls yield no response.

However, there’s a solution—our expert services ensures your TIN certificate application is approved within 24 hours. Please chat with us now.

Here are some real questions people are asking across different social media platforms

Question 1 : Please what is happening with approval of JOINT TAX BOARD (JTB) TIN? I have an application that is up to 7 days without approval

Question 2 : How do I progress for JTB TIN for a new business name, I got the request ID already

Question 3 :Please I applied for TIN online for Company name and it’s not yet out. What is the problem

Question 4 :I applied for a business TIN over a month now, but JTB remains incommunicado. Sent emails, and called, yet no response

Question 5 :Please I applied for my TIN since 5th of September. I have not ye received my Tin. I went to FIRS OFFICE and submitted everything they requested ..then they said, that JTB have not respond their email. Is it that JTB portal is having issue?

Question 6:@OfficialJTBNg I wish to inform you of the non availability of TIN Certificate for the below registered Business Name since July 11. Please do something about it.

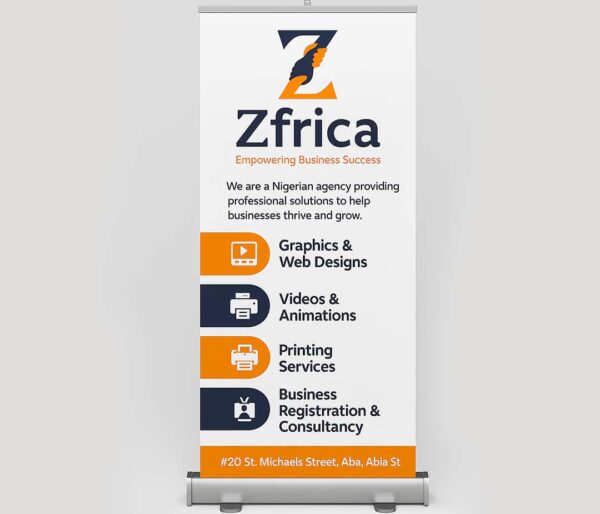

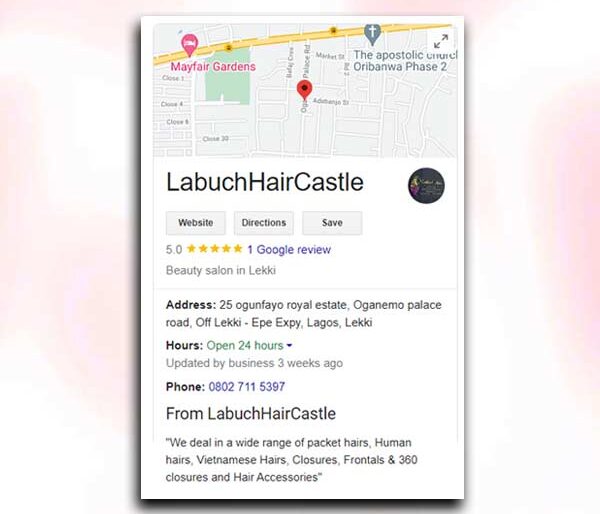

Our Top Selling Services

Even after applicants calls out JTB publicly, they still wouldn’t respond to them publicly or privately. That’s where our service matters, we can assist you with your TIN application approval within 24 hours. We are just a chat away.

What Is the Joint Tax Board (JTB)?

The Joint Tax Board (JTB) is a regulatory body in Nigeria responsible for ensuring effective tax administration. It oversees the issuance of the Tax Identification Number (TIN), a mandatory requirement for businesses and individuals to comply with Nigeria’s tax regulations.

A TIN is essential for:

- Filing tax returns.

- Opening business bank accounts.

- Registering businesses with the Corporate Affairs Commission (CAC).

- Accessing government contracts or services.

Despite its importance, the approval process for a TIN has become a daunting task for many.

How Does the JTB TIN Application Work?

The TIN application process is relatively straightforward:

- Visit the JTB portal or use an authorized tax agent.

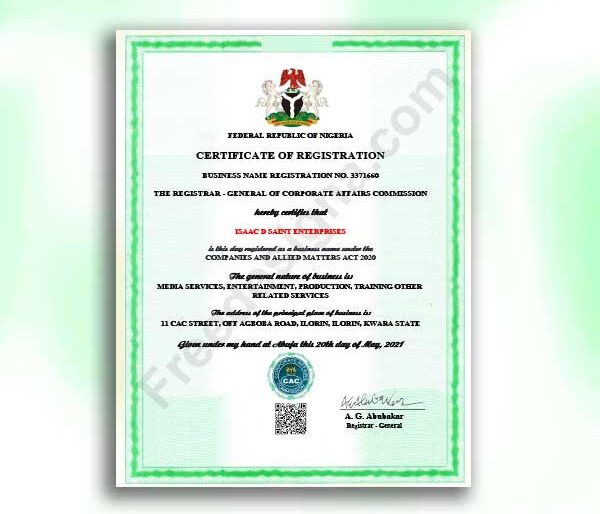

- Provide personal or corporate details, including supporting documentation (e.g., ID or CAC registration).

- Receive a Request ID, which you can use to track the application.

In theory, the approval process should be seamless. However, in reality, applicants often encounter significant hurdles.

Why Is My JTB TIN Application Not Approved?

Despite completing the steps, many applicants experience long delays. Possible reasons include:

We recommend this for you

- Incomplete or Incorrect Documentation

Errors in the provided information or missing documents can stall the approval process. The JTB does not always notify applicants of these issues promptly. - System Glitches

Technical issues on the JTB portal often cause applications to get stuck, leaving applicants in limbo. - High Application Volume

With thousands of Nigerians applying daily, the JTB struggles to process applications quickly, resulting in backlogs. - Lack of Feedback

Even after calling or emailing the JTB for updates, applicants rarely get actionable responses. The lack of transparency exacerbates frustrations.This is where our service matters, we can assist you with your TIN application approval within 24 hours. We are just a chat away.

The Impact of TIN Delays on Individuals and Businesses

Delays in obtaining a TIN CERTIFICATE can have serious consequences, including:

- Loss of Business Opportunities: Without a TIN, businesses cannot bid for government contracts or access critical financial services.

- Non-Compliance Penalties: Operating without a TIN violates Nigerian tax laws, leading to fines or legal actions.

- Personal Frustration: Lengthy waiting periods cause stress, especially when communication with the JTB is unresponsive.

The Solution: Get Your TIN Approved in 24 Hours

At Zfrica, we can get your new or existing application approved within 24 hours.

We understand how frustrating the TIN approval process can be. That’s why we’ve mastered the art of streamlining applications and resolving issues directly with the JTB. Here’s how our service works:

- Expert Application Review

We carefully review your application and ensure all information is accurate and complete. This eliminates the common errors that cause delays.

- Direct Liaison with JTB

Our team has established channels with the JTB, allowing us to expedite the approval process.

- Guaranteed Approval in 24 Hours

Once we handle your new or existing application, you can rest assured that your TIN certificate will be approved within a day.

Ready to skip the hassle? Chat with us now

Why Choose Our TIN Approval Service?

- Fast Turnaround: We guarantee results in 24 hours—no waiting weeks or months.

- Experience: Our team has handled hundreds of successful applications, even for cases stuck for months.

- Affordable Fees: Our service is cost-effective, saving you time and stress.

- Personalized Support: We provide updates throughout the process, ensuring transparency and peace of mind.

Tips for Avoiding JTB TIN Application Issues

If you choose to handle your application independently, follow these tips:

- Double-Check Your Information: Ensure all details are accurate before submission.

- Attach All Required Documents: Missing documents are a common cause of delays.

- Track Your Application: Use your Request ID to monitor progress on the JTB portal.

- Follow Up Regularly: Call or email the JTB, but be prepared for delays in responses.

However, if you’ve tried these steps and your application is still not approved, it’s time to seek our professional help.

Frequently Asked Questions (FAQs)

-

What is a Tax Identification Number (TIN)?

A TIN is a unique number issued by the JTB to individuals and businesses for tax purposes in Nigeria.

-

Why is my TIN application delayed?

Delays can occur due to missing documents, system glitches, or high application volumes.

-

How can I track my TIN application?

Use your Request ID on the JTB portal to check the status of your application.

-

Can I reapply if my TIN application is rejected?

Yes, but it’s important to correct any errors or provide missing information.

-

How long does it usually take to get a TIN?

With us it takes only 24 hours. On your own, it can take weeks or months, depending on the efficiency of the JTB per time of application.

-

How can your service help me get a TIN quickly?

We ensure your application is complete and liaise directly with the JTB to secure approval in just 24 hours.

Conclusion

Applying for a TIN through the JTB can be a frustrating process, with delays and lack of communication often leaving applicants stranded. However, you don’t have to endure these challenges. With our expert assistance, you can bypass the red tape and get your TIN certificate approved within 24 hours.

Don’t let delays hold you back—take control of your TIN application today.

Get started now. Chat with us