Are you ready to take your business to the next level with the FG Loan 2024? The Federal Government of Nigeria has rolled out a new loan program aimed at supporting traders, food vendors, ICT professionals, transport workers, creatives, and artisans.

In the loan scheme, Regular businesses can apply for and get FG loans ranging from ₦500,000 to ₦1 million. Manufacturers can apply for larger loans, ranging from ₦2 million to ₦1 billion.

Here’s a step-by-step guide on how to apply for the FG Loan 2024 and give your business the boost it deserves.

Step 1: Check Eligibility

Before you dive into the application process, ensure your business qualifies. The loan targets existing businesses in operation for at least one year and startups that are registered. As such

- Applicants must be 18 years and above

- Your business has been operational for at least one year.

- The business must be registered with CAC

- Your business is involved in sectors like trading, ICT, transport, creatives, etc.

Step 2: Documents Required to apply & Get the FG Loan 2024

Gather all necessary documents including your

Our Top Selling Services

- NIN ID CARD

- TIN CERTIFICATE,

- Company’s bank statements for the past year,

- Personal guarantee of the promoter.

These documents will support your application and increase your chances of approval. However the last two documents mentioned here will only be needed at the bank after the online application.

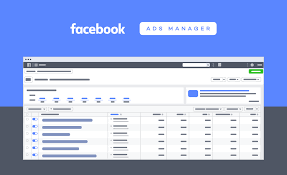

Step 3: Apply Online

Head over to the official FG Loan portal at Federal Government Loan Website. https://loan.fedgrantandloan .gov.ng. The application is fully digital, making it easy and efficient. Fill in the required details about your business and attach the necessary documents.

Step 4: Wait for Approval

After submitting your application, it will be reviewed by the bank. If you meet the eligibility criteria, your application will be sent for processing. You can check the status of your application by logging into your profile. Once your application has been forwarded to your bank for processing, you should follow up with your bank for updates until the loan amount is disbursed directly to your bank account.

Step 5: Repayment

The loan must be repaid in monthly installments over a period of up to three years, depending on the terms specified for your particular loan type. There is no moratorium period. ( that is a specific period during a loan’s tenure when the borrower is not required to make regular loan repayment). So plan your finances accordingly.

Additional Tips:

This loan is a great opportunity for small and medium-sized enterprises to expand and thrive. Make sure you understand all the terms and conditions and prepare your business for a successful application.

For further enquiries or assistance, please feel free to chat with Helen now. Good luck!

Frequently Asked Questions about FG Loan 2024

1. Who is eligible for the FG Loan 2024?

Eligible candidates include business owners in sectors such as trading, ICT, transport, and creatives, who have been operational for at least one year and are registered with the CAC.

2. How much can I apply for under the FG Loan 2024?

Regular businesses can apply for loans ranging from ₦500,000 to ₦1 million. Manufacturers can apply for larger loans, ranging from ₦2 million to ₦1 billion.

We recommend this for you

3. What documents are needed to apply?

You’ll need your business’s bank statements from the past year, a personal guarantee from the promoter, and BVN details.

4. How do I apply for the loan?

Apply online by visiting the official FG Loan portal, fill in your business details, and upload the necessary documents.

5. What are the interest rates for the loan?

The loan comes with 9% annual interest rate.

6. When do I need to start repaying the FG loan 2024?

Repayment starts immediately with monthly installments over up to three years, without a grace period.