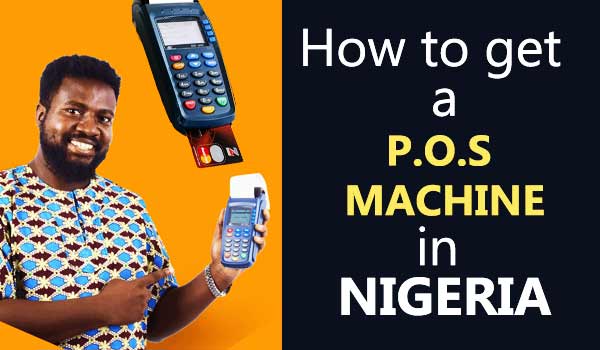

In this post, we detailed all you need to know on how to get a POS machine in Nigeria. We highlighted the requirements, cost, institutions where you can get it, how to get it and the duration it takes to get one.

In this post, we detailed all you need to know on how to get a POS machine in Nigeria. We highlighted the requirements, cost, institutions where you can get it, how to get it and the duration it takes to get one.

POS machine for your business or POS as a business

POS stands for POINT of SALE. It’s been around in Nigeria for about a decade now. As a business / company owner, you could spice up things within your business and make sales better and smoother by obtaining a POS machine. As an individual, you can also start making money today by starting a POS business as a POS agent. Whatever be your reason to have a POS machine, we will walk you through the steps involved.Where you can get POS machine.

Broadly, there are two places you can get a POS machine. Either from a reputable Nigerian bank e.g., (First Bank, GT Bank, Zenith Bank etc.) or from registered Fintech company in Nigeria, e.g., Opay, Paga, MoniePoint etc.Difference in getting a POS machine from a Bank and getting it from a Fintech Company

| S/N | Getting from Bank | Getting from Fintech company |

| 1 | Getting a POS machine from a Nigerian Bank is FREE | Getting your Machine from a Fintech company comes with a cost (ranging from #8500 to #50,000) |

| 2. | It may take a longer while before your machine reaches you (usually, 1 week to 1 month) | The time duration is shorter usually (24 hours—72 hours) |

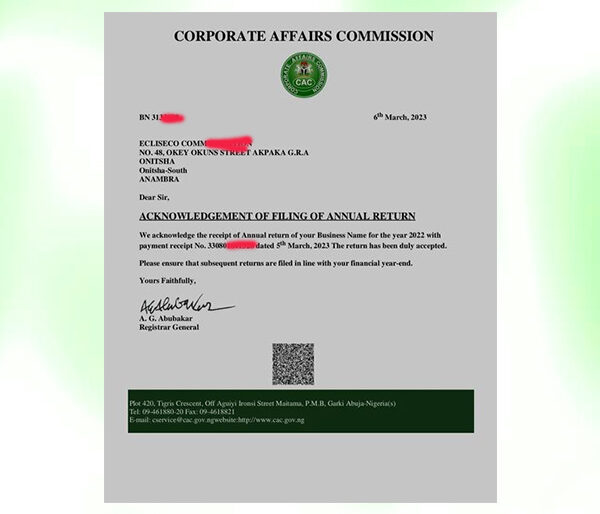

| 3. | Banks may compulsorily need you to have a registered business with CAC | CAC registered business is not mandatory |

Requirements to get POS machine in Nigeria

Although there may slight differences in requirement depending on bank or Fintech Company you choose, but generally, below are the common requirementsFor Bank POS

- Proof of ownership of business. This means your business has to be registered with CAC as any of the following.

-

- Business Name

- Limited Liability Company

- Partnership

- Cooperative Societies

- Public Entities

- Incorporated Trustee / NGO, except faith-based NGO.

-

See the requirements needed to register your business as a Business Name for as low as #19,000

-

- You need to maintain a not less than 6 months account with the bank of your choice (A Current account for most of the banks)

- Valid means of identification e.g. Driver’s license, National ID card, International passport or voter’s card.

- BVN

- Phone Number

- Two passport photographs

- Two current account referees : These are people who can attest that you really own the business.

- Credit Bureau Report

- A minimum working capital of N50,000

For Fintech Companies

- A valid Identification Card (International Passport, NIN, Voters’ Card, or Driver’s License)

- Utility Bill (waste bill, electricity bill, land-use charge, water bill, or tenancy agreement)

- CAC documents (for registered businesses only)

- BVN

- A standard account number in any commercial bank.

How to apply for POS Machine.

The application process differs from Bank to Bank, Fintech company to Fintech Company. However, the protocols are similar. Hence, we will explain the processes involved for a few banks and for a few Fintech Companies. So, you should expect similar protocols for the ones we could not explain here.For Bank (Zenith Bank)

If you meet the aforementioned requirements to get a POS from Bank, then- Walk into any Zenith bank branch closes to you

- Submit the details

- Fill in the POS application form:

- Sign the POS agreement document with Zenith bank.

This process for Zenith banks is almost the same for all other Nigerian commercial banks

For Fintech (MoniePoint).

MONIEpoint POS is most likely the easiest to get. Once you have the aforementioned requirements,- Simply walk in to their office at No.12 Wole Ariyo St, Lekki Phase 1 office.

- Submit your details

- Get mapped to an aggregator (an officer in charge of POS agents).

- Make the non-refundable payment of about #10,000

- visit their website https://moniepoint.com

- Click on Get Started

- Complete the registration Form

- Submit

For Fintech (Kudi)

- Walk into the nearest Kudi office to you

- Obtain the form from their agent

- Fill and submit it

- Make a payment of N20,000 to the office (money is nonrefundable).

Notice the cost involvements for the Fintechs, while that of Banks are FREE

| S/N | POS NAME | PRICE (N) | Requirement |

| 1 | Opay mini POS | 8,500 naira | Any Valid ID card, Nepa bill, and passport. |

| 2 | Opay traditional POS | 35,000 naira | Any Valid ID card, Nepa bill, and passport. |

| 3 | Opay Android/Smart POS | 50,000 naira | Any Valid ID card, Nepa bill, and passport. |

| 4 | Moniepoint POS | 10,000 Naira | Any Valid ID card, Nepa bill, and passport. |

| 5 | Kudi POS | 20,000 Naira | Any Valid ID card, NIN, Nepa bill, and passport. |

| 6 | Palmpay POS | 20,000 Naira | Any Valid ID card, Nepa bill, and passport. |

| 7 | Baxi mPOS | 10,000 Naira | Valid ID card, Nepa bill, and passport. |

| 8 | Baxi Android POS | 30,000 Naira | Any Valid ID card, Nepa bill, and passport. |

| 9 | Flutterwave POS | 10,000 Naira | Valid ID card, Nepa bill, and passport. |

| 10 | Bankly POS | FREE | Any Valid ID card, Nepa bill, and passport. |

| 11 | Paycentre POS | 14,000 naira | Valid ID card, Nepa bill, and passport. |

| 12 | Surebanka POS | 10,000 Naira | Any Valid ID card, Nepa bill, and passport. |

| 13 | Accelerex POS | 10,000 Naira | Any Valid ID card, Nepa bill, and passport. |

| 14 | NowNow POS | Any Valid ID card, Nepa bill, and passport. | |

| 15 | Firstmonie POS (By First bank) | FREE | Any Valid ID card, Nepa bill, and passport. |

| 16 | Surepadi POS (By Polaris bank) | FREE | Valid ID card, Nepa bill, and passport, plus a current account with the bank. |

| 17 | Zenith Bank POS | FREE | Any Valid ID card, Nepa bill, and passport, plus a current account with the bank. |

| 18 | Access Closa (By Access bank) | FREE | Any Valid ID card, Nepa bill, and passport, plus a current account with the bank. |

| 19 | UBA POS | FREE | Any Valid ID card, Nepa bill, and passport, plus a current account with the bank. |

| 20 | Union Bank POS | FREE | Any Valid ID card, Nepa bill, and passport, plus a current account with the bank. |

| 21 | Heritage Bank POS | FREE | Any Valid ID card, Nepa bill, and passport, plus a current account with the bank. |

| 22 | Stanbic Bank POS | FREE | Any Valid ID card, Nepa bill, and passport, plus a current account with the bank. |

| 23 | GTBank POS | FREE | Any Valid ID card, Nepa bill, and passport, plus a current account with the bank. |

| 24 | Itex POS | Any Valid ID card, Nepa bill, and passport | |

| 25 | ECOSA POS | 25,000 naira | Any Valid ID card, Nepa bill, and passport |

| 26 | Wema Bank POS | FREE | Any Valid ID card, Nepa bill, and passport, plus a current account with the bank. |

| 27 | Parallex Bank POS | FREE | Any Valid ID card, Nepa bill, and passport, and Maintain a current account with Parallex Bank. |