Why need Paypal Account

If you have ever worked for a company that isn’t in Nigeria, you may have had the issue of getting the money into Nigeria or into your Nigerian bank account. You must have had to go through all the host of options that have been touted to work and gone through some of the rigorous registration processes of the top-notch ones like Payoneer, PayPal, Western Union etc.

If your choice, at last, is PayPal, then your next immediate issue is the way to withdraw the money into Nigeria, and this must have posed a few issues for you. Because you must have heard the fact that you require a PayPal business account to be able to withdraw this money and a business account requires getting a website and a website shopping cart to withdraw this money. Well, I’m here today to help give you an insight into everything required to successfully withdraw money from your PayPal account to your Nigerian bank account.

See how to open a Paypal account in Nigeria

First, let me give you some words of caution and some criteria that you have to watch out for if you ever wish to withdraw money from your PayPal account

They Are;

Important Criteria to watch out for

- Your PayPal account can and will be re-verified once you hit a certain milestone of sending money out of the account.

- make sure that the names on your PayPal account are the same as the ones on your Nigeria bank statement of account or you are going to have a lot of issues when withdrawing the money

- This is the same thing for your address.

- Your new account will undergo heavy review if a huge amount of money enters when it is still fresh and new so take it so to avoid needless suspicion of the account.

- Please don’t try to play smart with PayPal because you could lose your money.

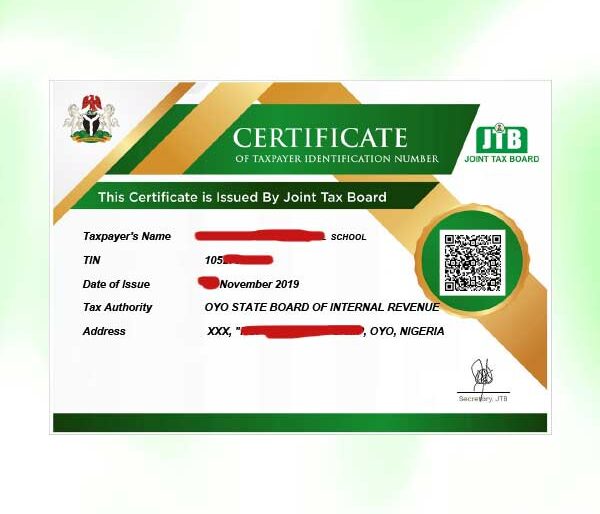

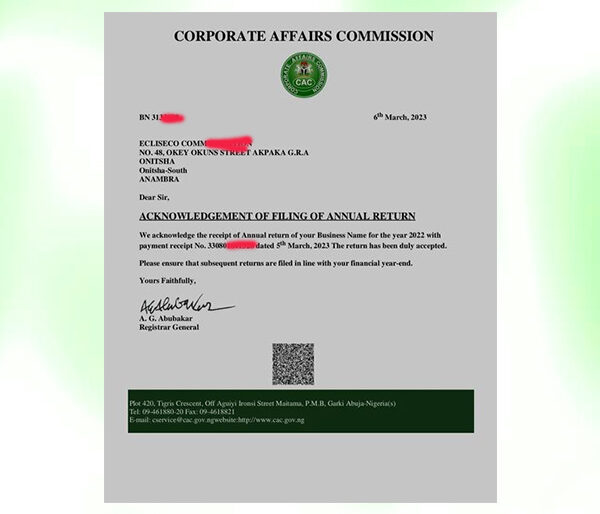

Now remember that you can only get payment from PayPal when you are in Nigeria if you possess a business account and a business account requires you to get a website linked to a web-shopping cart. This is because that they believe your need to receive money means that you have goods or services to sell to the public. Having a website is necessary for doing serious business online.

Our Top Selling Services

Since buyers can pay for their merchandise immediately, sellers receive payments immediately without having to wait for checks to go through the long and rigorous mail service or clear the bank and their overwhelming procedures. Individual sellers can accept credit card payments without having to pay the fees credit card processors charge, because if you were to get it directly through credit card, you will require paying a service fee to the credit card company, and merchants may find PayPal’s fees lower than other monetary processors. PayPal offers a top-notch seller protection policy that may cover losses for products lost or damaged in shipment or from a chargeback, and this helps to prevent frequent monetary loss.

Therefore, as an affiliate marketer, a blogger or all if you do business online, it will be better to use PayPal to receive funds because it will be easier. You can use PayPal directly on your website using the shopping cart feature I mentioned above and then you can withdraw funds to your credit card or your Payoneer account…

How to Transfer money to your Bank Account

If you desire to receive money on your PayPal account, you just need to provide the sender with one key piece of information and that is the email address your PayPal account is registered under.

That is the only requirement, then the sender enters your email address into a field in their PayPal account and chooses how much they wish to send, and then it will head your way. You will get an email alert when you have received the money into your PayPal account.

Once you have received the funds, and you want to transfer them to your bank account, let me show you the steps to do so

1. Log into your PayPal account using your email account and unique password.

2. On your transaction Summary page, click the “Transfer Money” button just beneath your PayPal monetary balance. You can also access this option using the “Wallet” menu button in the top toolbar.

3. Click on “Transfer to your bank.”

We recommend this for you

If you have multiple bank accounts or cards linked to your PayPal account, choose which one you wish to transfer your funds to, and click on “Next.”

5. Key in the money you want to transfer to your bank, then clicks on “Next” again.

6. On the next page, you will be asked to review your money transfer. If after this, all information shown is correct, click on “Transfer [your amount here] now.” Your funds will then be transferred to your bank account.

Things to remember when you withdraw from Paypal in Nigeria

- A transfer to your bank account usually completes itself in 1 business day, but it may take longer depending on how long your bank’s clearing process lasts.

- To withdraw from Paypal in Nigeria, they only support money transfers in your local currency. If you have a PayPal account in England (GBP) and want to transfer money to your bank account in Germany (EUR), you will be subject to cross border conversion fees, which will be deducted from you.

- Sometimes banks may additionally charge fees for electronic funds transfers. So please contact your bank directly for more information before you start fretting for stolen funds.

That pretty much sums up much of the requirements for withdrawing money from your PayPal account to your bank account. If you have any other issues, please contact PayPal support

Written by; William Nwokoji (+234) 8080641583