Hello business owner! Here at Zfrica, we’re passionate about your success journey, steering your ventures toward triumph.

To be here, we believe you have registered your business already and its been close to a year or so now.

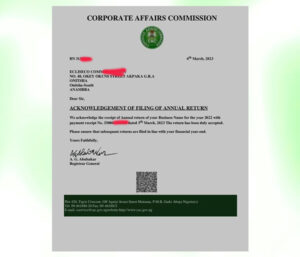

In one way or the other, you have been informed about CAC annual returns for CAC registered businesses and you are now wondering why this and why should you file CAC annual returns. Ok. Lets find solution to your challenges

Why CAC Annual Returns

Think of CAC annual returns as your business’s way of telling Corporate Affairs Commission (CAC) yearly —”Hey, we’re here, and we’re active!” It’s the only way to ensures that your business name stays alive and kicking in the official records. When you fail to file your annual returns, any or a combination of these below could happen to you or your business.

Business Name Deactivation:

When you miss filing your annual returns, CAC might deactivate your business name. This deactivation can hinder your business’s visibility and credibility, impacting potential customers’ trust in your brand.

Our Top Selling Services

Risk of Delisting:

Prolonged defaults on filing your annual returns may result in your business name being entirely delisted. This delisting could erase your business identity from official records, posing a significant setback to your business reputation.

Penalties:

For each year missed, there’s a penalty of N5,000-N10000. These penalties can accumulate quickly and become an unnecessary financial burden on your business, affecting your resources that could be used for growth.

Contract Hurdles:

An inactive business name can block opportunities. You might miss out on potential contracts with companies or government bodies due to the inactivity of your business name. This restriction could slow down your business growth significantly.

Visa Rejections:

Presenting an inactive CAC certificate might lead to visa rejection, especially when expanding your business internationally. It can complicate your international business aspirations and hinder growth opportunities abroad.

Business Standstill:

Without filing your annual returns, you’re stuck! Making changes or updates to your business becomes impossible. It’s like putting a pause on your business’s progress until the paperwork is sorted.

When is your business due for Annual Return?

The Company and Allied Matters Act (CAMA) requires that annual returns is filed each year and should start

— one year after registration, for business names

—18 months after registration, for Limited companies

— one year after registration, for Incorporated Trustees (Churches, Associations, Mosque, NGO etc. )

We recommend this for you

In any case,

— businesses are required to file their annual returns for each year between 1st January and 30th June.

— limited companies are required to file their annual returns 14 days after their annual general meeting.

—incorporated trustees are required to file their annual returns between 1st July to 31st December.

Failure to adhere to the CAMA act provisions results to penalties.

CAC Annual Return Cost?

Below is the official cost for filing CAC annual returns.

Business Names : ₦3000

Limited Company : ₦5000

Have you Read this ?

Incorporated Trustees: ₦5000

Note: Accredited agents service charge and possible late filing charges have not been added to the cost listed above. Adding such can significantly increase the cost.

Requirements to file CAC annual returns?

To file CAC annual returns, you will need

— complete CAC documents, which clearly shows the business details

— a financial figure stating the business total income for the year

— a financial figure stating the business total profit for the year. That is (total income – all expenditure)

— an audited financial report (only for incorporated trustees – NGO, Mosque, Churches etc.).

We can as well assist you prepare the audited report through our chattered accountant.

In a case where the business did not carry out any financial operation for the year, that is, no income nor expenditure, the business will still need to file annual returns for that year but will fill in the financial record space with NIL.

Conclusion

Navigating CAC Annual returns need not be overwhelming. At Zfrica, we’re not just a service provider; we’re your growth partner. From registrations to designs and consultancy, our services align with your business needs.

If you need assistance with filing CAC Annual returns, quickly contact us now let’s keep your business shining bright!

Remember, staying on top of these filings is key to a thriving business. Stay active, stay ahead!