If you have ever done any business on the web whether it is freelancing, buying things online or working with a web company, you must have had to think about how to receive the money especially if you are not in the same country as the company. This brings a lot of issues as you begin to get concerned about the safety and credibility of the payment method you wish to use. There are a lot of payment options ranging from direct bank transfer to crypto wallets to Payoneer, but I can assure you that the hassles of these are not worth it, you will be literally shocked at the requirements for all of these not to mention that our country’s terrible international image has made these requirements bigger than it should be, meaning a Nigerian receiving money from foreign sources is increasingly harder.

Well, I have a solution, it’s a world-trusted platform used by top sites all across the world Like Google, Fiverr, Upwork. It is by far the most popular monetary exchange platform on the web, tested and trusted by millions of people worldwide with no fears of money loss or fraud. It is called PayPal.

PayPal is the famous online wallet of an American financial institution registered in the United States and several other countries in the world. Other countries it is also registered in include Canada, Luxemburg, Singapore, Spain, and the U.K etc.

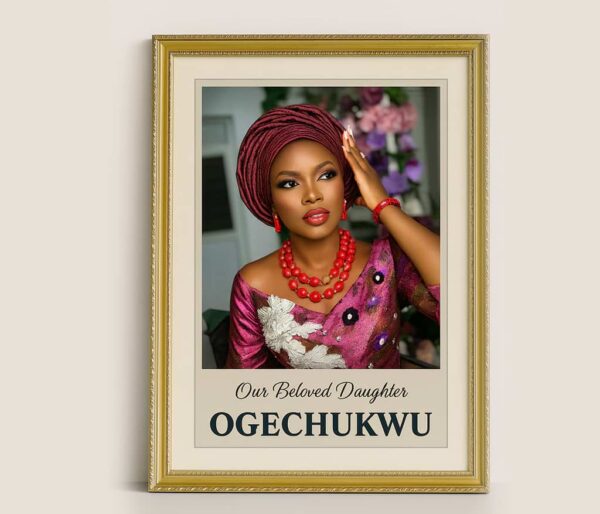

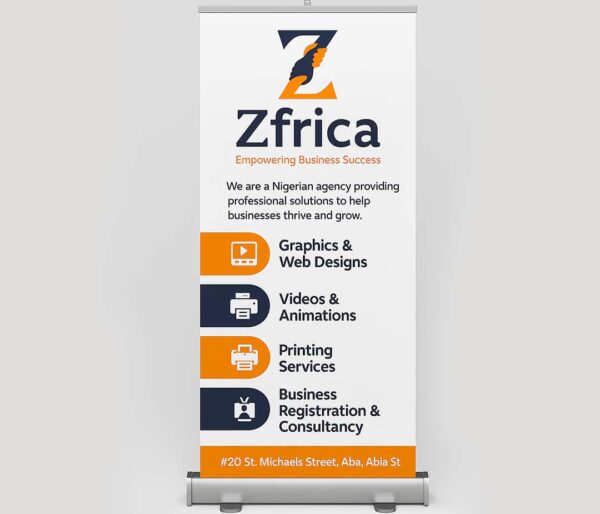

Our Top Selling Services

It serves as a global marketplace and is by far the biggest internet wallet service in the whole wide world.

It officially opened up to countries in 2014. It became officially available to residents of Nigeria since 2015. Before then, only Nigerians residents in countries supported by PayPal could open and operate an account.

You can send funds to anyone with an e-mail address linked to a PayPal account, whether or not your recipient has a PayPal account. To receive the transferred funds, though, the recipient must have a PayPal account associated with that specific e-mail address. All Basic PayPal accounts are free, and all purchases to be made in the United States with the service are also completely free. The company charges fees for sellers, all international transactions, and for sending money with a credit or debit card.

Having a PayPal account, you can add, withdraw funds in so many different ways. You can associate your account with bank accounts or credit cards for much more direct transactions, including adding and withdrawing money. Other withdrawal options include using a PayPal debit card to make purchases or get cash from an ATM or requesting a check in the mailbox.

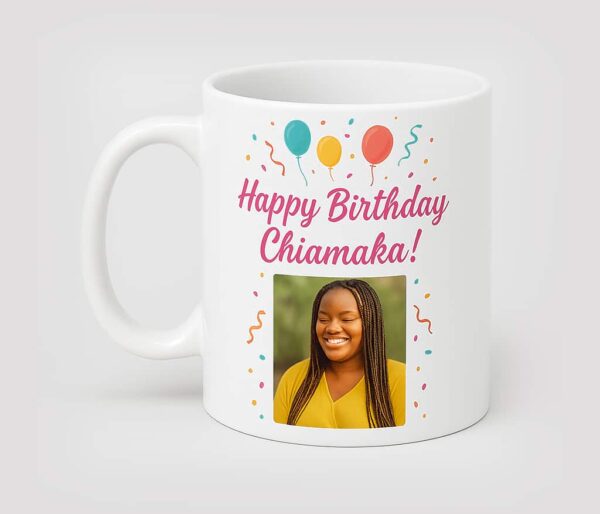

We recommend this for you

So you now know what it is, you must have a few questions like;

- How can I register?

- Can I withdraw with it?

- What are the requirements for registering?

- Any Service Charges?

I will treat all these questions so that when I am done, you will have an in-depth knowledge of everything concerning PayPal.

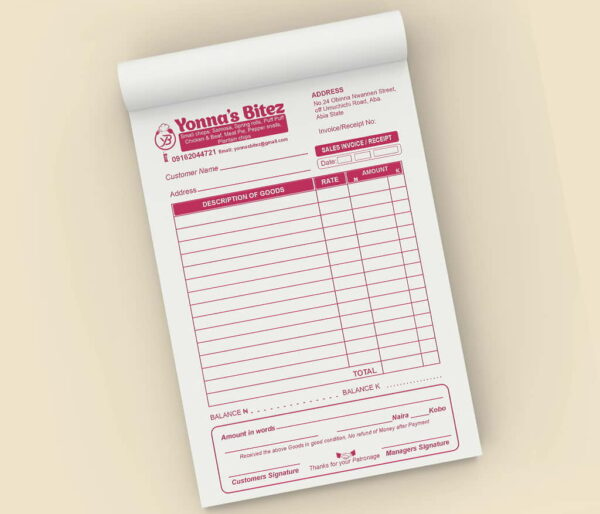

Have you Read this ?

First, let us start with the Registration Process;

Requirements for Registering

Please note that the requirements that I am about to talk about here are for Nigerian accounts alone

They are;

- The most important requirement is to get yourself a valid email address that you have uninterrupted access to. Please try to make sure that it is yours. PayPal will attempt to validate this email address by sending a message to it. You would need to confirm the validity and existence of the email address by following the steps in the message they sent.

- Another requirement is a Visa or MasterCard linked to an active Nigerian bank account, this could either be a credit or debit card. This is highly important for the verification of your PayPal account. The service will debit a tiny amount from the card, so don’t fret if you notice a debit alert from your account and once you confirm this transaction, your PayPal account will be fully verified and confirmed.

- As of December 2018, Inters witch’s Verve card no longer works with the service, so if this is your card, I suggest you get another one when you wish to register.

- A mobile phone number easily accessible and must be on when the registration is to be made.

Now that we have looked at the requirements, let us look at the process of registration, pay attention here, any mistake could result in a prolonged ability to successfully create the account. So heed my words and read this part very carefully.

Here is the registration procedure;

How to Register

Here are the steps:

- Uninterrupted Connection to the web: You need a source of connection to the internet and steady as network lapses could make you repeat the same processes repeatedly. You can use your Wi-Fi, LAN connection, hotspot, or mobile data to connect to the internet.

- Open your browser: Navigate to your app menu until you locate your browser, tap on its logo. Launch the start menu by double-clicking on the web browser’s icon.

- Go to the platform: Use the PayPal Nigeria address.

- Tap on “Sign Up for Free”: You will then be taken to the PayPal registration page. Enter your details for registration.

- Specify type of account you desire: There are two options to choose when reregistering, they are the personal and business options. I will be explaining the better when I talk about their implications to you but for now here is a brief summary of them, the former is the best for receiving payments, online shopping, and buyer protection. While the latter is best suited for receiving payments under a unique business name or website, fraud monitoring, and seller protection.

- Provide your valid and accessible email address and phone number: They should all be very valid, as you will be required to confirm them while using your account.

- Key in your name: Your first name and last name will be required at this phase, please use your real name and not a nickname. If it is possible, let it appear in the same way as it appeared on your card as verification can become daunting if there ARE name discrepancies.

- Create a Special password: This unique password should contain some special characters, numbers, and a mix of capital and small case letters to prevent it from being hacked as the combination I gave you above is the best password format that is unguessable. Confirm this password and move on to the next step.

- Accept the terms and conditions of PayPal: You should be the owner of the mobile phone number you provided. You should also be ready to receive a confirmation text to the number you provided.

- Once you click to create your account, you’ll receive an e-mail with instructions for verifying your account and confirming your address

You should now be ready for the PayPal confirmation and vetting g of your account. Having your information vetted by PayPal shows both the buyers and sellers that you are less likely to be a scammer or a fraudster.

- A PayPal account is verified if you have associated that PayPal account with a current bank account or credit card or debit card. This is much more than just entering your account information. PayPal will ask you to follow some certain steps to complete the verification process. You will be required to make some micropayments from your bank to your PayPal account to validate and verify it. These payments are usually minute about #30 or less.

- A PayPal account is deemed confirmed by PayPal if you have completed one of three options to signal to PayPal that the address on your account is valid. The fastest of these three is to verify a bank account or credit card matching the address you have entered as the PayPal account’s address, this is the one I also recommend to you. As an added alternative, you can request a confirmation code by mail after you’ve had the account for 90 or more days, not really plausible if you need to transact with the account immediately, or you can apply for a PayPal MasterCard which confirms your address by running a credit check although this will make you wait for who knows how long for the card to be shipped from USA to Nigeria which has been further complicated by the ravaging pandemic.

Now that the registration is complete, let us talk about the processes of receiving and sending money on the platform.

Can I Withdraw From It?

To treat this section, you are going to have to remember what I said above about the two types of accounts that you can open with PayPal (Personal and business). Let me explain the two accounts better

Personal: As the name suggests, the account is for personal purposes only, such as sending and receiving money between people. It can also be used to buy things from online stores and pay for stuff online.

Business: This is for business owners and website owners

Withdrawal

Now here’s the catch, you can’t receive money on the PayPal platform if you have a personal account. However you can do all the other activities a personal account has to offer. This is one of the many drawbacks of the PayPal platform in Nigeria. I repeat withdrawal can’t be done with Personal account.

However, this is not the case with the business account, you can receive money with the business account but it has a few requirements necessary for it to work.

For you to withdraw money into your business account, you must possess a website that’s active on the web, even with this you still need to possess a shopping cart as the funds will be sent there and not directly to you

Now let’s talk about transactions on these platforms,

Transactions

It is actually free to send money from your PayPal account to any part of the world. The recipient of the money will be the one to pay for conversion fees necessary to convert the received funds from foreign currency to their local currency in their country.

If a website that you are transacting on only accepts credit cards and not PayPal for payment, you can still use funds in your PayPal account to make a purchase. However, for you to do this, you will need to request for a PayPal debit card which operates on the famous MasterCard network. You can use that PayPal Debit card number with any merchant who accepts MasterCard, and the funds will be deducted from the PayPal account. This service is actually free but has a daily spending limit of $3,000 that you cannot go further than. That debit card can also be used at ATMs to withdraw up to $400 cash daily from your PayPal account, and it can earn 1 percent cash back on purchases if you are enrolled for the famous PayPal Preferred Rewards prize

Once money is sent on the platform, the transfer is reviewed manually and not automatically. This can take between 3 to 5 business days before the amount is actually credited to your receiver’s account.

If you need to send the money very urgently, you can use the instant transfer, which takes about 30 minutes to be completed. But however, you will need pay a 1% fee of the amount being transferred, with the maximum charge collected being $10.

After you send money, the record of your transaction will appear on the Activity page at the official website at PayPal.com. If you deem it necessary, you can search that history for a specific time in the past transactions. If you click on the “details” link for a transaction, you can view all the details of the transactions , including the amount, date, recipient and a unique transaction ID used by PayPal to track your specific transaction. If you ever dispute a transaction, then customer service will use this transaction number when handling the dispute from sides, the sender and recipient.

These are the transaction limits on the platform:

- $5,000 for one transaction

- $5,000 every day

- $5,000 every week

- $15,000 every month

This simply means that you can only receive a maximum of $5,000 from one of your friends or family in a week and receive a maximum of $15,000 in a month.

For cashing out, follow the procedure below:

- Log into your PayPal account: Use your unique password and the email address used to open the account.

- Go to the withdrawal tab: Specify the amount you wish to withdraw

- Select the withdrawal method you prefer: Choose the bank or cards that will be credited with the funds.

- Initiate the process: PayPal will then transfer the amount to your account.

There are millions of global websites that are happy to accept payment via PayPal. They include:

- airlines like Kenya Airways, Ethiopia Airways, Southwest Airways, South African Airlines;

- music streaming services like the famous Spotify;

- video streaming services like Hulu, Roku and so on ;

- online gaming platforms like Sony PlayStation Network, Steam;

- global shopping platforms like eBay, Best Buy, Amazon;

- Freelance sites like Upwork, Fiverr

Why PayPal is best for US citizens

PayPal is an American service hosted in the USA. The best experience with this payment system is available to residents of the USA. No other country in the world enjoys the depth and richness of features offered in the USA. Countries like Nigeria are on the other end of this spectrum. So I will be sharing the features available in the USA that are not available to Nigerians, to illustrate the limitations experienced by users in Nigeria while making use of this famous payment platform.

- PayPal Credit: This is subject to credit approval, American users can make use of a digital credit line to make purchases online exceeding $99 and repay it in instalments. I don’t need to tell you that Nigerians don’t have access to this.

- Card issuance: PayPal issues Cashback Mastercard (2% cashback everywhere the card is accepted), Extras MasterCard (cardholders can earn points on every spend), Cash MasterCard (a debit/ATM card linked directly to the PayPal wallet), and Prepaid MasterCard (for funds transfer from the wallet to the card) to residents of the USA and only the USA, nowhere else least of all in our country Nigeria.

- Near Instant Bank withdrawal: this is a relatively new feature that allows USA users to withdraw to their eligible debit card or bank account almost instantly, albeit for a premium fee. Regular withdrawals are always free-of-charge and reflect the next working day unlike that of Nigerians which takes so long.

- Fees: US-based merchants enjoy some of the lowest transaction fees for accepting payment over famous this platform. Sales within the USA can be as low as 2.9% + $0.30 per transaction depending on the volume of the transaction.

- PayPal Here card reader: US-based merchants also have the amazing luxury of a card reader that enables them to accept payments physically from major card schemes.

Now every site has its own problems and limitations, so this article will not be complete without listing some of the most commonly complained issues on the site. So here are the major

Problems

With

PayPal

One of the most common problems that are encountered by PayPal users is the sudden and inexplicable freezing of their PayPal accounts. If peradventure your PayPal account is frozen, you can’t add or withdraw any funds from your account, and you’re required to go through a very long and complicated process to verify your identity. Some users have claimed that PayPal had simply seized their funds and never returned them thereby stealing their money. Other complaints against PayPal include very rude and insulting customer service representatives; a long and confusing user agreement that has so many loopholes that PayPal can exploit and lose hiring practices that may have led to account fraud.

Despite its many criticisms, PayPal continues to be one the most popular money transfer service for online transactions. Though PayPal has occasionally had trouble with fraud, lawsuits and very zealous government regulators, the company now boasts of over 277 million active accounts

PayPal alternatives

There are hundreds of other online platforms to receive cash online in Nigeria. But, only a few of these are reliable, fast, and convenient. So I took the pain of getting some alternatives to it, they include the following:

- Payoneer

- Skrill

- Western Union

- Bank Wire

- 2checkout

Conclusion

If you want to use this site. If you have reservations though, you can always use the other methods I mentioned above although each does come attached with its own cons although most of them are better than PayPal except for the price tag maybe.

Each site has its pros and cons, PayPal is no exception, so I ask you to consider it carefully if you

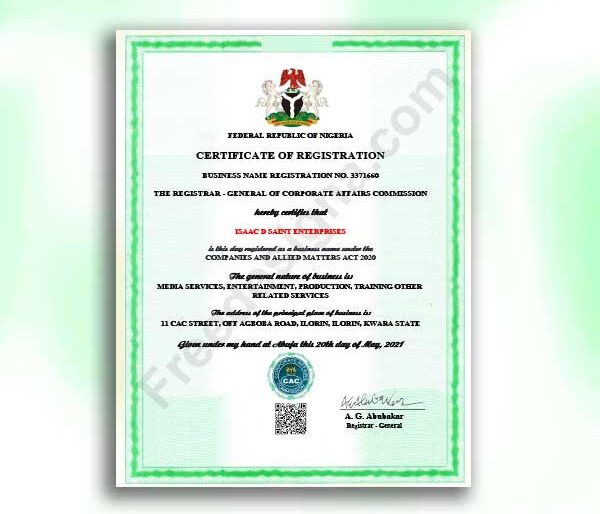

This article was written by the eccentric, loyal and highly experienced content writer; William Nwokoji. You can contact him on his mobile number (+234)8080641583 or his Facebook Profile William Nwokoji