Introduction

Nigeria remains one of Africa’s most attractive destinations for foreign investment — and in recent years, entrepreneurs and investors from the United Arab Emirates (UAE), especially Dubai, have begun to expand rapidly into its growing economy. With a population exceeding 200 million people, a youthful consumer base, and access to the entire ECOWAS sub-region, Nigeria offers unmatched potential across trade, energy, real estate, agriculture, logistics, and technology.

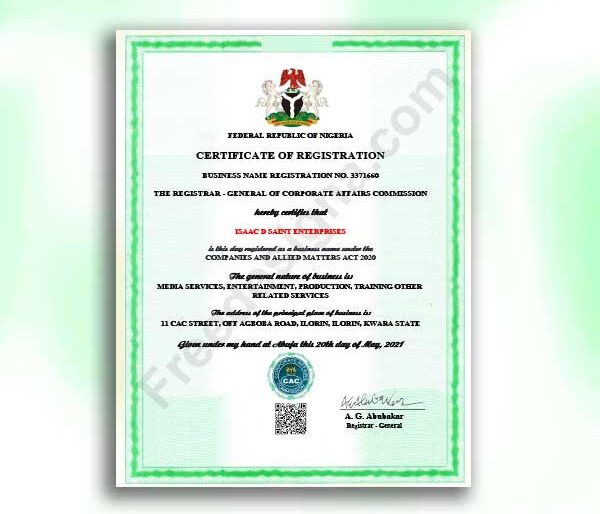

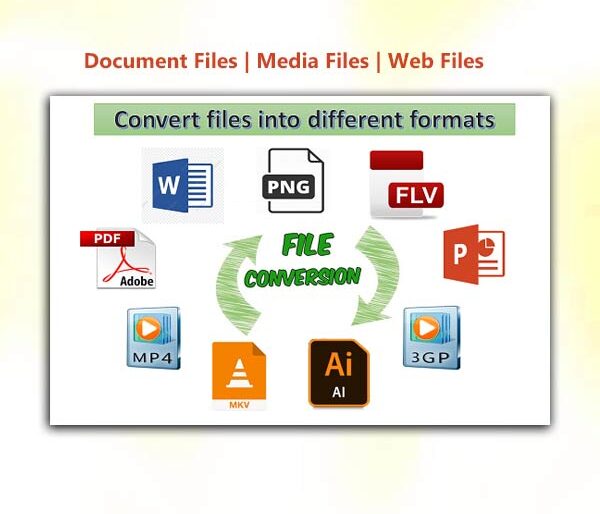

The Corporate Affairs Commission (CAC), Nigeria’s company registration authority, now provides a fully digital, AI-powered portal — allowing UAE and Dubai investors to register a Limited Liability Company (LLC) remotely without ever setting foot in Nigeria.

This guide explains the requirements and cost for UAE & Dubai investors to register a company in Nigeria, including what documents are needed, how the CAC process works, how to open a corporate bank account, and how Zfrica can help streamline your incorporation process.

Why UAE & Dubai Investors Are Setting Up in Nigeria

Across Africa, Nigeria stands as the continent’s leading commercial hub — and Emirati investors are tapping in for several strategic reasons:

- Gateway to West Africa

Nigeria provides direct access to 15 ECOWAS member states, creating a regional market of over 400 million consumers. - Booming Youth Demographic

Over 60% of Nigeria’s population is under 30, fueling consumer demand in tech, e-commerce, fashion, logistics, and fintech. - Expanding Trade Links

With over $1.2 billion in annual trade volume between Nigeria and the UAE, both nations are strengthening their bilateral investment ties, particularly in construction, real estate, and halal-certified trade. - Digitized Incorporation System

Thanks to the CAC’s automation, foreign investors can now complete the entire registration process online — from name reservation to certificate issuance — without mailing or couriering physical documents. - Tax and Investment Incentives

The Nigerian Investment Promotion Commission (NIPC) offers pioneer status incentives and tax holidays for companies operating in strategic sectors like manufacturing, agriculture, and export processing.

Stat Insight:

According to Zfrica business data, inquiries from UAE-based entrepreneurs seeking Nigerian company registration have grown by over 47% since 2023, reflecting the surge of Gulf–Africa commercial partnerships.

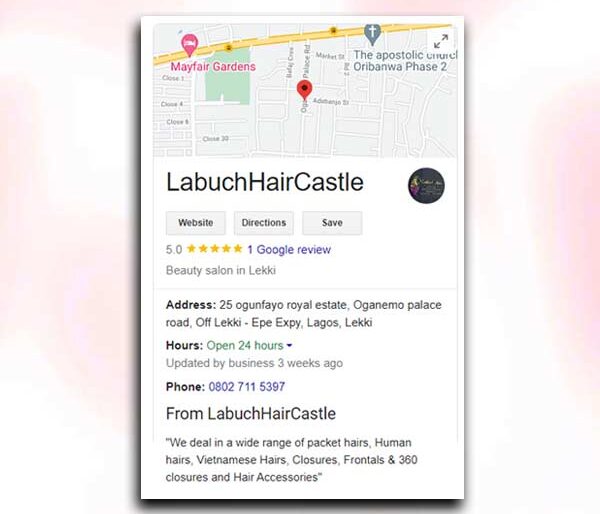

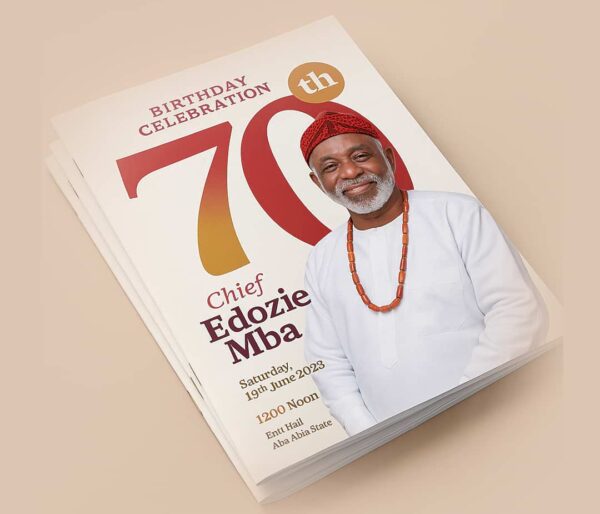

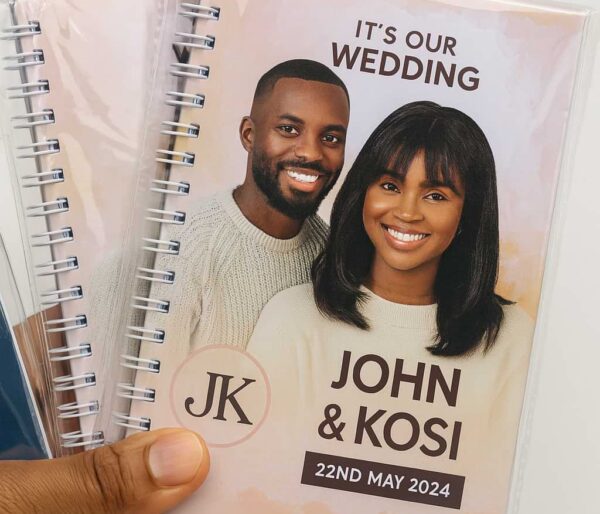

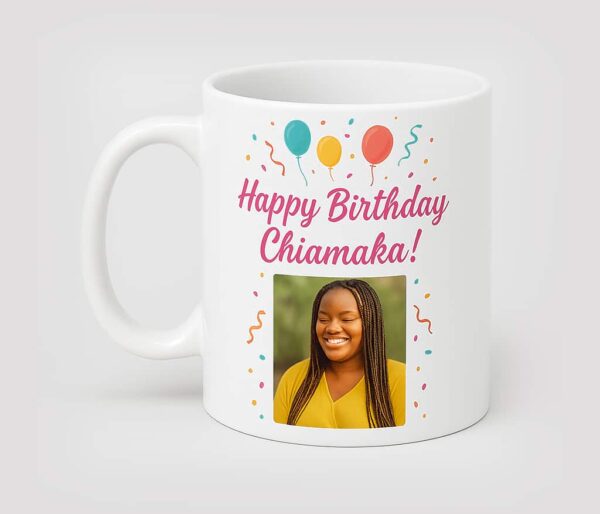

Our Top Selling Services

Legal Entity Options for UAE and Dubai Investors

Foreign investors in Nigeria have several legal entity options, but the most popular and flexible structure remains the Private Limited Liability Company (LLC).

Here’s why:

- It allows 100% foreign ownership — no mandatory Nigerian partner is required.

- Shareholders enjoy limited liability, meaning personal assets are protected.

- It provides a separate legal identity, allowing the company to own property, sign contracts, and sue or be sued in its own name.

- It qualifies for corporate banking, tax registration, and business permits.

Alternative structures include Business Names (for small enterprises), Partnerships, and Public Limited Companies — but for foreign investors, the LLC structure offers the best balance of credibility, protection, and operational flexibility.

Step-by-Step Guide to Registering a Nigerian Company from the UAE

Even while based in Dubai, Abu Dhabi, or Sharjah, Emirati investors can incorporate their Nigerian company entirely online through CAC’s AI-driven system.

Below is the standard process and timeline:

- Reserve Your Company Name

Submit up to two preferred name options through the CAC portal. Once approved, the reservation remains valid for 60 days. - Provide Required Company Details

You’ll need to supply your company’s business objectives, Nigerian registered address (can be provided by your CAC agent), and director/shareholder information including full names, emails, and nationalities. - Upload Documents

Scan and upload the following:

- Emirates passport or national ID of each director/shareholder.

- Digital signature on plain paper.

- Proof of residential address.

- Pay Online Fees

All fees (registration and stamp duty) can be paid securely online through CAC’s payment portal using international cards. - AI Review and Approval

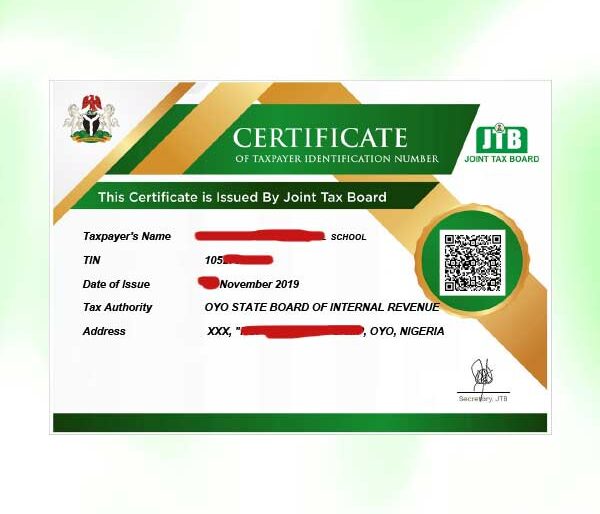

The CAC automatically verifies submitted data. Once approved, you’ll receive your digital Certificate of Incorporation, Status Report, and Memorandum & Articles of Association (MEMART). - Obtain Your Tax Identification Number (TIN)

After incorporation, the Federal Inland Revenue Service (FIRS) automatically issues a TIN linked to your new company — essential for tax and banking operations. - Apply for a SCUML Certificate

The Special Control Unit Against Money Laundering (SCUML) certificate (issued by the EFCC) is mandatory for corporate bank account opening and compliance verification. - Appoint Temporary Local Director (If Needed)

Although foreigners can be directors, a temporary Nigerian director helps facilitate smoother account setup until your residency permit (CERPAC) is ready. - Open a Corporate Bank Account

Once your CAC, TIN, and SCUML documents are ready, proceed with bank account setup. Many Nigerian banks support remote onboarding and correspondence via their international branches or partners.

At this stage, Zfrica can handle the entire incorporation, TIN, SCUML, and banking coordination process for you, ensuring no delays.

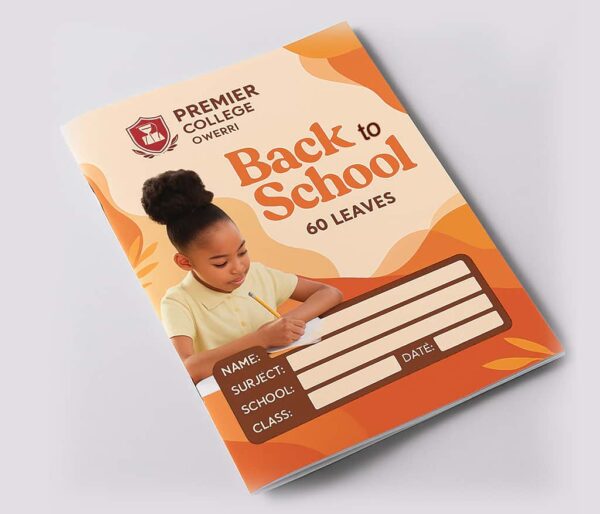

We recommend this for you

Post-Incorporation Compliance

After successfully obtaining your digital Certificate of Incorporation, there are a few post-registration steps every UAE or Dubai investor must complete to ensure their business is legally operational in Nigeria.

- Obtain TIN from the Federal Inland Revenue Service (FIRS)

This is mandatory for tax compliance and invoicing. Without a TIN, your company cannot open a corporate bank account or file annual returns. - Apply for SCUML Certification

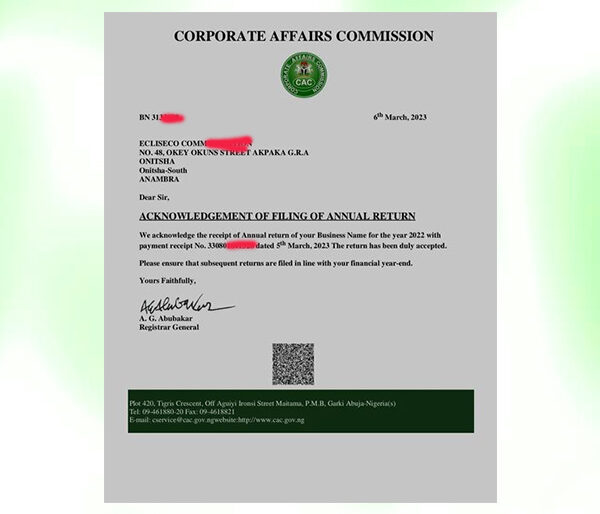

The Special Control Unit Against Money Laundering (SCUML) certificate, issued by the EFCC, validates your company’s compliance with Nigeria’s anti–money laundering laws. It’s usually processed within 5–7 working days. - File Annual Returns with CAC

Every incorporated company must file its annual returns within 18 months of incorporation and subsequently every year. Failure to do so may result in penalties or deregistration. - Register with the Nigerian Investment Promotion Commission (NIPC)

For foreign-owned entities, NIPC registration is mandatory before commencing business operations. It allows you to benefit from tax incentives and investor protection under Nigerian law. - Obtain a Business Permit (if 100% foreign-owned)

Issued by the Ministry of Interior, this permit authorizes foreign companies to operate legally and repatriate profits. - Maintain Proper Accounting and Tax Records

Nigeria’s tax regime requires accurate financial statements, audited annually. Zfrica’s team partners with certified accountants to simplify your compliance process.

Bank Account Opening for Foreign-Owned Companies

Foreigners can legally own and direct Nigerian companies, but practical limitations apply when it comes to banking.

To activate a company bank account, all signatories must possess a Bank Verification Number (BVN) and a National Identification Number (NIN) — both of which require a Nigerian residency permit known as CERPAC.

The simple solution:

While awaiting your CERPAC, appoint a temporary Nigerian director who can manage compliance and banking transactions locally. You remain the principal shareholder, with full digital access to all accounts. Once your residency is regularized, you can assume directorship and remove the temporary director without affecting ownership rights.

Immigration & Expatriate Quota Requirements

If an Emirati investor wishes to work or act as a company director in Nigeria, the following steps apply:

- Expatriate Quota: Authorizes your company to employ foreign nationals.

- STR Visa (Subject to Regularization): Granted by the Nigerian Embassy in the UAE.

- CERPAC Card: A residency permit obtained after arrival, enabling BVN and NIN registration for banking and compliance.

Once these are in place, you can manage your Nigerian company directly, travel freely, and repatriate profits under the protection of Nigerian law.

Cost Breakdown and Timeline

Below is a realistic breakdown of the requirements and cost for UAE & Dubai investors to register a company in Nigeria through Zfrica and authorized partners:

| Service | Duration | Estimated Cost (USD) |

| LLC Incorporation (₦100m Share Capital) | 7–14 working days | $1,775 |

| SCUML Certificate | 5–7 working days | $60 |

| TIN & Tax Clearance | 3–5 weeks | $275 |

| Director Verification | Same day | $150 |

| Bank Account Setup | After TIN | $80 |

| Registered Office (1 year) | 1 year | $250 |

| Expatriate Quota & STR Visa | 2–4 weeks | $300 |

| Estimated Total | ≈ 35 working days | ≈ $2,650 |

At Zfrica, we handle the entire process — from CAC registration to TIN and SCUML certification — ensuring your incorporation meets all regulatory standards.

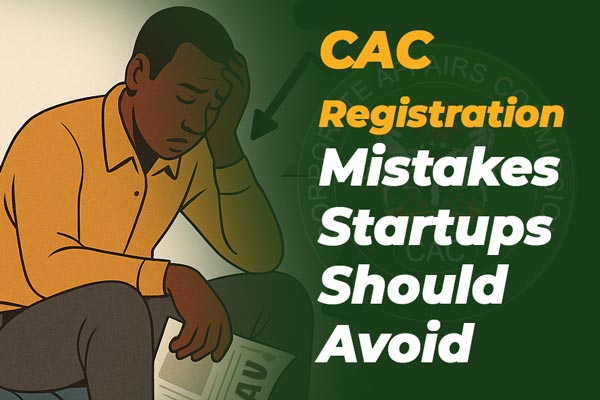

Common Mistakes to Avoid

- Assuming physical presence is mandatory.

Company registration is now fully digital. You can complete everything online from Dubai or Abu Dhabi. - Ignoring banking compliance (BVN/NIN).

Without CERPAC, banking becomes difficult. Appoint a temporary Nigerian director to manage this phase. - Skipping SCUML certification.

Even if your company is non-financial, most banks require SCUML for compliance. - Not filing annual returns.

Neglecting this can cause penalties and loss of good standing with CAC. - Using unverified agents.

Always work with CAC-accredited agents like Zfrica, known for reliability and transparent processing.

Conclusion

Registering a Nigerian company as a UAE or Dubai investor is now easier than ever. With Nigeria’s digital CAC portal, transparent tax systems, and growing investor protections, Emirati entrepreneurs can build long-term value across one of Africa’s most profitable markets.

Nigeria offers over 200 million potential customers, regional access to 15 West African nations, and a government eager to attract foreign investors through incentives and policy reforms.

If you’re ready to start, Zfrica can help you register your company in Nigeria, obtain all compliance documents, and set up your bank account — all handled remotely from Dubai.

Visit Zfrica.com today or chat with us via WhatsApp to get started on your registration journey

FAQs

Q1. Can UAE and Dubai investors register a company in Nigeria remotely?

Yes. The CAC portal allows full online registration and digital document issuance — no physical submission required.Q2. Can foreigners own 100% of a Nigerian company?

Absolutely. Nigerian law permits full foreign ownership across most sectors.Q3. Do I need to be in Nigeria to open a bank account?

Initially, yes — or you may appoint a local director until your residency permit is ready.Q4. How long does the process take?

Typically between 5–6 weeks, including incorporation, tax, and banking setup.Q5. Can I repatriate profits back to Dubai or the UAE?

Yes. Nigeria’s investment laws protect foreign investors’ rights to repatriate profits through licensed banks.