In this post, we detailed all you need to know about the N-YIF CBN loan scheme. You will know who is eligible, the requirements, steps to apply and get the loan, centers where you can go for the training.

Framework of the CBN loan scheme

The loan is called the (AGSMEIS) Agribusiness/Small and Medium Enterprise Investment Scheme. It’s an initiative of the Federal Government, through the FEDERAL MINISTRY OF YOUTH AND SPORTS DEVELOPMENT. Hence, it is also called Nigeria Youth Investment Fund (N-YIF).

The initiative is for the promotion of agricultural businesses and small/medium enterprises (SMEs) as vehicles for sustainable economic development and employment generation

The loan is to be disbursed by NIRSAL Microfinance Bank (NMFB), to be monitored by the Central Bank of Nigeria (CBN) while the CBN Entrepreneurship Development Institute (EDI) will handle the all the necessary trainings.

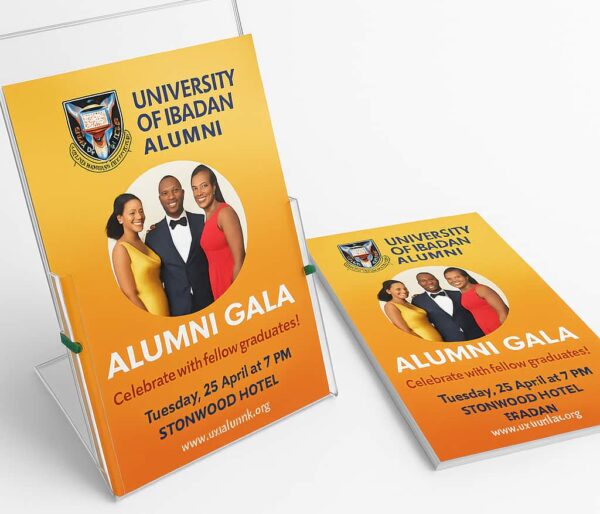

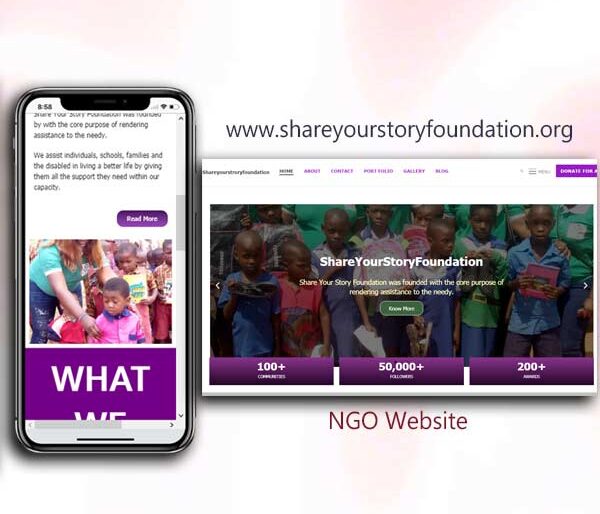

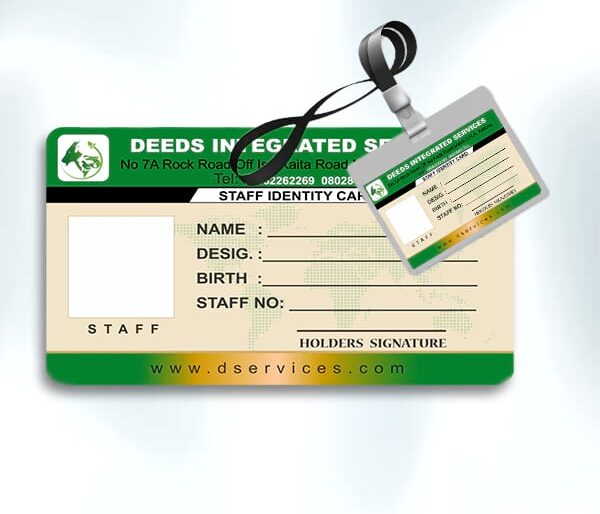

Our Top Selling Services

The loan scheme runs till 2023, with 25 billion disbursed each year.

Note: This is a loan scheme and not a grant. As such, you will have to pay it back in due time, with the attached interest.

Who is eligible for the Loan + Requirements

Formal (CAC Registered) and Informal (Non-registered) business enterprises can benefit from the scheme.

For individuals (Non-registered businesses)

To be eligible, they must fulfil the following conditions:

- —Be a youth within the age bracket of 18-35 years.

- —Have business/enterprises domiciled and operational in Nigeria.

- —Has not been convicted of any financial crime in the last 10 years.

- —Has a valid Bank Verification Number (BVN)

- —Possess Local Government Indigene Certificate.

For the formal business enterprises (Youth Owned Registered Businesses)

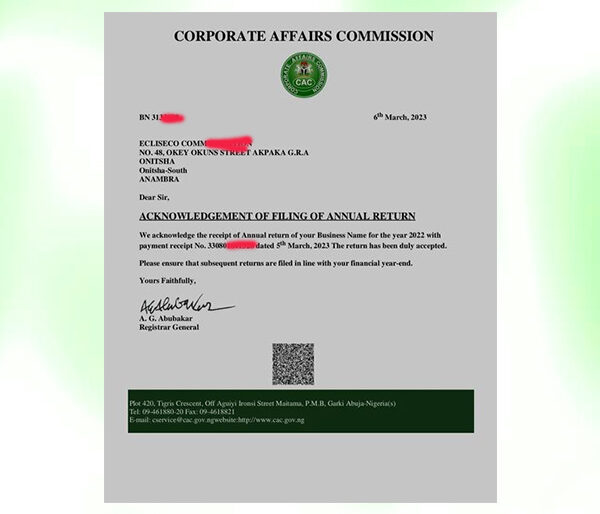

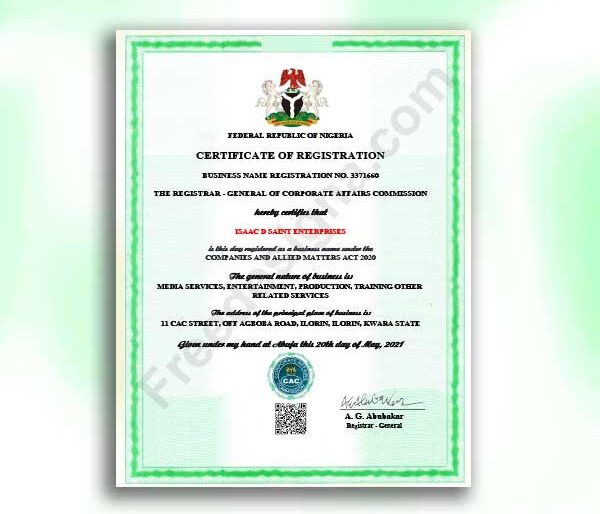

These are legal business entities duly registered with the Corporate Affairs Commission (CAC). To be eligible, the following documents and conditions must be fulfilled;

- —Business must be owned by a youth of age bracket 18 – 35 years

- —Evidence of registration with the Corporate Affairs Commission (Certificate of Incorporation, CAC CERTIFICATE)

- —Business questionnaire;

- —List of Directors with BVN nos. (for Ltd companies only);

- —Evidence of regulatory approvals (where applicable);

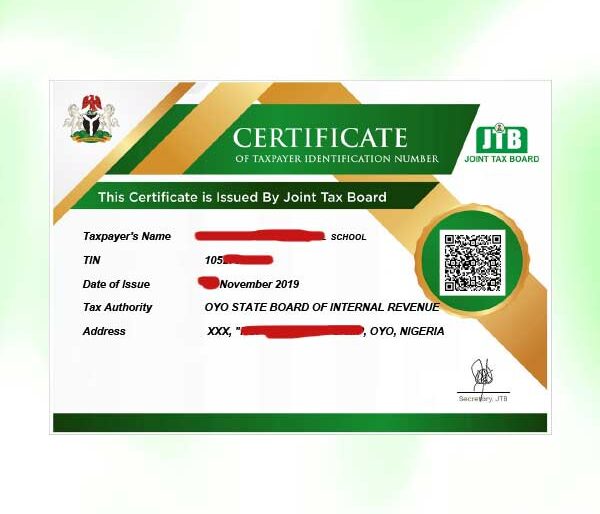

- —Tax Identification Number (TIN).

Cooperative societies duly registered with the relevant government authorities and members of Commodity Associations that fall within the eligible age bracket are also eligible to participate.

Who is not eligible for the CBN Loan

Any applicants currently enjoying NMFB loans, including the Targeted Credit Facility (TCF) and Agribusiness/Small and Medium Enterprises Investment Scheme (AgSMEIS) loans that remain unpaid are not eligible to apply.

How much is given per applicant ?

Individuals with unregistered businesses can get up to N250,000 loan, while registered businesses can get up to N3 million (including working capital) with not more than 5 per cent per annum interest rate.

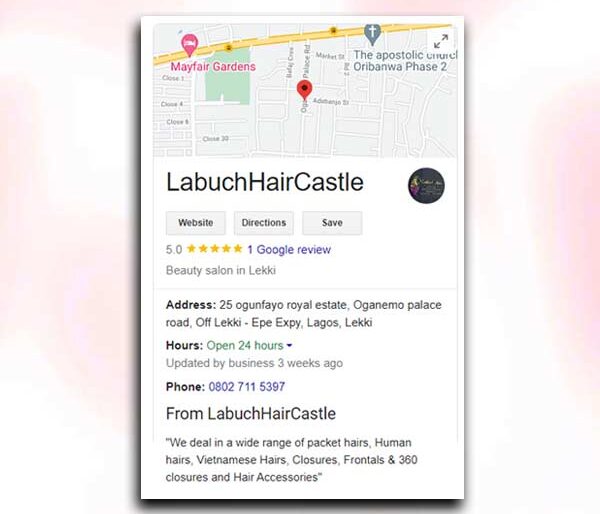

We recommend this for you

Let’s assist you today, register your business with CAC. The cost is super affordable.

Steps to apply for the CBN loan scheme

1. Get Trained

Attend a compulsory training with a NIRSAL MFB certified Entrepreneurship Development Institute (EDI). We have listed the approved training centers after this post.

2. Apply For Loan

Create an account on the agsmeis website by clicking on ‘Apply now’ as an applicant, validate your BVN and select a NIRSAL MFB certified Entrepreneurship Development Institute (EDI).

3. Receive Funds

The Loans are paid into the account of beneficiaries. Unqualified candidates are given feedback.

4. Get Business Support Service

The Entrepreneurship Development Institute assists you to implement business plan and provide business support services commercially

5. Make Sales

Sell products and services to pay back loan and make profit.

6. Repay Loan

Run your business, keep proper records, monitor sales and expenses to maximize profit and pay back the loan.

Common questions asked about the CBN loan

What is the interest rate for this loan?

The interest rate is currently at five percent (5%) per annum.

Do I need collateral?

No, this loan scheme does not require a collateral.

Has disbursement started?

Yes, disbursement has started and will last till 2023.

Upon approval of my loan, can the funds be released to me as I deem fit?

Upon meeting all terms and conditions, the working capital will be accessible through your account for withdrawal, while some loan amount will be disbursed to your NMFB account for the purchase of your equipment(s)/machineries.

This will be handled by one of the NMFB’s certified Vendors.

List of CBN Entrepreneurship Development Centres in Nigeria and their addresses

1. CBN-EDC, Ibadan (South West)

Website: www.edcsouthwest.org

Address: Old SDSTC (Oyo Oodua Skill Acquisition Centre Premises),

Samonda, along Sango-UI Road, Ibadan, Oyo State, Nigeria.

2. CBN-EDC, PortHarcourt (South South)

Website: www.ssedc.org

30 Trans-Woji road, Grace plaza, by Slaughter Bridge Woji Town, Port Harcourt, Rivers State

3. CBN-EDC, Maiduguri (North East)

website : edcnortheast.com.ng

Address: Old Informatics Institute, Njimtillo, Kano Road, Maiduguri, Borno State

4. CBN Entrepreneurship Development Centres , Kano (North West)

Address: Murtala Muhammed Library Complex, Kano, Kano State

5. CBN Entrepreneurship Development Centres, Makurdi (North Central)

Off Jonah Jang Crescent, Near Federal Secretariat, Makurdi, Benue State.

6. CBN Entrepreneurship Development Centres, Minna (North Central)

Address: Minna Innovation Institute,

Behind Niger State Sharia Commission, Justice Ndajiwo Drive, Minna, Niger State.

7. CBN Entrepreneurship Development Centres, Enugu (South East)

Address: Ebenezer Villa Suite

8, Ogenyi Close, Off Cornerstone Avenue Off Nike Lake Resort Road, Enugu, Enugu State.

8. Center for Entrepreneurial Development.

Website : www.cedl.org

36, Murtala Mohammed International Airport Road, Lagos.

9. Ideas Center

60 Erinwole Awolesi Road, GRA Sagamu, Ogun state